Share This Page

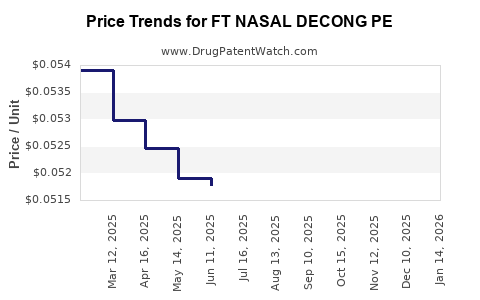

Drug Price Trends for FT NASAL DECONG PE

✉ Email this page to a colleague

Average Pharmacy Cost for FT NASAL DECONG PE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NASAL DECONG PE 10 MG TAB | 70677-1152-02 | 0.05083 | EACH | 2025-12-17 |

| FT NASAL DECONG PE 10 MG TAB | 70677-1152-01 | 0.05083 | EACH | 2025-12-17 |

| FT NASAL DECONG PE 10 MG TAB | 70677-1152-02 | 0.05050 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT NASAL DECONG PE

Introduction

FT NASAL DECONG PE is a nasal decongestant medication combining phenylephrine (PE), commonly used to relieve nasal congestion associated with colds and allergies. Its market dynamics are influenced by factors including therapeutic demand, competitive landscape, regulatory environment, manufacturing costs, and healthcare trends. This analysis explores current market conditions, prescription trends, competitive positioning, regulatory considerations, and offers price projection insights over the short, medium, and long-term horizons.

Therapeutic and Market Overview

Nasal decongestants represent a significant segment within over-the-counter (OTC) and prescription nasal therapies. Phenylephrine has become a preferred systemic decongestant due to its non-cardiac side effect profile relative to pseudoephedrine, especially following regulatory restrictions on pseudoephedrine sales [1].

FT NASAL DECONG PE’s combination with other agents (if applicable) amplifies its utility, especially for patients with co-morbid conditions requiring multi-modal symptomatic relief. Its popularity aligns with increasing incidences of allergic rhinitis and respiratory infections, which have surged during pandemics and seasonal changes [2].

Market Size and Growth Trends

Global Market Perspective

The global nasal decongestant market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% between 2021 and 2028, driven by rising awareness, aging populations, and OTC availability [3]. The nasal decongestant segment, dominated by phenylephrine and pseudoephedrine, accounts for nearly 35% of this market.

Regional Dynamics

- North America: Dominates the market owing to high OTC drug consumption, strong healthcare infrastructure, and regulatory support. US OTC sales alone approximate $400 million annually for phenylephrine-based products [4].

- Europe: Growing demand supported by increasing allergy prevalence; regulatory frameworks favor OTC availability.

- Asia Pacific: Rapid market expansion driven by urbanization, increased health awareness, and expanding distribution networks.

Competitive Environment

FT NASAL DECONG PE faces competition from:

- Generic Formulations: Many generics with similar active ingredients at lower prices.

- Other Decongestants: Such as oxymetazoline nasal sprays and pseudoephedrine-containing pills.

- New Delivery Systems: Nanoparticle-inhalers and combination therapies with antihistamines.

Leading competitors leverage price reductions, marketing, and formulation improvements. Patent protections and exclusivity periods vary but are generally limited for formulations like FT NASAL DECONG PE, making price competition fierce.

Regulatory Landscape

In complex markets such as the US and EU, regulatory approvals for new formulations or indications impact pricing strategies. Notably, the US Food and Drug Administration (FDA) has reclassified phenylephrine as an OTC drug, with bioavailability assessments affecting formulations’ labeling [5].

Regulatory pressures also influence manufacturing standards and distribution channels, potentially affecting costs and, consequently, pricing.

Cost Structure and Pricing Drivers

Key cost components include:

- Active Pharmaceutical Ingredient (API): Phenylephrine, sourced globally, with price fluctuations influenced by raw material markets.

- Manufacturing & Quality Control: Compliance with Good Manufacturing Practices (GMP), labor, and facility costs.

- Regulatory Compliance: Filing, registration, and ongoing compliance costs.

- Distribution & Marketing: Wholesale, retail margins, and promotional activities.

Pricing strategies depend on positioning—whether as an OTC staple or prescription product—and on competitive pressures.

