Share This Page

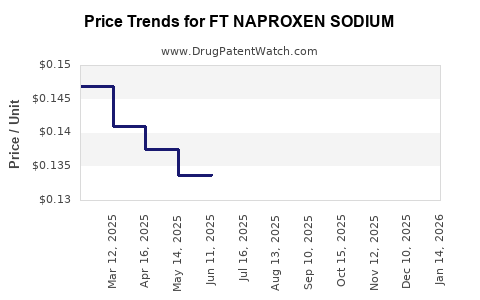

Drug Price Trends for FT NAPROXEN SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for FT NAPROXEN SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT NAPROXEN SODIUM 220 MG CAP | 70677-1148-01 | 0.14422 | EACH | 2025-12-17 |

| FT NAPROXEN SODIUM 220 MG CAP | 70677-1148-01 | 0.14448 | EACH | 2025-11-19 |

| FT NAPROXEN SODIUM 220 MG CAP | 70677-1148-01 | 0.14464 | EACH | 2025-10-22 |

| FT NAPROXEN SODIUM 220 MG CAP | 70677-1148-01 | 0.14225 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT NAPROXEN SODIUM

Introduction

FT NAPROXEN SODIUM, a formulation of naproxen sodium, serves as a widely utilized Nonsteroidal Anti-Inflammatory Drug (NSAID) predominantly prescribed for pain relief, inflammation reduction, and fever management. Its market trajectory is influenced by key factors including patent status, regulatory landscape, competitive dynamics, and geographic demand. This analysis provides a detailed overview of the current market situation, future price projections, and strategic insights essential for stakeholders in the pharmaceutical sector.

Market Landscape

Global Demand Dynamics

Naproxen sodium’s prominence stems from its effectiveness in treating musculoskeletal disorders, osteoarthritis, rheumatoid arthritis, and acute pain episodes, notably in North America, Europe, and select Asian markets. The global NSAID market has historically exhibited compound annual growth rates (CAGR) of approximately 4-6%, driven by increasing prevalence of chronic inflammatory conditions and an aging population[1].

According to IQVIA, the NSAID segment accounted for over $15 billion in revenue in 2022, with naproxen-based formulations constituting a significant share owing to patent exclusivities and brand recognition[2].

Regulatory and Patent Milestones

The patent expiration landscape critically influences pricing strategies. For FT NAPROXEN SODIUM, patent expiration dates vary by region but are generally forecasted between 2024-2028[3]. Patents protecting specific formulations or delivery mechanisms provide competitive barriers, maintaining premium price points.

Generic entry post-patent expiry typically induces substantial price reductions, often up to 70-80%, as generic manufacturers leverage scale and cost efficiencies. Regulatory approvals from entities like the FDA and EMA further influence market entry and pricing dynamics.

Competitive Market Players

Major pharmaceutical companies, including Pfizer (original patent holder), Teva, Mylan, and Sandoz, dominate the generic naproxen sodium space. Their pricing strategies are influenced by manufacturing costs, market share targets, and competitive pressures.

Innovative formulations—such as delayed-release or combination products—may command higher prices and capture niche markets, reinforcing the importance of product differentiation.

Pricing Analysis

Current Pricing Trends

- Brand-Name FT NAPROXEN SODIUM: The branded product generally commands a premium, averaging $20-$40 for a 30-count pack of 500 mg tablets in the U.S.

- Generic Alternatives: Generic versions are priced markedly lower, around $5-$15 for comparable quantities, reflecting the typical cost-saving post-patent expiry.

Pricing varies geographically; for instance, prices tend to be lower in European countries with centralized healthcare systems and high brand competition.

Factors Affecting Price Fluctuations

- Patent Status: Upcoming patent cliffs tend to lead to rapid price declines owing to generic competition.

- Regulatory Approvals & Compliance: Stringent quality standards may impact manufacturing costs and pricing.

- Market Penetration & Distribution: Extended distribution networks can influence retail pricing strategies.

