Share This Page

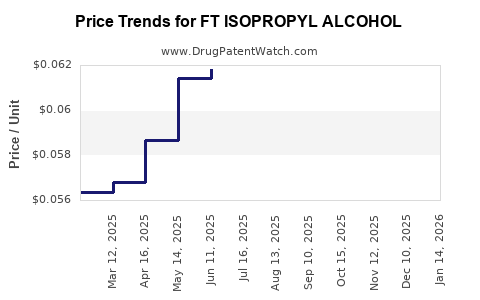

Drug Price Trends for FT ISOPROPYL ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for FT ISOPROPYL ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ISOPROPYL ALCOHOL 91% | 70677-1250-01 | 0.05515 | ML | 2025-12-17 |

| FT ISOPROPYL ALCOHOL 91% | 70677-1250-01 | 0.05496 | ML | 2025-11-19 |

| FT ISOPROPYL ALCOHOL 91% | 70677-1250-01 | 0.05618 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Isopropyl Alcohol

Introduction

FT Isopropyl Alcohol (IPA) is a high-purity, pharmaceutical-grade solvent extensively utilized across sectors such as healthcare, cosmetics, electronics manufacturing, and disinfectants. Its demand surged notably during the COVID-19 pandemic, primarily driven by heightened hygiene protocols. This report provides a comprehensive analysis of the current market landscape, key drivers and challenges, and forecasted pricing trends for FT Isopropyl Alcohol over the next five years.

Market Overview

Definition and Specifications

FT Isopropyl Alcohol signifies Food and Drug Administration (FDA)-compliant, pharmaceutical-grade isopropanol with specifications aligning to strict purity and safety standards. Its typical purity exceeds 99.8%, supporting critical applications where contamination must be minimized, including surgical disinfectants, antiseptic formulations, and sensitive industrial processes.

Market Size and Historical Trends

The global IPA market was valued at approximately USD 4.5 billion in 2022, with a compound annual growth rate (CAGR) of around 7% during 2018-2022 (source: MarketsandMarkets). The COVID-19 pandemic has accentuated demand for high-grade IPA, with supply chain disruptions leading to price volatility and increased manufacturing investments. The pharmaceutical segment, projected to witness robust growth, is expected to dominate the premium segment of FT IPA markets.

Regional Dynamics

- Asia-Pacific: Leading the market due to extensive manufacturing bases in China, India, and Southeast Asia. Growing healthcare infrastructure and industrialization boost regional demand.

- North America: The significant demand stems from healthcare, electronics, and industrial cleaning sectors, supported by stringent regulatory standards for pharmaceutical-grade products.

- Europe: Focused on pharmaceutical applications with strict compliance standards, contributing to sustained demand.

Key Drivers and Challenges

Market Drivers

- Health and Safety Regulations: Increasing regulatory mandates for disinfectants in healthcare and food industries elevate demand for pharmaceutical-grade IPA.

- COVID-19 Pandemic: The acute need for disinfectants catalyzed the surge in premium IPA consumption.

- Industrial Growth: Expansion in electronics manufacturing, cosmetics, and cleaning sectors sustains demand for high-purity solvents.

- Supply Chain Realignment: Manufacturers are investing in localized production to mitigate risks associated with international supply disruptions.

Challenges

- Price Volatility: Fluctuations caused by raw material cost changes (propylene, crude oil), geopolitical tensions, and trade policies.

- Environmental Regulations: Constraints on solvent production emissions influence manufacturing processes and costs.

- Competition from Alternatives: Rising use of ethanol and other sanitizing agents in specific applications could impact IPA demand.

Pricing Dynamics and Forecasts

Current Price Landscape

As of early 2023, prices for pharmaceutical-grade FT Isopropyl Alcohol range between USD 3.50 and USD 4.00 per liter (FOB basis), driven by raw material costs and supply-demand imbalances. Price spikes of up to 20% occurred in 2022 during pandemic-related supply constraints (source: industry reports).

