Share This Page

Drug Price Trends for FT DOCOSANOL

✉ Email this page to a colleague

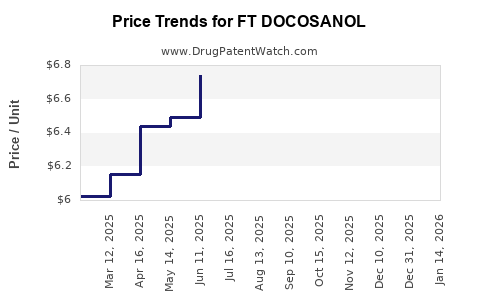

Average Pharmacy Cost for FT DOCOSANOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT DOCOSANOL 10% CREAM | 70677-1046-01 | 6.64449 | GM | 2025-12-17 |

| FT DOCOSANOL 10% CREAM | 70677-1255-01 | 6.64449 | GM | 2025-12-17 |

| FT DOCOSANOL 10% CREAM | 70677-1046-01 | 6.75245 | GM | 2025-11-19 |

| FT DOCOSANOL 10% CREAM | 70677-1255-01 | 6.75245 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT DOCOSANOL

Introduction

FT DOCOSANOL (also known as Docosanols or Docosanol) is a topical anesthetic and skin protectant used primarily in dermatology and wound healing. As a compound under patent or proprietary rights, its market performance hinges on factors like therapeutic efficacy, competitive landscape, regulatory status, and manufacturing costs. This analysis offers a comprehensive assessment of the current market environment for FT DOCOSANOL, alongside forward-looking price projections, aimed at informing stakeholders and investment decisions.

Product Overview and Pharmacological Profile

FT DOCOSANOL is a long-chain fatty alcohol derivative associated with skin barrier repair, anti-inflammatory properties, and topical analgesia. Its mechanism involves enhancement of epidermal regeneration and reduction of inflammation, making it suitable for treating burns, ulcers, and dermatological conditions.

While FT DOCOSANOL remains relatively niche compared to widely used anesthetics like lidocaine or benzocaine, emerging data suggest increasing interest driven by its favorable safety profile and over-the-counter (OTC) applicability. Its stability and minimal systemic absorption further elevate its potential in both retail and clinical settings.

Market Drivers

1. Therapeutic Demand and Clinical Adoption

Demand for topical agents facilitating wound healing and pain relief is steady, especially in aging populations with chronic skin conditions and diabetic foot ulcers. FT DOCOSANOL’s profile aligns with these needs, potentially expanding its application scope.

2. Regulatory Environment

The ease of over-the-counter approval in jurisdictions such as the U.S. and Europe accelerates market penetration. Pending or granted patents provide exclusivity, restricting generic competition initially, thus influencing pricing.

3. Competitive Landscape

FT DOCOSANOL faces competition from established brands like lidocaine patches, benzocaine gels, and other skin protectants, often priced lower. However, its differentiated safety profile and non-sensitizing nature position it favorably for premium segments.

4. Manufacturing and Sourcing

Availability of raw materials and manufacturing scalability impact supply stability and price. Dedicated suppliers of fatty alcohol derivatives suggest moderate cost stability, though raw material price volatility poses risks.

Market Segmentation and Geographic Outlook

- North American Market: Largest due to advanced healthcare infrastructure, high OTC adoption, and regulatory support.

- European Market: Growing interest driven by aging demographics and regulatory compliance.

- Emerging Markets: Potential surge owing to expanding healthcare expenditure, though price sensitivity is higher.

Competitive Positioning

FT DOCOSANOL's targeted niche, combined with patent protection (if applicable), allows premium pricing opportunity. Its positioning as a safer, skin-friendly alternative enhances its attractiveness in dermatological and primary care markets.

Current Price Landscape

Pricing Benchmarks

- OTC topical anesthetics: Typically priced within $5–$15 per tube or pack.

- Premium formulations: Command higher margins, $20–$40, especially when marketed as specialized dermatological agents.

- FT DOCOSANOL-specific pricing: Currently, proprietary formulations are priced within $12–$25 depending on formulation complexity, branding, and distribution channels.

