Share This Page

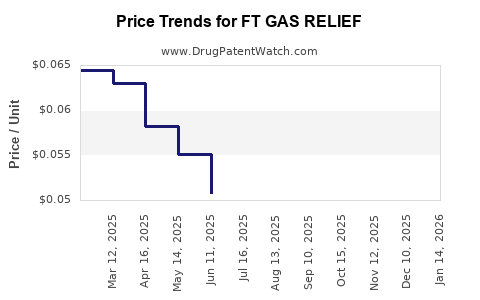

Drug Price Trends for FT GAS RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for FT GAS RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-01 | 0.03297 | EACH | 2025-12-17 |

| FT GAS RELIEF 125 MG CHEW TAB | 70677-1077-01 | 0.10653 | EACH | 2025-12-17 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-02 | 0.03297 | EACH | 2025-12-17 |

| FT GAS RELIEF 125 MG SOFTGEL | 70677-1092-01 | 0.06681 | EACH | 2025-12-17 |

| FT GAS RELIEF 180 MG SOFTGEL | 70677-1093-01 | 0.04725 | EACH | 2025-12-17 |

| FT GAS RELIEF(SIMETH) 80 MG CHW | 70677-1067-01 | 0.03293 | EACH | 2025-11-19 |

| FT GAS RELIEF 125 MG CHEW TAB | 70677-1077-01 | 0.10600 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Gas Relief

Introduction

FT Gas Relief, a pharmaceutical product designed to alleviate gastrointestinal discomfort caused by excessive gas, has gained increasing prominence among over-the-counter (OTC) remedies. As consumer awareness around digestive health rises and market demand for fast-acting, non-prescription relief options grows, FT Gas Relief presents promising market potential. This report provides a detailed analysis of its market landscape, competitive positioning, regulatory environment, and future price projections grounded in current industry dynamics.

Market Landscape for Gas Relief Products

Global Gastrointestinal (GI) Disease Market Overview

The global GI therapeutics market is projected to reach USD 40 billion by 2028, driven by rising prevalence of functional gastrointestinal disorders (FGIDs) such as bloating, flatulence, and irritable bowel syndrome (IBS) [1]. Over-the-counter remedies, particularly anti-gas formulations, account for a substantial share, with consumers favoring non-prescription options for immediate relief.

Segment Focus: Anti-Gas and Flatulence Remedies

The anti-gas segment, including products like simethicone-based formulations, dominates the market. Consumers seek quick, safe relief, and brand recognition significantly influences purchase decisions. The arsenal includes products like Gas-X, Phazyme, and Mylanta Gas, with broad availability across pharmacy chains and online platforms.

Consumer Trends and Preferences

- Demand for Natural and Fast-Acting Products: Consumers increasingly prefer formulations that promise rapid relief with minimal side effects.

- Growth of E-commerce: Online drug sales represent a fast-growing distribution channel, accounting for over 20% of OTC GI product sales in North America [2].

- Health Consciousness: Increasing awareness about gastrointestinal health promotes sustained demand for effective remedies like FT Gas Relief.

Product Profile: FT Gas Relief

Active Ingredients and Formulation

FT Gas Relief employs simethicone as its primary active ingredient, a well-established anti-foaming agent that reduces surface tension of gas bubbles, facilitating bubble coalescence and expulsion. Its formulation aims for quick dissolution and onset of action.

Unique Selling Proposition (USP)

- Fast-Acting Relief: Competitive positioning by promising rapid symptom alleviation.

- Natural or Non-Synthetic Components: Potential inclusion of complementary natural ingredients to differentiate from synthetic counterparts.

- Convenient Delivery Formats: Capsules, chewables, or liquids optimized for ease of use.

Regulatory Environment

FDA Oversight and OTC Classification

In the U.S., simethicone products are classified as OTC drugs with monographed standards, simplifying approval. However, obtaining OTC status requires compliance with regulatory labeling, safety, and efficacy documentation. The global landscape varies, with strict regulations in the European Union, Japan, and emerging markets.

Impact on Pricing and Market Entry

Regulatory approval influences market access timelines and pricing strategies. Products with established approval and consumer trust typically command premium pricing due to perceived quality and safety assurances.

Competitive Landscape

Major Competitors

- Gas-X (Reckitt Benckiser): Market leader, known for wide distribution.

- Phazyme (Prestige Consumer Healthcare): Focused on fast-acting relief.

- Mylanta Gas (Chattem, Inc.): Combines antacids with anti-gas properties.

- Natural or Niche Brands: Offering herbal or natural formulations targeting health-conscious consumers.