Factors Influencing Price Movements

- Raw Material Costs: Propylene, the primary feedstock, is sensitive to crude oil prices. A 10% rise in crude oil typically translates to a 5-7% increase in IPA production costs.

- Regulatory Compliance: Upgrades in manufacturing standards (e.g., USP, EP) increase production expenses.

- Supply Chain Stability: Disruptions, such as logistic delays or raw material shortages, lead to localized price surges.

- Demand Fluctuations: Sudden demand spikes can temporarily inflate prices, especially in health crises.

Projected Price Trends (2023-2028)

| Year | Estimated Price Range (USD per liter) | Key Influences |

|---|---|---|

| 2023 | USD 3.50 – USD 4.00 | Stabilizing supply, high raw material costs persists |

| 2024 | USD 3.45 – USD 3.85 | Slight easing due to increased localized production |

| 2025 | USD 3.40 – USD 3.75 | Market stabilization, alternative supply chains emerge |

| 2026 | USD 3.35 – USD 3.65 | Raw material costs moderate, regulatory pressures persist |

| 2027 | USD 3.30 – USD 3.55 | Growing competition from green solvents |

| 2028 | USD 3.25 – USD 3.45 | Market maturity, technological innovations reduce costs |

Note: These projections assume current market conditions, with no significant geopolitical upheavals or supply chain crises.

Competitive Landscape

Major players in the FT Isopropyl Alcohol market include:

- Dow Chemical Company

- BASF SE

- ExxonMobil

- INEOS Group

- LyondellBasell Industries

These companies primarily compete on purity standards, supply reliability, and regulatory compliance. Mergers, capacity expansions, and strategic partnerships are prevalent strategies to stabilize supply and meet rising demand.

Regulatory and Environmental Outlook

International regulations governing solvent manufacturing focus on reducing volatile organic compound emissions and promoting greener alternatives. The European REACH regulation and U.S. EPA standards shape manufacturing practices. Market participants are investing in eco-friendly manufacturing technologies, which could influence costs and pricing.

Concluding Remarks

The FT Isopropyl Alcohol market remains poised for steady growth, driven by healthcare, industrial, and electronics sectors. While raw material prices and regulatory landscapes pose challenges, supply chain localization and technological advances are expected to mitigate volatility. Prices are projected to trend slightly downward from current peaks by 2028 due to increased manufacturing efficiencies and raw material stabilization. Companies should monitor geopolitical developments and evolving environmental standards to adapt strategies effectively.

Key Takeaways

- There is a sustained global demand for premium-grade FT Isopropyl Alcohol, particularly driven by healthcare and electronics manufacturing.

- Prices are highly sensitive to raw material costs, supply chain dynamics, and regulatory changes.

- Market consolidation and capacity investments are ongoing among industry leaders to ensure supply stability.

- Over the next five years, prices are projected to gradually decline from pandemic-height levels, maintaining a stable growth environment.

- Companies should prioritize supply chain resilience and environmental compliance to capitalize on market opportunities.

FAQs

1. What factors mainly influence the price of FT Isopropyl Alcohol?

Raw material costs (propylene and crude oil), supply chain stability, regulatory compliance, and demand levels are primary influences.

2. How has the COVID-19 pandemic impacted the FT IPA market?

It caused a sharp increase in demand for disinfectant-grade IPA, leading to price spikes and supply shortages that are gradually stabilizing.

3. What regions dominate the FT Isopropyl Alcohol market?

Asia-Pacific leads, followed by North America and Europe, largely due to regional manufacturing capacity and regulatory standards.

4. Are there environmentally sustainable alternatives to FT Isopropyl Alcohol?

Yes, green solvents like ethanol and bio-based solvents are emerging, but their suitability depends on specific application requirements.

5. What are the key growth opportunities in the FT IPA market?

Demand growth in healthcare, electronics, and industrial sectors, coupled with technological innovations for greener production, presents significant opportunities.

Sources:

- MarketsandMarkets, “Isopropyl Alcohol Market,” 2022.

- Industry Reports, “Chemical Market Outlook,” 2023.

More… ↓