- Insurance & Reimbursement Policies: Favorable coverage enhances affordability and market volume, indirectly impacting pricing.

Price Projections (2023-2030)

Pre-Patent Expiry Phase (2023-2024)

During this period, prices for the branded FT NAPROXEN SODIUM remain relatively stable, with slight fluctuations due to inflation and manufacturing costs. The average retail price hovers around $25 per 30-count pack in the U.S.

Post-Patent Expiry (2024-2026)

Following patent expiration, the entry of generics is anticipated to reduce prices by approximately 60-75%. By 2025, the average generic price could decline to $4-$8 per pack, driven by increased competition.

Market Stabilization and Growth Phase (2027-2030)

As more players enter the market, price erosion may plateau. However, innovative formulations or niche delivery mechanisms could sustain higher price points in select markets. Additionally, supply chain efficiencies and scale economies are expected to gradually reduce manufacturing costs.

Projected prices are estimated to settle around $3-$6 per pack in mature markets, with regional variations influenced by regulatory and reimbursement frameworks.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Rapid healthcare infrastructure growth in Asia-Pacific and Latin America presents expansion avenues with competitive yet affordable pricing.

- Formulation Innovation: Continued R&D investments in delayed-release or combination drugs can command premium pricing.

- Partnerships & Licensing: Strategic alliances can facilitate market penetration and bioequivalence studies accelerating approval timelines.

Risks

- Regulatory Hurdles: Stringent approval processes may delay market entry or increase costs.

- Pricing Pressure: Intensified generic competition can erode profit margins.

- Market Saturation: Existing players’ aggressive pricing strategies could limit premium pricing opportunities.

Strategic Recommendations

- Monitor Patent Timelines: Prepare for market transitions by aligning R&D and marketing strategies around patent expiry milestones.

- Cost Optimization: Invest in manufacturing efficiencies and supply chain management to sustain margins amidst price erosion.

- Market Diversification: Explore opportunities in emerging regions with less price sensitivity and growing demand.

- Innovate Delivery Mechanisms: Develop patient-friendly formulations that justify premium pricing.

Key Takeaways

- The FT NAPROXEN SODIUM market is poised for significant price reductions post-patent expiration, with generic entries expected to dominate the landscape.

- Current prices for brand-name formulations are around $20-$40 per pack, falling to approximately $3-$8 within 2-3 years after patent expiry.

- Regional disparities, regulatory environments, and formulation innovations will shape pricing trajectories.

- Strategic product differentiation and market diversification remain crucial to maintaining competitive advantage.

- Continuous market and patent landscape monitoring are essential for timely decision-making.

FAQs

1. When is the patent expiry for FT NAPROXEN SODIUM in the major markets?

Patent expiry varies regionally, with the U.S. expected around 2024-2025, and EU markets following shortly after. Stakeholders should confirm specific patent statuses through regional patent offices and legal counsel.

2. How will pricing change post-generic entry?

Prices are projected to decrease by approximately 60-75%, with generics offering significant cost savings. The rate of decline depends on market competition and regulatory factors.

3. Are there regional differences in FT NAPROXEN SODIUM pricing?

Yes, pricing varies due to healthcare policies, insurance coverage, and market maturity. European markets typically offer more affordable options owing to centralized pricing controls.

4. What factors can influence the market share of innovative formulations of naproxen sodium?

Patient compliance benefits, improved efficacy, patent protection, and physician preferences can all favor innovative formulations, enabling premium pricing.

5. What are the key considerations for pharmaceutical companies entering this market?

Regulatory compliance, patent landscape, manufacturing costs, distribution channels, and regional market dynamics are critical considerations for success.

References

[1] IQVIA. Global NSAID Market Data and Trends, 2022.

[2] IQVIA. Pharmaceutical Market Reports, 2022.

[3] PatentX Database. Naproxen Sodium Patent Lifecycles, 2023.

More… ↓