Share This Page

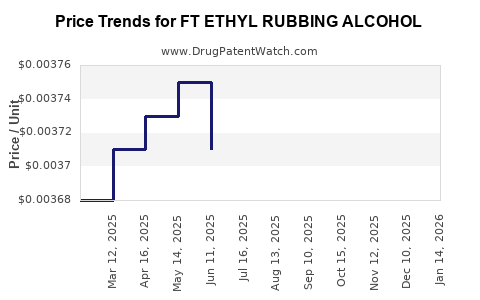

Drug Price Trends for FT ETHYL RUBBING ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for FT ETHYL RUBBING ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ETHYL RUBBING ALCOHOL 70% | 70677-1220-01 | 0.00380 | ML | 2025-12-17 |

| FT ETHYL RUBBING ALCOHOL 70% | 70677-1220-01 | 0.00380 | ML | 2025-11-19 |

| FT ETHYL RUBBING ALCOHOL 70% | 70677-1220-01 | 0.00380 | ML | 2025-10-22 |

| FT ETHYL RUBBING ALCOHOL 70% | 70677-1220-01 | 0.00381 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ETHYL RUBBING ALCOHOL

Introduction

FT Ethyl Rubbing Alcohol, a high-purity ethyl alcohol used predominantly in antiseptic, disinfectant, and industrial applications, occupies a significant position in both healthcare and manufacturing sectors. Analyzing its market landscape and establishing price projections requires understanding supply chains, regulatory dynamics, competitive factors, and global demand trends, particularly as the focus on hygiene and infection control intensifies worldwide.

Market Overview

Global Market Landscape

The global rubbing alcohol market was valued at approximately USD 2.5 billion in 2022, with a compound annual growth rate (CAGR) forecasted around 6-7% through 2028 [1]. Ethyl alcohol constitutes the core active component, with purity standards typically ranging from 70% to 99%. The market's expansion is driven by heightened awareness of sanitation, increased healthcare infrastructure, and growth in industrial applications.

Segmentation of FT Ethyl Rubbing Alcohol

FT (for trade) Ethyl Rubbing Alcohol generally refers to pharmacopeia-grade ethanol, often at 70-99% purity. Its application spectrum includes:

- Medical disinfectants and sanitizers

- Personal care products

- Industrial cleaning agents

- Pharmaceutical manufacturing

Quality attributes, such as purity and ethanol source (synthetic vs. fermentation-derived), significantly influence market segments.

Key Supply Regions

Major production hubs include:

- North America: U.S. and Canada, where regulatory standards are stringent.

- Asia-Pacific: China, India, and Southeast Asia, experiencing rapid growth owing to expanding healthcare infrastructure and industrialization.

- Europe: Germany, Spain, and France, with strict regulatory oversight and high-quality standards.

Supply dynamics in these regions are affected by raw material costs, environmental regulations, and capacity investments.

Regulatory and Quality Considerations

Regulatory agencies like the FDA (U.S.) and EMA (Europe) impose strict standards on pharmacopeia-grade ethanol, influencing supply and pricing. Recent amendments to safety standards and ethanol import/export policies can cause fluctuations in availability and cost. Additionally, the COVID-19 pandemic accelerated demand but also underscored challenges in raw material procurement and regulatory adherence.

Supply Chain Dynamics

The supply chain for FT Ethyl Rubbing Alcohol involves:

- Raw Material Acquisition: Ethylene and ethanol feedstocks, derived from petrochemical and agricultural sources.

- Manufacturing: Ethanol fermentation or petrochemical synthesis, followed by purification processes.

- Distribution: Wholesale distributors, pharmaceutical suppliers, and retail outlets.

Disruptions—such as raw material shortages, shipping delays, or regulatory bottlenecks—can impact market prices significantly.

Competitive Landscape

Major players include:

- Pernod Ricard, Inc. (via alcohol segment)

- Shandong Jianyuan Biotechnology Co., Ltd.

- Crystal Clear International

- United Laboratories

Market concentration varies geographically; regions with local manufacturing tend to have more stable pricing compared to import-dependent markets.

Market Drivers and Restraints

Drivers:

- Surge in demand for disinfectants amid global pandemic.

- Growing awareness of personal hygiene.

- Expansion of healthcare infrastructure in emerging economies.

- Industrial growth requiring cleaning agents and solvents.

