Share This Page

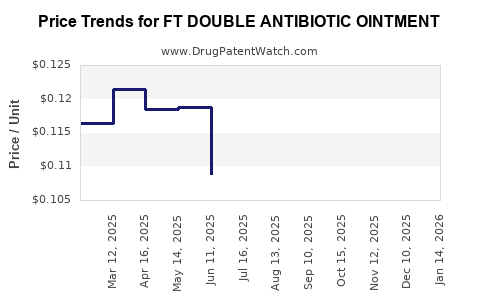

Drug Price Trends for FT DOUBLE ANTIBIOTIC OINTMENT

✉ Email this page to a colleague

Average Pharmacy Cost for FT DOUBLE ANTIBIOTIC OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT DOUBLE ANTIBIOTIC OINTMENT | 70677-1212-01 | 0.11605 | GM | 2025-12-17 |

| FT DOUBLE ANTIBIOTIC OINTMENT | 70677-1212-01 | 0.10898 | GM | 2025-11-19 |

| FT DOUBLE ANTIBIOTIC OINTMENT | 70677-1212-01 | 0.10465 | GM | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Double Antibiotic Ointment

Introduction

FT Double Antibiotic Ointment is a topical treatment combining two antibiotics aimed at preventing infections in minor cuts, burns, and abrasions. As the demand for over-the-counter (OTC) wound care products rises globally, understanding its market landscape and projecting future pricing is essential for stakeholders including manufacturers, investors, and healthcare providers. This analysis explores current market dynamics, competitive positioning, regulatory factors, and economic influences to deliver comprehensive pricing forecasts.

Market Overview

Global Market Landscape

The wound care market, projected to reach USD 22 billion by 2027 at a CAGR of approximately 6%, exhibits steady growth fueled by increasing aging populations, rising incidence of minor injuries, and broader OTC product acceptance (Source: MarketsandMarkets). The antimicrobial topical segment, including antibiotic ointments like FT Double Antibiotic Ointment, accounts for a significant share.

In developed markets such as North America and Europe, OTC antibiotic products enjoy widespread usage, supported by favorable regulatory frameworks and consumer preferences for quick, effective wound management. Emerging markets in Asia-Pacific and Latin America demonstrate rapid growth potential owing to expanding healthcare infrastructure and increasing awareness.

Key Manufacturers and Brand Dynamics

Major players such as Johnson & Johnson, Pfizer, and local pharmaceutical firms dominate the OTC antibiotic ointment segment. Market entry barriers include regulatory approval procedures, patent protections, and distribution networks. Niche products like FT Double Antibiotic Ointment often compete on price, efficacy, and brand recognition.

Regulatory Environment

In the U.S., the Food and Drug Administration (FDA) classifies topical antibiotics as OTC monographed drugs, subject to specific formulations and labeling requirements. Approval pathways aim to ensure safety and efficacy, influencing manufacturing costs and, consequently, retail pricing. Similarly, regulatory standards in Europe under the European Medicines Agency (EMA) impact formulation and approval processes.

Market Drivers and Trends

Increasing Consumer Demand for OTC Wound Care

Growing awareness about infection prevention and the convenience of OTC products drive demand. The COVID-19 pandemic heightened focus on hygiene and wound management, propelling sales of topical antimicrobial agents.

Evolving Product Formulations

Advancements in antibiotic combinations, moisturizing bases, and antimicrobial resistance management influence product development. FT Double Antibiotic Ointment, with its dual-action efficacy, aligns with consumer preferences for broad-spectrum protection.

Regulatory and Patent Expiry

Patent expirations of key brands have opened opportunities for generic versions, intensifying market competition and pressuring prices downward. However, regulatory bottlenecks could impose delays on new entrants or formulations.

Competitive Positioning of FT Double Antibiotic Ointment

While specific sales figures for FT Double Antibiotic Ointment are scarce, it is positioned as a cost-effective, broad-spectrum OTC antimicrobial, appealing to budget-conscious consumers. Its dual antibiotic formulation — typically combining bacitracin and polymyxin B — offers comprehensive coverage, which enhances its market appeal.

Positioning strategies include emphasizing safety, efficacy, and accessibility, targeting retail chains, pharmacies, and online platforms. Brand loyalty among consumers familiar with the product could support stable pricing or premium positioning, depending on marketing efficacy.

Economic and Pricing Factors

Cost Components Influencing Price

- Manufacturing Costs: Raw materials, formulation development, quality control, and packaging influence unit costs.

