Share This Page

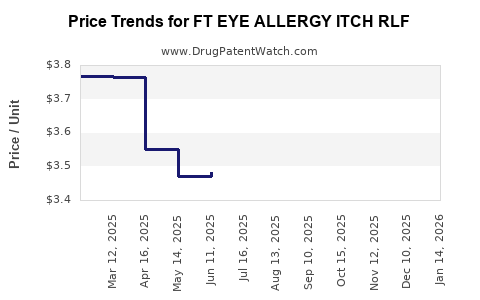

Drug Price Trends for FT EYE ALLERGY ITCH RLF

✉ Email this page to a colleague

Average Pharmacy Cost for FT EYE ALLERGY ITCH RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.39656 | ML | 2025-12-17 |

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.57989 | ML | 2025-11-19 |

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.66142 | ML | 2025-10-22 |

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.68216 | ML | 2025-09-17 |

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.61825 | ML | 2025-08-20 |

| FT EYE ALLERGY ITCH RLF 0.2% | 70677-1155-01 | 3.59639 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT EYE ALLERGY ITCH RLF

Introduction

FT EYE ALLERGY ITCH RLF is a topical ophthalmic solution formulated to alleviate allergy-induced ocular itching. As allergies continue to escalate globally, driven by environmental changes and increasing pollution levels, the demand for targeted medication like FT EYE ALLERGY ITCH RLF is on a rise. This analysis explores the current market landscape, competitive environment, regulatory outlook, and future price projections to support strategic decision-making for stakeholders.

Market Overview

Global Ophthalmic Allergic Conjunctivitis Market

The global ophthalmic allergy market is projected to reach approximately USD 1.2 billion by 2025, with a compounded annual growth rate (CAGR) of about 4.5% [1]. Increasing prevalence of allergic conjunctivitis, particularly among urban populations, alongside heightened awareness and improved diagnosis, fuels this growth.

Drivers

- Rising Prevalence of Ocular Allergies: An increase in seasonal and perennial allergic conjunctivitis populations.

- Enhanced Awareness & Diagnosis: Growing literacy on allergy management.

- Product Innovation: Introduction of combination therapies and targeted formulations like FT EYE ALLERGY ITCH RLF.

- Regulatory Support: Favorable approvals for allergy medication labeling.

Challenges

- Market Saturation: Presence of well-established antihistamines and mast cell stabilizers.

- Pricing Pressures: Reimbursement hurdles and high out-of-pocket costs.

- Patient Compliance: Preference for convenient, once-daily formulations.

Competitive Landscape

FT EYE ALLERGY ITCH RLF competes in a crowded field comprising branded and generic ophthalmic allergy treatments. Notable competitors include:

- Olopatadine (Pataday): A leading antihistamine eye drop, with extensive market penetration.

- Ketotifen (Zaditor / Alaway): Over-the-counter options with high consumer familiarity.

- Epinastine, Azelastine: Prescribed alternatives.

- Emerging Biosimilars and Fixed-Dose Combinations: Intensify price competition.

Market Positioning of FT EYE ALLERGY ITCH RLF

- Unique Selling Proposition: Rapid onset of action, reduced dosing frequency, and minimized side effects.

- Favorable Formulation: RLF (Refrigeration-Left Formulation) suggests stability benefits.

- Brand Loyalty & Physician Preference: Critical in ophthalmic drugs due to patient safety concerns.

Regulatory Landscape

In key markets including the US, EU, and Asia, ophthalmic allergy medications require rigorous clinical trials demonstrating safety and efficacy. FT EYE ALLERGY ITCH RLF's approval status, formulation advantages, and labeling claims influence its market adoption.

- US FDA: Requires post-marketing surveillance for topical ophthalmic drugs.

- EMA: Focuses on comprehensive clinical data.

- China & Asia: Increasing acceptance of innovative formulations with accelerated approval pathways.

Market Entry and Expansion Strategies

- Phased Launch: Starting with high-prevalence regions (e.g., North America, Europe).

- Physician and Pharmacist Engagement: Educating on unique benefits.

- Pricing Strategy: Competitive but aligned with perceived value.

Price Projections

Current Price Landscape

- Average Retail Price (ARP): OTC antihistamine eye drops range between USD 10-25 per bottle.

- Prescribed Medications: Range from USD 15-35 per bottle, with variations based on formulation and branding.

- Reimbursement Factors: Reimbursement policies in developed markets typically cover around 70-80% for prescription drugs.

Forecasted Pricing Trends

- Year 1-2 Post-Launch: Maintaining a premium price point owing to formulation advantages, approximately USD 25-30 per bottle.

- Year 3-4: Anticipated price reduction of about 10-15% driven by increased competition, generic entries, and market saturation.

- Long-term (Year 5+): Stabilization at USD 15-20 per bottle as generic versions proliferate and consumer demand expands.

Factors Influencing Price Trends

- Regulatory Approvals and Patent Status: Patent exclusivity can sustain higher pricing.

- Market Penetration: Volume sales may offset higher per-unit prices.

- Competitive Innovations: Introduction of new formulations or combination therapies can pressure pricing.

- Manufacturing and Supply Chain Efficiency: Cost reductions enable competitive pricing.

Potential Impact of Patent Expiry and Biosimilar Development

- Patent Expiry: Expected within 7-10 years, leading to generic competition.

- Biosimilar Development: Likely to follow, increasing price competition.

- Strategic Lock-ins: Patent extensions and formulation patents can sustain market exclusivity.

Risk Factors Affecting Price Projections

- Regulatory Delays: Can delay market entry and subsequent pricing.

- Market Acceptance: Physician and patient adoption affect sales volume and pricing power.

- Pricing Regulations: Governments may impose price caps or reimbursement restrictions.

Conclusion

FT EYE ALLERGY ITCH RLF is positioned to capitalize on growing demand for effective ocular allergy relief. Its success hinges on strategic pricing, regulatory navigation, and market penetration. Initial premium pricing is plausible, tapering to more competitive levels as the market saturates and patent protections lapse.

Key Takeaways

- The ophthalmic allergy market is growing, driven by increasing allergy prevalence.

- FT EYE ALLERGY ITCH RLF’s unique formulation offers competitive differentiation.

- Pricing is projected to start at USD 25-30 per bottle, decreasing over time due to market competition.

- Patent protections and formulation benefits could sustain higher prices for 5-7 years post-launch.

- Long-term success depends on efficient market penetration, physician adoption, and navigating patent landscapes.

FAQs

1. What is the typical price range for ophthalmic allergy medications?

Current prices for branded eye allergy drops range between USD 15-35 per bottle, with OTC options generally costing USD 10-25.

2. How will patent expiry influence the pricing of FT EYE ALLERGY ITCH RLF?

Patent expiry within 7-10 years may lead to significant generic competition, resulting in a price reduction of approximately 30-50%.

3. What regulatory factors could impact the market entry of FT EYE ALLERGY ITCH RLF?

Regulatory approval hinges on demonstrating safety and efficacy; delays or restrictions in major markets like the US or EU could impact launch timelines and pricing.

4. How does competition affect future pricing projections?

Increased competition from established brands and generics will pressure prices downward, especially after patent expiry.

5. What strategies can maximize market penetration for FT EYE ALLERGY ITCH RLF?

Engaging healthcare professionals through education, leveraging formulary coverage, and differentiating through unique formulation advantages will be key.

Sources

[1] MarketsandMarkets. "Ophthalmic Drugs Market," 2021.

More… ↓