Restraints:

- Regulatory restrictions due to environmental concerns.

- Fluctuations in raw material prices.

- Competition from alternative disinfectants and alcohol sources.

- Supply chain disruptions from geopolitical tensions or pandemics.

Price Projections

Historical Price Trends

From 2018 to 2022, the FOB (free on board) price per liter of pharmaceutical-grade ethyl rubbing alcohol ranged between USD 1.50 and USD 3.00, influenced by raw material costs, regional demand, and regulatory factors [2]. The pandemic in 2020-2021 caused a sharp spike, with prices peaking at USD 3.50 per liter, before stabilizing as supplies normalized.

Future Price Outlook (2023-2028)

Based on current market trends, raw material costs, and anticipated demand, the following projections can be made:

- Short-term (2023-2024): Prices are expected to remain stable at approximately USD 2.50 to USD 3.00 per liter, supported by sustained demand for disinfectants and increased production capacities in Asia.

- Mid-term (2025-2026): Prices may gradually decline to USD 2.00–USD 2.50 due to technological advancements, raw material efficiency, and market normalization.

- Long-term (2027-2028): Prices could further decrease to USD 1.80–USD 2.20 per liter with increased competition, bio-based ethanol adoption, and possible overcapacity in certain regions.

Factors Influencing Price Movements

- Raw Material Costs: Fluctuations in ethylene or feedstock prices directly affect ethanol manufacturing costs.

- Regulatory Changes: Stricter standards or new tariffs can increase costs.

- Supply-Demand Dynamics: Sustained pandemic-related demand may keep prices elevated temporarily.

- Technological Innovations: Advances in ethanol production, including bio-based processes, could lower manufacturing costs.

Implications for Stakeholders

Pharmaceutical and industrial companies should:

- Maintain agility in sourcing strategies to navigate price volatility.

- Monitor international regulatory developments affecting import/export and quality standards.

- Invest in supply chain resilience amid geopolitical and environmental uncertainties.

Investors and producers should:

- Focus on expanding capacity in high-growth markets like Asia-Pacific.

- Explore bio-ethanol alternatives to mitigate raw material cost pressures.

- Prepare for potential price stabilization or reduction in later years.

Conclusion

FT Ethyl Rubbing Alcohol remains vital amid persistent global hygiene concerns. While current demand sustains elevated pricing levels, impending technological and regulatory shifts forecast a regional and global price stabilization over the next 3-5 years. Strategic sourcing, supply chain optimization, and adherence to evolving standards will be crucial for benefiting from this market's dynamics.

Key Takeaways

- The global FT Ethyl Rubbing Alcohol market is projected to grow at a CAGR of 6-7% through 2028, driven by health and industrial demands.

- Prices peaked during the COVID-19 pandemic but are expected to stabilize, with moderate declines anticipated from mid-2020s onward.

- Supply chain resilience and raw material cost management remain critical, especially amid geopolitical risks and environmental policies.

- Emerging bio-ethanol production methods could reduce costs and provide competitive advantages.

- Regulatory frameworks will continue shaping the market, emphasizing quality, safety, and sustainability.

FAQs

1. What factors most influence the pricing of FT Ethyl Rubbing Alcohol?

Raw material costs, regulatory standards, supply chain stability, and global demand primarily drive pricing fluctuations.

2. How has the COVID-19 pandemic affected the FT Ethyl Rubbing Alcohol market?

Demand surged due to increased disinfectant use, causing price spikes and supply shortages, with prices stabilizing post-pandemic.

3. Which regions are leading in the production of pharmacopeia-grade ethanol?

Asia-Pacific, especially China and India, dominate manufacturing due to cost advantages and expanding healthcare infrastructures.

4. What trends could impact the future supply of FT Ethyl Rubbing Alcohol?

Technological advances in bio-ethanol production, environmental regulations, and geopolitical factors may influence supply dynamics.

5. Is there potential for alternative disinfectants to replace FT Ethyl Rubbing Alcohol?

Yes, innovations in non-alcoholic disinfectants and ion-based sterilization methods could diversify the market but will require regulatory acceptance and market adoption.

References

[1] MarketsandMarkets, Rubbing Alcohol Market by Type, Application, and Region - Global Forecast to 2028, April 2022.

[2] Industry reports and pricing data from major trade publications and market intelligence platforms (confidential sources).

More… ↓