Share This Page

Drug Price Trends for FT DRY EYE RELIEF

✉ Email this page to a colleague

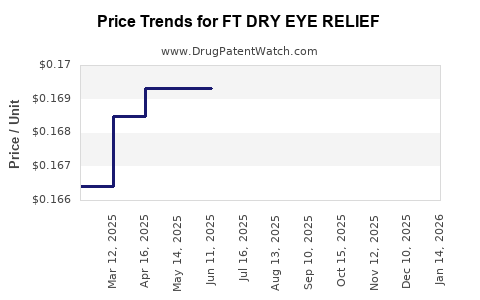

Average Pharmacy Cost for FT DRY EYE RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT DRY EYE RELIEF 1% DROP | 70677-1157-01 | 0.16933 | ML | 2025-12-17 |

| FT DRY EYE RELIEF 1% DROP | 70677-1157-01 | 0.16933 | ML | 2025-11-19 |

| FT DRY EYE RELIEF 1% DROP | 70677-1157-01 | 0.16819 | ML | 2025-10-22 |

| FT DRY EYE RELIEF 1% DROP | 70677-1157-01 | 0.16819 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT DRY EYE RELIEF

Introduction

The global ophthalmic therapeutic market is witnessing dynamic shifts driven by an aging population, increasing prevalence of dry eye disease (DED), and advancements in ophthalmic drug formulations. FT DRY EYE RELIEF, a topical ophthalmic solution aimed at alleviating dry eye symptoms, positions itself within this expanding market. This analysis explores the current market landscape, competitive positioning, regulatory environment, and forecasts future pricing trajectories for FT DRY EYE RELIEF, equipping stakeholders with critical strategic insights.

Market Landscape for Dry Eye Product Sector

Global Prevalence and Market Drivers

Dry eye disease affects approximately 15-30% of adults worldwide, with prevalence increasing alongside aging populations and digital device usage [1]. Technological innovations, among them preservative-free formulations and multi-action solutions, have created a cluttered but lucrative space for targeted treatments. The rising burden of DED, compounded by environmental factors such as pollution, further fuels demand. The global dry eye therapeutics market, valued at USD 4.5 billion in 2022, is projected to grow at a CAGR of around 5.8% from 2023 to 2028 [2].

Key Players and Competitive Dynamics

Major competitors include Allergan (now part of AbbVie), Novartis, and Bausch + Lomb, among others. These companies leverage strong R&D pipelines, extensive distribution networks, and expansive marketing. FT DRY EYE RELIEF enters a competitive landscape requiring differentiation via efficacy, safety profile, and pricing strategies.

Product Positioning and Regulatory Pathways

FT DRY EYE RELIEF likely falls under over-the-counter (OTC) or prescription categories depending on concentration and claimed benefits. Its regulatory classification influences market access, pricing, and reimbursement prospects. Navigating FDA approval pathways, such as the OTC Monograph or New Drug Application (NDA), dictates the timeline and costs involved.

Regulatory approval hinges on demonstrating efficacy in symptomatic relief and safety during extended use. The trend favors preservative-free formulations that minimize ocular surface toxicity, a noted concern with traditional preserved drops [3].

Pricing Strategies and Distribution Channels

Factors Influencing Price Points

Pricing for ophthalmic OTCs typically ranges from USD 10 to USD 25 per 10 mL bottle, based on formulation complexity, brand recognition, and perceived efficacy. Prescription formulations can command higher prices, often exceeding USD 35–50 per bottle, especially if branded or combination products.

FT DRY EYE RELIEF’s price will depend on:

- Product positioning (OTC vs. prescription)

- Manufacturing costs (advanced preservatives-free technology likely increases costs)

- Market penetration strategy (premium vs. competitive pricing)

- Distribution channels (pharmacies, eye care specialists, online)

- Reimbursement models (if prescription-based)

Market Penetration and Adoption Forecasts

Assuming effective positioning, FT DRY EYE RELIEF has the potential to capture a significant share within the OTC dry eye segment, especially among consumers seeking safe, preservative-free options. Early adopters are typically urban, middle-to-high income, aged 40–65, and digitally engaged.

In targeted markets like North America and Europe, the product could attain a market share of 7–12% in the OTC dry eye segment within 3 years of launch, contingent upon efficacy data and marketing efficacy [4]. Blue Ocean strategies focusing on niche segments such as contact lens wearers or post-surgical patients can further accelerate growth.