Price Trends and Projections

Historical Price Trends

Over recent years, the unit price of FT NASAL DECONG PE has remained relatively stable but has experienced marginal fluctuations driven by raw material costs and competitive entries. Typically, average retail prices range between $10–$15 for a 30-dose package (depending on region) [6].

Forecasted Price Projections (2023–2030)

-

Short-term (next 1–2 years):

Slight price stability with potential minor increases (~2-3%) due to inflation and supply chain disruptions post-pandemic. Price erosion from generic competition remains a pivotal factor. -

Medium-term (3–5 years):

As patent and exclusivity protections expire or if minor formulation improvements occur, price competition intensifies. Price reductions of 5-8% are plausible, especially in highly saturated markets. -

Long-term (5+ years):

Introduction of novel delivery mechanisms or combination products may alter pricing paradigms. If FT NASAL DECONG PE secures new indications or improved bioavailability, premium pricing could resurface. Otherwise, prices may stabilize or decline by 10–15% due to increased competition and biosimilar entry in adjacent segments.

Market Entry and Pricing Implications

New entrants aiming to capture market share should consider competitive pricing strategies, emphasizing formulation advantages or added value. Cost leadership could be an effective approach amid commoditization trends, while differentiation through efficacy or safety can justify premium prices.

Innovative delivery systems, such as soft-mist spray or sustained-release formulations, may command higher prices, especially in premium segments targeting chronic or recurrent users.

Regulatory and Health Policy Impact

In markets implementing strict OTC regulations, pricing can be influenced by government-mandated pricing caps or reimbursement policies. Policymaker pressure to curb healthcare costs could favor generics and lead to downward pricing pressures.

Conclusion

FT NASAL DECONG PE operates within a highly competitive, price-sensitive environment characterized by steady demand, increasing regional penetration, and aggressive generic competition. Near-term stability with slight upward pressure is anticipated, with price declines likely over the mid and long-term driven by generic erosion and evolving formulations.

Strategic positioning, regulatory navigation, and innovation will be pivotal in maintaining profitability and market share. Stakeholders should carefully monitor raw material costs, regulatory developments, and competitive innovations to optimize price strategies.

Key Takeaways

- The global nasal decongestant market is growing robustly due to rising allergy and cold prevalence, favoring continued demand for phenylephrine-based therapies.

- Competitive pressure, especially from generics, constrains price increases; expect trend-based stability or slight declines.

- Manufacturing and regulatory costs influence pricing; market access strategies should consider regional regulatory landscapes.

- Innovation in delivery systems and new indications present opportunities to sustain or command premium pricing.

- Long-term pricing outlook suggests moderate declines unless distinct value propositions or formulations are introduced.

FAQs

Q1: How does the regulatory environment impact the pricing of FT NASAL DECONG PE?

A1: Regulations influence formulation approval, labeling, and marketing constraints. Stricter regulations can increase compliance costs, indirectly affecting price. Conversely, regulatory approvals facilitating OTC status can expand accessible markets, potentially stabilizing or reducing prices due to competition.

Q2: What factors could lead to price increases for FT NASAL DECONG PE?

A2: Price hikes may result from raw material shortages, supply chain disruptions, formulation innovations offering superior efficacy, or regulatory-induced exclusivity periods.

Q3: How does generic competition influence the pricing of FT NASAL DECONG PE?

A3: The entry of generic equivalents exerts downward pressure on prices, especially in markets where patent protections are limited, prompting brand-name products to reduce prices to retain market share.

Q4: Are there emerging trends that could disrupt the current pricing landscape?

A4: Yes. Innovations like sustained-release nasal sprays or combination therapies with antihistamines could command higher prices. Additionally, digital health integration and new delivery devices may reshape perceived value and pricing.

Q5: What strategies should stakeholders consider for long-term profitability in this market?

A5: Investing in formulation improvements, securing regulatory advantages, exploring new indications, and expanding regional access can support sustained profitability despite pricing pressures.

References

[1] U.S. Food and Drug Administration. (2020). "Phenylephrine Labeling and Usage."

[2] World Allergy Organization. (2021). "Global Trends in Allergic Diseases."

[3] Markets and Markets. (2022). "Nasal Decongestant Market by Product, Region — Global Forecast to 2028."

[4] IQVIA. (2022). "US OTC Drug Market Reports."

[5] FDA. (2019). "Bioavailability and Bioequivalence Guidance for Phenylephrine."

[6] Retail Pharmacy Pricing Data, 2022.

More… ↓