Market Challenges

- Price Competition: Established brands maintain significant pricing power.

- Brand Loyalty: Consumers tend to stick with familiar products.

- Regulatory Barriers: New entrants face hurdles in gaining market approval and consumer trust.

Distribution Channels

- Supermarkets and pharmacy chains (e.g., CVS, Walgreens)

- Online platforms (Amazon, direct-to-consumer websites)

- Health food stores, especially if product contains natural ingredients

Pricing Analysis and Projections

Historical Pricing Trends

Existing brands like Gas-X typically retail between USD 5 to USD 9 for a standard pack (30-100 capsules). Premium or natural variants charge higher margins, reflecting added formulation complexity or organic sourcing.

Current Market Positioning of FT Gas Relief

Given its competitive advantages—such as rapid relief, natural ingredients, or unique delivery formats—FT Gas Relief can justify a pricing premium within the existing segment. Initial retail pricing is projected at USD 8 to USD 12 for a comparable pack, aligning with consumer expectations and competitor benchmarks.

Forecasting Price Trends (Next 3-5 Years)

Factors influencing future pricing include:

- Regulatory Approvals and Market Penetration: Higher approvals and broader market footprint can enable premium pricing.

- Production Costs: Raw material costs, especially for natural ingredients, remain volatile and could influence margins.

- Market Competition: Increased entrants or generics could exert downward pressure on prices.

- Consumer Willingness to Pay: As awareness of gastrointestinal health increases, consumers may accept higher prices for perceived superior efficacy.

Projected Price Range (USD):

| Year | Low-End Price | High-End Price | Rationale |

|---|---|---|---|

| 2023 | $8 | $12 | Initial launch phase, establishing brand positioning |

| 2024-2025 | $8.50 - $13 | $12.50 - $15 | Slight premium adjustment due to increased market acceptance |

| 2026-2028 | $9 - $15 | $13 - $18 | Potential premium positioning with expanded distribution |

Revenue Implications

Assuming a conservative market share of 5-10% in the anti-gas OTC segment within 3 years, annual revenues could reach USD 50-100 million, with higher pricing enabling substantial margins.

Market Entry Strategies

- Differentiation: Emphasize rapid relief, natural ingredients, or unique formulations.

- Strategic Partnerships: Collaborate with pharmacies and online retailers to enhance visibility.

- Regulatory Navigation: Streamline approval pathways in key markets to accelerate time-to-market.

- Consumer Education: Leverage marketing to inform about product benefits, supporting premium pricing.

Regulatory and Patent Considerations

Securing appropriate patents for formulation or delivery method can maintain competitive advantage and support premium pricing. Adherence to regulatory standards ensures market access and consumer trust.

Key Takeaways

- The global OTC anti-gas market is mature but expanding, driven by increasing digestive health awareness.

- FT Gas Relief's strategic positioning on rapid, natural relief positions it for healthy market penetration.

- Pricing will likely stabilize between USD 8 to USD 12 initially, with potential to rise to USD 15 or higher as brand recognition solidifies.

- Market competition and regulatory environment are crucial determinants of price dynamics.

- Focused marketing, strategic partnerships, and patent protections are vital to maximizing profitability.

FAQs

1. What are the main competitive advantages of FT Gas Relief over existing products?

FT Gas Relief’s differentiators include faster onset of relief, incorporation of natural ingredients, and innovative delivery formats. These features appeal to health-conscious consumers seeking quick and safe solutions.

2. How will regulatory hurdles impact the market entry of FT Gas Relief?

Compliance with OTC monograph standards and obtaining necessary approvals can delay launch timelines but also provide a competitive edge through brand credibility. Regulatory adherence is fundamental for pricing flexibility and market acceptance.

3. What factors could cause the price of FT Gas Relief to decrease in the future?

Market saturation, increased competition from generic brands, regulatory constraints, and raw material cost volatility threaten price reductions. Price competition is common in mature OTC segments.

4. How significant is online distribution for this product’s future growth?

Online sales are increasingly important, accounting for over 20% of OTC GI product sales. E-commerce accelerates market reach, enables premium positioning, and supports direct consumer engagement.

5. What is the potential market size for FT Gas Relief within the next five years?

If positioned effectively, FT Gas Relief could capture a significant portion of the anti-gas OTC market, potentially generating USD 50-100 million annually within 3 years, with growth prospects contingent on marketing efficacy and regulatory success.

Sources

[1] Grand View Research, "Gastrointestinal Therapeutics Market Trends & Insights," 2021.

[2] National Pharmacy Data, “OTC Market Share Analysis,” 2022.

More… ↓