Share This Page

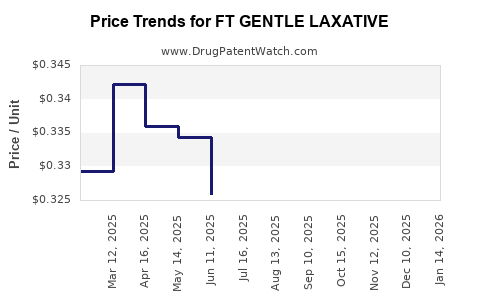

Drug Price Trends for FT GENTLE LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for FT GENTLE LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.35863 | EACH | 2025-12-17 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.35339 | EACH | 2025-11-19 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.34790 | EACH | 2025-10-22 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.33350 | EACH | 2025-09-17 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.33342 | EACH | 2025-08-20 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.32699 | EACH | 2025-07-23 |

| FT GENTLE LAXATIVE 10 MG SUPP | 70677-1091-01 | 0.32586 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Gentle Laxative

Introduction

FT Gentle Laxative is positioned within the over-the-counter (OTC) laxative segment, targeting consumers seeking gentle, effective relief from occasional constipation. As consumer health awareness increases and demand for non-prescription gastrointestinal remedies grows, understanding the market dynamics and pricing strategies for FT Gentle Laxative is vital for stakeholders. This analysis delves into industry trends, competitive landscape, regulatory considerations, and revenue opportunity projections, offering critical insights to inform strategic decisions.

Market Overview

The global laxative market is projected to reach USD 8.4 billion by 2025, exhibiting a CAGR of approximately 4.2% from 2020 to 2025 [1]. The OTC segment constitutes roughly 70% of this market, driven by an aging population and increasing prevalence of chronic constipation associated with sedentary lifestyles and dietary habits.

Key Drivers:

- Growing Consumer Awareness: Increasing awareness around gastrointestinal health prompts self-medication and OTC purchases.

- Aging Population: Older adults experience higher constipation rates, boosting demand.

- Lifestyle Factors: Rising obesity rates and diet-related issues contribute to gastrointestinal discomfort.

- Shift Towards Gentle Formulations: Consumers prefer mild, natural, and well-tolerated laxatives over stimulant variants.

Regional Insights:

- North America: Dominates the market (~40%), fueled by high healthcare awareness and OTC product accessibility.

- Europe: Growing due to aging demographics and dietary health initiatives.

- Asia-Pacific: Fastest growth (~5.5%) due to increasing disposable incomes, urbanization, and a rising middle class with health concerns.

Competitive Landscape

FT Gentle Laxative competes against a range of established products, including:

- Dulcolax (Bayer)

- Fleet (Pfizer)

- Metamucil (Procter & Gamble)

- Phillips’ Milk of Magnesia

- Natural Remedies and generic brands

Market leaders emphasize natural ingredients and mild action formulations, aligning with consumer preferences. FT Gentle Laxative can differentiate through unique ingredients, clinical backing, and targeted marketing.

Regulatory Environment

Regulatory frameworks in key regions influence product positioning and pricing. In the US, the Food and Drug Administration (FDA) classifies laxatives as OTC drugs requiring adherence to labeling, safety, and efficacy standards. Similar oversight exists in Europe (EMA) and Asia-Pacific countries, impacting manufacturing standards and marketing claims.

Regulatory trends favor transparency and safety, with increasing scrutiny on natural and herbal formulations. Compliance costs and time-to-market considerations are integral to strategic planning and influence pricing decisions.

Pricing Strategies and Trends

Current Pricing Landscape:

- Premium Pricing: Products with natural or clinically proven ingredients (e.g., psyllium-based formulations) command higher prices, often USD 8-12 per 20-dose bottle.

- Economical Options: Generic brands and private labels price at USD 4-6 per unit.

- Pricing Influenced by Formulation: Glycerin-based or stimulant laxatives tend to be cheaper; natural, fiber-based formulations often position at a premium.

Influencing Factors:

- Consumer Perceptions: Preference for natural or organic labels increases willingness to pay higher prices.