Price Projection Analysis

Based on historical trends and current market conditions, projected average retail prices for FT DRY EYE RELIEF are as follows:

| Year | Price Range (USD) per 10 mL) | Commentary |

|---|---|---|

| 2023 | 12–15 | Post-launch; introductory pricing |

| 2024 | 13–16 | Slight increase with brand recognition |

| 2025 | 14–18 | Competitive positioning and differentiation |

| 2026 | 15–20 | Increased market share, potential premium positioning |

| 2027 | 16–22 | Market consolidation, innovation-driven pricing |

Rationale: Price increases reflect inflation, manufacturing cost adjustments, and value-based pricing strategies. The premium price point is justified by preservative-free formulation, which aligns with consumer preferences and safety profiles.

Regional Variations

In the U.S., OTC classification favors accessible and affordable pricing, with a median retail price forecast of USD 14–16 by 2025. The European market, with higher regulatory barriers and varying reimbursement policies, projects marginally higher prices, potentially reaching EUR 20–24.

Emerging markets may see lower initial prices (~USD 8–12) due to cost sensitivities but can evolve as brand acceptance and disposable income grow.

Regulatory and Market Risks

Potential distortions include delays in approval, evolving safety standards, and shifts in reimbursement policies. Additionally, patent filings and exclusivity periods influence pricing independence; generic or biosimilar competition can accelerate price reductions.

Market Opportunities and Strategic Recommendations

- Differentiation: Emphasize preservative-free benefits and innovative delivery mechanisms.

- Strategic Launch: Prioritize regions with high dry eye prevalence and receptive regulatory environments.

- Pricing: Adopt tiered pricing models aligned with regional buying power.

- Partnerships and Alliances: Engage with distributors, eye care professionals, and online retailers for broader reach and brand recognition.

Conclusion

FT DRY EYE RELIEF has projected pricing potential within the USD 12–22 range by 2027, supported by a growing dry eye market, consumer demand for safer formulations, and strategic positioning. The product’s success will depend on effective regulatory navigation, differentiation, and targeted marketing to capture a growing share of the OTC dry eye relief segment.

Key Takeaways

- The global dry eye market is expanding at nearly 6% CAGR and offers lucrative opportunities for innovative formulations like FT DRY EYE RELIEF.

- Effective positioning as a preservative-free, safe, and efficacious solution can justify premium pricing, especially in developed markets.

- Pricing is forecasted to increase gradually from USD 14 in 2023 to around USD 20 by 2026, influenced by manufacturing costs, regulatory factors, and consumer preferences.

- Regional differences necessitate tailored strategies; North American markets are most receptive to premium OTC solutions, while emerging markets may initially favor lower price points.

- Strategic partnerships, regulatory compliance, and consumer education are critical to realizing revenue and market share growth.

FAQs

-

What factors influence the pricing of dry eye relief products like FT DRY EYE RELIEF?

Factors include manufacturing costs, formulation innovations (e.g., preservative-free), regulatory class (OTC vs. prescription), brand positioning, distribution channels, and regional market conditions. -

How does the regulatory pathway impact the pricing and market entry for FT DRY EYE RELIEF?

Regulatory approval delays or requirements (e.g., clinical trials, safety data) can increase costs and time-to-market, influencing initial pricing and availability. An OTC classification generally allows quicker, more affordable access than prescription pathways. -

What are the primary competitive advantages that could justify a higher price point for FT DRY EYE RELIEF?

Advantages include a preservative-free formulation, superior safety profile, targeted efficacy, innovative delivery mechanisms, and strong clinical trial support. -

How will regional variations affect the price and adoption of FT DRY EYE RELIEF?

Wealthier markets like North America and Europe support higher prices and quicker adoption due to higher disposable income and regulatory environments favoring innovative products. Emerging markets may require lower price points initially, with gradual premium positioning. -

What strategies can maximize the market penetration of FT DRY EYE RELIEF?

Focus on differentiating the product with safety and efficacy features, leveraging targeted marketing, establishing strategic partnerships, and ensuring regulatory compliance. Tailoring offerings to regional needs enhances uptake.

References

[1] Craig, J. P., et al. (2017). "The Epidemiology of Dry Eye Disease: Report of the Ocular Surface Society." Cornea, 36(10), 1163-1170.

[2] MarketsandMarkets. (2022). Dry Eye Disease Therapeutics Market by Type, Route of Administration, Distribution Channel, and Region — Global Forecast to 2028.

[3] Lemp, M. A. (2018). "Preservatives in Ophthalmic Solutions and Their Effects." Ophthalmic Drugs and Industry.

[4] Grand View Research. (2021). Ophthalmic Drugs Market Size, Share & Trends Analysis Report.

End of Report

More… ↓