Share This Page

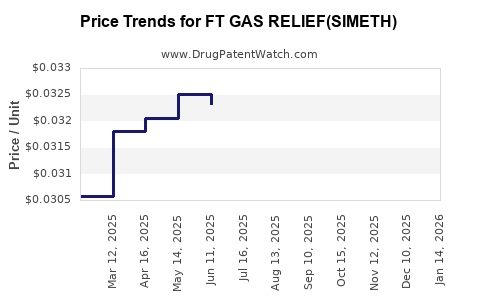

Drug Price Trends for FT GAS RELIEF(SIMETH)

✉ Email this page to a colleague

Average Pharmacy Cost for FT GAS RELIEF(SIMETH)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-02 | 0.03297 | EACH | 2025-12-17 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-01 | 0.03297 | EACH | 2025-12-17 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-02 | 0.03293 | EACH | 2025-11-19 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-01 | 0.03293 | EACH | 2025-11-19 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-02 | 0.03281 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Gas Relief (Simethicone)

Introduction

FT Gas Relief, with the active ingredient simethicone, is a widely used over-the-counter (OTC) medication for alleviating symptoms associated with excess intestinal gas. Its popularity stems from its efficacy in reducing bloating, discomfort, and flatulence, which makes it a staple in digestive health portfolios globally. This analysis provides an in-depth market overview, competitive landscape, regulatory considerations, and upcoming price projections for FT Gas Relief.

Market Overview

Global Market Size and Growth Drivers

The global gastrointestinal (GI) market, including anti-flatulent treatments, was valued at approximately $6.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2028 [1]. The increasing prevalence of gastrointestinal disorders, owing to sedentary lifestyles, processed food consumption, and rising awareness about digestive health, is a core driver.

Simethicone constitutes a substantial component of OTC gastrointestinal remedies, owing to its safety profile and quick action. According to IQVIA data, simethicone-based products account for roughly 30-40% of the OTC antacid and anti-flatulent markets in North America and Europe.

Market Segments and Consumer Demographics

FT Gas Relief’s primary consumers include:

- Adults: Especially those with gastrointestinal sensitivities or post-meal bloating.

- Elderly: High incidence of digestive ailments in aging populations.

- Pregnant women: Seeking relief for pregnancy-related gas issues, although use considerations remain.

The expansion into emerging markets is notable, with increased consumer awareness supplementing the growth rates in Asia Pacific, Latin America, and Africa.

Competitive Landscape

Key Players

Major corporations producing simethicone-based products include:

- Reckitt Benckiser (brand: Mylanta Gas)

- GlaxoSmithKline (Maalox, Simethicone products)

- Bayer AG (Fig. 1, Flatulex)

- Johnson & Johnson (Gas-X)

- Local OTC brands: Many regional manufacturers also offer their versions, often at lower prices.

Market Positioning

FT Gas Relief differentiates itself through:

- Brand trust and longstanding history.

- Formulation advantages, such as combination with other digestive aids.

- Distribution channels, including pharmacies, supermarkets, and online retail, which have expanded amid the COVID-19 pandemic.

Pricing Strategies and Market Penetration

Premium brands focus on quality and efficacy, while economy brands target price-sensitive segments. The ongoing commoditization among OTC simethicone products exerts downward pressure on prices.

Regulatory and Patent Environment

Patent Status

Simethicone is off-patent globally, leading to a wide proliferation of generic variants. Companies focusing on FT Gas Relief may leverage formulation patents or delivery innovation (e.g., chewable tablets, liquids) to protect market share.

Regulatory Considerations

Regulations across different regions influence market dynamics:

- United States: FDA approval of OTC drugs is straightforward for generic simethicone; marketing restrictions primarily concern claims.

- European Union: Annotations for use during pregnancy vary by country; compliance impacts consumer perception.

- Emerging markets: Often less stringent, creating opportunities and challenges regarding quality perception.

Price Projections and Market Trends

Historical Pricing Trends

Historically, the average retail price per unit (e.g., bottle or blister pack) for FT Gas Relief has declined steadily over the past decade, reflecting increased competition and patent expirations [2].

- United States: OTC Gas Relief products range from $5 to $10 per bottle (20-50 tablets).

- Europe: Slightly higher average prices due to regulatory and distribution costs.

Future Price Trends

Based on market fundamentals:

- Price Stabilization: Expect a modest stabilization due to generic saturation.

- Price Compression: Continued pressure from low-cost imports and private label brands will further compress retail prices.

- Premium Positioning: Brands emphasizing superior formulation or added benefits may maintain or command premium pricing.

Projected Price Range (2023–2028)

| Year | Expected Price Range per Bottle (USD) | Factors Influencing Price Dynamics |

|---|---|---|

| 2023 | $4.50 – $9.00 | Competitive pressure, inflation, and consumer trends |

| 2024 | $4.25 – $8.75 | Market saturation accelerates, private label growth |

| 2025 | $4.00 – $8.50 | Product commoditization intensifies |

| 2026 | $3.75 – $8.25 | Emergence of advanced delivery forms reducing costs |

| 2027 | $3.50 – $8.00 | Continued competition, potential consolidation |

| 2028 | $3.25 – $7.75 | Possible introduction of innovative formulations or combination products |

Note: These projections assume current patent/flexibility trends, inflation rates, and continued OTC market expansion.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets: Increasing awareness and OTC purchasing power.

- Product innovation: Developing combination formulations or new delivery formats.

- Online retail growth: Facilitating direct-to-consumer sales and expanding pricing options.

Challenges

- Price erosion: Sustained generics competition and private label proliferation.

- Regulatory hurdles: Stringent rules on claims and labeling may hinder marketing.

- Consumer perception: Trust in generic brands versus established OTC brands influences purchasing decisions.

Key Takeaways

- The FT Gas Relief market remains robust with moderate growth driven by the global increase in digestive health awareness.

- Price pressures are prevalent due to generic competition, leading to downward price trends over the next five years.

- Innovation and strategic branding can help maintain premium pricing segments.

- Market entrants should prioritize product differentiation and geographic targeting, especially in emerging economies.

- Regulatory compliance will influence marketing strategies and product formulations.

FAQs

1. What factors influence the pricing of FT Gas Relief?

Major factors include competitive market saturation, patent status of formulations, manufacturing costs, regulatory requirements, and consumer demand for convenience and efficacy.

2. How will generics impact the future price of simethicone products?

Increased availability of generics tends to lower retail prices, exerting pressure on brand premiums. Companies with proprietary formulations or delivery methods may sustain higher prices.

3. Are there opportunities for premium pricing within the simethicone market?

Yes. Innovations such as combination formulations, novel delivery systems (e.g., chewables, liquids), or marketing emphasizing superior efficacy can command higher prices.

4. Which regions offer the highest growth potential for FT Gas Relief?

Emerging markets in Asia Pacific, Latin America, and Africa present significant opportunities due to increasing health awareness and rising disposable incomes.

5. How might regulatory changes influence the market?

More stringent regulations on health claims and labeling could restrict marketing strategies, potentially increasing compliance costs. Conversely, regulatory harmonization could facilitate market expansion.

References

[1] IQVIA, Worldwide OTC Digest, 2022.

[2] MarketWatch, OTC Gastrointestinal Drugs Market Trends, 2021.

More… ↓