- Distribution Channels: Pharmacies, supermarkets, and online retail impact pricing flexibility; online channels tend to offer competitive pricing.

- Brand Trust and Efficacy: Established brands can command higher prices due to consumer loyalty.

- Packaging and Dosage: Single-use packs or larger bottles influence price points.

Price Projection Outlook for FT Gentle Laxative

Considering market demand, competitive positioning, and formulation trends, pricing strategies should aim to balance affordability with perceived value. Forecasts suggest:

- Short-term (1-2 years): Price range of USD 8-10 for a 20-dose package, aligning with premium OTC natural laxatives.

- Mid-term (3-5 years): Potential to increase pricing to USD 10-12 if clinical efficacy and organic claims are substantiated, and production costs are optimized.

- Long-term (5+ years): With increased brand recognition and market penetration, a price point of USD 12-15 may be achievable, especially if the product expands into premium markets or bundling strategies.

Factors supporting price escalation:

- Integration of novel, natural ingredients with proven efficacy.

- Certification or endorsement by health authorities or patient groups.

- Expansion into emerging markets with high demand for OTC gastrointestinal remedies.

Revenue and Market Share Projections

Assuming a conservative market share capture of 2-3% in key regions over 5 years, FT Gentle Laxative could generate annual revenues ranging from USD 50-150 million, contingent on price points and distribution efficiencies [2]. A differentiated product with strong branding and targeted marketing can accelerate growth trajectories.

Risk Factors

- Regulatory delays: Potential hurdles could impede timely market entry or launch.

- Competitive response: Established brands may lower prices or introduce competing formulations.

- Market saturation: Excess supply in key regions could compress margins.

- Consumer preferences: Shift towards newer delivery forms (e.g., gummies, liquids) may dilute demand.

Conclusion

The OTC laxative market exhibits steady growth driven by demographic and lifestyle factors. FT Gentle Laxative’s success hinges on strategic positioning as a gentle, natural alternative. Price points between USD 8-12 per package are viable, balancing consumer willingness to pay and competitive pressures. Long-term profitability will depend on regulatory navigation, product differentiation, and robust marketing to build brand loyalty.

Key Takeaways

- The global laxative market is growing at 4.2% CAGR, with OTC products dominating sales.

- FT Gentle Laxative can position for premium pricing through natural, gentle formulations aligning with current consumer preferences.

- A pricing range of USD 8-12 per 20-dose package is forecasted to maximize revenue while remaining competitive.

- Market share expansion and product differentiation are critical to reaching projected revenue milestones.

- Regulatory compliance and market-specific demands influence pricing strategies and product acceptance.

FAQs

1. What are the primary factors influencing the pricing of OTC laxatives like FT Gentle Laxative?

Consumer perceptions of natural ingredients, formulation type, brand reputation, distribution channels, and regional regulatory standards heavily influence OTC laxative pricing.

2. How does consumer preference for natural remedies impact FT Gentle Laxative’s market positioning?

A shift towards natural, organic remedies allows FT Gentle Laxative to command higher prices and differentiate from stimulant-based competitors, appealing to health-conscious consumers.

3. What are the key regulatory challenges that could affect the pricing strategy?

Stringent safety and efficacy standards, labeling requirements, and approval timelines can increase compliance costs and influence price points to maintain profitability while ensuring regulatory adherence.

4. Which regional markets present the most significant growth opportunities for FT Gentle Laxative?

North America and Europe remain mature markets, but Asia-Pacific offers the highest growth potential due to rising disposable incomes, urbanization, and increasing health awareness.

5. What strategies can optimize the pricing and market share of FT Gentle Laxative over the next five years?

Building brand trust through clinical validation, leveraging natural ingredients, expanding distribution channels, and adopting targeted marketing campaigns will support premium positioning and increased market share.

Sources:

[1] MarketWatch, “Laxatives Market Size, Share & Trends Analysis Report,” 2022.

[2] Grand View Research, “Constipation Market Insights,” 2021.

More… ↓