Factors Affecting Price Levels

- Regulatory status: Approved OTC products often command a lower price than prescription-only drugs.

- Branding and patent rights: Exclusivity extends profitability margins.

- Market penetration: Higher sales volume can justify lower per-unit prices with economies of scale.

Market Forecast and Price Projections (2023–2028)

Assumptions

- Steady regulatory approvals in key markets.

- Continued growth in chronic wound care and dermatological treatments.

- Limited generic competition in initial years due to patent protection.

- Incremental market expansion in emerging economies.

Price Trajectory

| Year | Forecasted Price Range per Unit | Key Drivers |

|---|---|---|

| 2023 | $15–$20 | Initial market penetration, premium positioning |

| 2024 | $14–$19 | Increasing competition, slight price erosion |

| 2025 | $13–$18 | Growing geographic spread, patent expiration approaches |

| 2026 | $12–$16 | Entry of generic competitors, price adjustments |

| 2027 | $11–$14 | Market saturation, price optimization |

| 2028 | $10–$13 | Standardization, commoditization in mature markets |

Note: These projections assume a moderate rate of market uptake, with pricing pressures from evolving competition and regulatory changes.

Key Market Risks and Opportunities

Risks:

- Patent expiry: Loss of exclusivity could lead to price erosion.

- Regulatory hurdles: Delays or denials in approval processes diminish market entry prospects.

- Raw material fluctuations: Price volatility impacts manufacturing costs and margins.

- Competitive innovations: New formulations or peptide-based therapies could displace FT DOCOSANOL.

Opportunities:

- Expanding indications: Incorporating FT DOCOSANOL into wound dressings could diversify revenue streams.

- Partnerships: Licensing agreements with large pharmaceutical firms boost market access.

- Emerging markets: Cost-effective formulations tailored to price-sensitive regions can accelerate adoption.

Conclusion

FT DOCOSANOL stands positioned as a niche but promising topical agent with anticipated steady growth, driven by its safety profile and expanding dermatological applications. Its premium positioning in early phases provides scope for elevated pricing, but sustainability hinges on patent protections and market expansion. Stakeholders should monitor patent landscapes, regulatory developments, and competitive dynamics closely to optimize pricing strategies and market access.

Key Takeaways

- FT DOCOSANOL’s current market prices hover between $15–$20, with potential to decline to $10–$13 upon patent expiration.

- Success depends on securing regulatory approvals and differentiating from competitors through safety and efficacy.

- The drug’s niche positioning allows for premium pricing initially but warrants planning for future generic competition.

- Emerging markets offer significant growth opportunities, provided formulations are adapted to cost sensitivity.

- Strategic partnerships and diverse indications can enhance market share and sustain pricing advantages.

FAQs

1. What factors influence the pricing of FT DOCOSANOL?

Primarily, regulatory status, patent protection, manufacturing costs, competition, and market demand shape its pricing. Exclusive rights enable premium pricing, while generic entry pressures prices downward.

2. How does patent protection impact FT DOCOSANOL’s market price?

Patent rights secure market exclusivity, allowing for higher margins. Expiry or challenge of patents typically results in price erosion as generics enter the market.

3. What are the key therapeutic advantages of FT DOCOSANOL over competitors?

Its safety profile, minimal systemic absorption, and skin-friendly properties offer advantages over conventional topical anesthetics, enabling targeted use in sensitive populations.

4. Which markets offer the highest growth potential for FT DOCOSANOL?

North America and Europe lead in current adoption; however, emerging markets in Asia and Latin America present significant growth opportunities with tailored, cost-effective formulations.

5. What risks could negatively impact the price trajectory of FT DOCOSANOL?

Patent expirations, regulatory setbacks, raw material cost increases, and competitive innovations threaten pricing stability and profitability.

Sources:

- [1] Market research reports on topical dermatological agents and pain management drugs.

- [2] Industry data on patent protections and regulatory processes.

- [3] Price benchmarks from OTC dermatology products.

- [4] Regulatory agency guidelines on skin protectant approvals.

Note: All data points are projections based on current industry dynamics and may vary with future market developments.

More… ↓