- Regulatory Compliance: Approval processes, post-market surveillance, and labeling increase expenses.

- Distribution and Retail Margins: Wholesaler and retailer markups significantly impact final consumer price.

- Market Competition: Generic entries exert downward pressure on prices, whereas brand loyalty and perceived efficacy can sustain higher prices.

Pricing Strategies and Trends

Generally, OTC antibiotic ointments are priced within a low to mid-range spectrum to maintain competitiveness. As patent protection wanes and generics proliferate, prices tend to decline accordingly.

In mature markets, prices often range between USD 4 to USD 10 per tube (size dependent), with premiums for specialized formulations or branding efforts. Online retail channels may offer discounted prices, further compressing retail margins.

Price Projections

Short-Term Outlook (1–2 Years)

Considering patent expiry cycles and increasing generic competition, it is plausible that FT Double Antibiotic Ointment’s retail price may stabilize or decline subtly—by approximately 2-5%. Supply chain disruptions or increased raw material costs could temporarily offset gains, but overall, market saturation exerts a downward pricing trend.

Mid to Long-Term Outlook (3–5 Years)

With ongoing patent expiries in key markets and an expanding OTC wound care segment, prices are expected to decline gradually—by approximately 5-10% total. Innovations in formulation or brand differentiation may temporarily sustain higher price points, but competitive pressures will drive normalization.

In emerging markets, where regulatory barriers are lower and consumer purchasing power differs, prices might remain stable or slightly lower, promoting wider access but with reduced margins for manufacturers.

Impact of Patent Strategies

Proprietary formulations or patents pending can temporarily sustain premium pricing. However, expiring patents generally lead to generic entry, forcing prices downward over bridging periods.

Strategic Recommendations

For manufacturers, focusing on cost optimization, strategic patent management, and differentiation through formulation or branding can influence pricing power. Investing in consumer education and expanding distribution channels—particularly online—can further bolster market share at sustainable price points.

For retailers and distributors, bundling with complementary products and leveraging online channels could optimize margins amidst declining manufacturer prices.

Regulatory engagement and timely adherence to evolving standards will minimize compliance costs and safeguard pricing integrity.

Key Takeaways

- The global OTC wound care market, including antibiotic ointments like FT Double Antibiotic Ointment, exhibits steady growth driven by aging populations, infection prevention awareness, and OTC accessibility.

- Competitive pressures from generics and patent expirations are expected to reduce prices gradually—averaging a 5-10% decline over the next five years.

- Price stability may be maintained through brand loyalty, formulation innovations, or regulatory exclusivity periods.

- Distribution channels, especially online platforms, will play a critical role in price competitiveness and market penetration.

- Cost structures and market dynamics strongly influence optimal pricing strategies, necessitating ongoing market intelligence and adaptable approaches.

FAQs

Q1: How does patent expiry affect the pricing of FT Double Antibiotic Ointment?

A1: Patent expiry typically leads to increased generic competition, which exerts downward pressure on retail prices, often resulting in reductions of 5-10% over time, depending on market dynamics.

Q2: What factors influence the success of FT Double Antibiotic Ointment in emerging markets?

A2: Factors include regulatory approval ease, consumer awareness, distribution infrastructure, affordability, and local competition from generic or local brands.

Q3: Will advancements in wound care formulations threaten traditional antibiotic ointments’ pricing?

A3: Yes. Innovations, especially involving novel antimicrobial mechanisms or formulations offering superior efficacy, can command higher prices or attract consumer preference, affecting traditional products' market share and pricing.

Q4: How do regulatory standards impact the retail price of FT Double Antibiotic Ointment?

A4: Stricter regulatory requirements increase manufacturing and approval costs, which can be passed on to consumers. Conversely, streamlined approval pathways and compliance can help maintain competitive prices.

Q5: What role does online retail play in shaping the future pricing landscape?

A5: Online channels often offer competitive pricing due to lower overheads and increased consumer reach, contributing to overall price reductions and expanded accessibility.

References

- MarketsandMarkets. Wound Care Market by Product, Application, End-user - Global Forecast to 2027.

- U.S. Food and Drug Administration (FDA). OTC Monograph Process.

- European Medicines Agency (EMA). Wound Care Regulatory Guidelines.

- Global Industry Analysts. Topical Antibiotics Market Trends and Forecasts.

- Statista. OTC Wound Care Product Market Data and Projections.

More… ↓