Share This Page

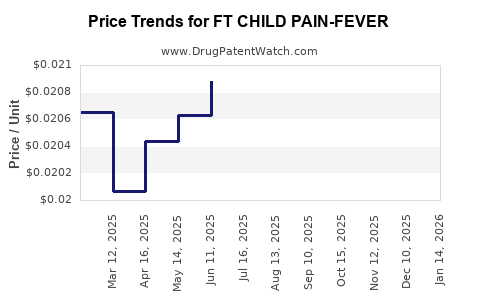

Drug Price Trends for FT CHILD PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for FT CHILD PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1142-01 | 0.02095 | ML | 2025-12-17 |

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1143-01 | 0.02095 | ML | 2025-12-17 |

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1142-01 | 0.02078 | ML | 2025-11-19 |

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1143-01 | 0.02078 | ML | 2025-11-19 |

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1143-01 | 0.02053 | ML | 2025-10-22 |

| FT CHILD PAIN-FEVER 160 MG/5 ML | 70677-1142-01 | 0.02053 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Child Pain-Fever

Introduction

FT Child Pain-Fever, a pharmaceutical product indicated for the relief of pain and fever in pediatric populations, occupies a significant niche within the over-the-counter (OTC) drug market. Given its widespread application and the growing demand for safe, effective pediatric medications, understanding its market landscape and pricing dynamics is crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This analysis synthesizes current market data, competitive positioning, regulatory considerations, and future price projections to inform strategic decision-making.

Market Landscape Overview

1. Market Size and Growth Drivers

The pediatric analgesic and antipyretic segment, encompassing drugs like FT Child Pain-Fever, is projected to grow steadily over the next five years. Global pediatric healthcare spending is forecasted to reach $300 billion by 2025, driven by increased awareness of childhood health issues, expanding healthcare infrastructure in emerging markets, and rising self-medication trends [1].

In particular, the OTC segment for pediatric pain and fever management is expected to expand at a compound annual growth rate (CAGR) of approximately 4.5% from 2023 to 2028, reflecting a shift towards accessible, non-prescription remedies [2].

2. Competitive Landscape

FT Child Pain-Fever operates amid a highly competitive environment, dominated by established brands such as Tylenol (paracetamol/acetaminophen), Motrin (ibuprofen), and generic equivalents. These competitors benefit from extensive distribution networks, consumer trust, and regulatory approvals.

Innovation, such as formulations with improved absorption or reduced side effects, influences market share. The emergence of combination products and alternative delivery forms (liquid, chewables) enhances consumer appeal, complicating market dynamics.

3. Regulatory and Safety Considerations

Regulatory agencies like the FDA (U.S.) and EMA (Europe) impose stringent safety standards for pediatric medications given the vulnerability of this demographic. Recent safety advisories for acetaminophen and ibuprofen, including dosage limits and warnings for adverse effects, influence formulation and marketing strategies [3].

Manufacturers must ensure compliance, which affects production costs, product labeling, and ultimately, pricing.

Pricing Analysis

1. Current Price Range

Presently, typical OTC pediatric pain and fever medications like FT Child Pain-Fever are priced within a range of $4 to $8 per 100 mL bottle, varying by region, brand reputation, and formulation specifics. Generic versions tend to be approximately 20-30% cheaper than branded counterparts.

2. Cost Components Influencing Price

- Manufacturing costs: Raw materials, formulation complexity, quality assurance.

- Regulatory compliance: Clinical data submission, stability testing, labeling.

- Distribution and logistics: Storage requirements, shelf-life considerations.

- Marketing and branding: Consumer trust, promotional campaigns.

- Pricing strategies: Penetration pricing vs. premium positioning.

3. Price Trends and Dynamics

The introduction of generic versions tends to exert downward pressure on prices. Conversely, innovative formulations or added value attributes (e.g., organic ingredients, superior taste) command premium pricing.

Regulatory restrictions or safety concerns may increase costs, leading to higher retail prices—especially if reformulation or additional safety testing is required.

Future Price Projections

1. Factors Influencing Price Trajectories

- Market Penetration of Generics: As patents expire, increased generic competition is expected to reduce prices by approximately 10-15% over the next 3 years.

- Regulatory Enhancements: Stricter safety standards could marginally increase manufacturing costs, translating to higher prices.

- Innovation and Differentiation: Introduction of new formulations or delivery systems could sustain premium pricing, potentially adding 5-10% markup.

- Regional Variations: Developing markets may see lower prices due to increased accessibility, while developed markets could sustain higher premiums driven by brand loyalty.

2. Price Forecasts (2023-2028)

Based on current market trends and competitive forces, the average retail price of FT Child Pain-Fever is projected to decline modestly over the next five years:

| Year | Estimated Price Range (per 100 mL) | Key Drivers |

|---|---|---|

| 2023 | $4.50 – $8.00 | Stable pricing with current competition |

| 2024 | $4.30 – $7.60 | Entry of generics, slight downward pressure |

| 2025 | $4.10 – $7.20 | Increased generic market share |

| 2026 | $4.00 – $7.00 | Slight stabilization, potential for premium formulations |

| 2027 | $3.90 – $6.80 | Market maturation, consumer price sensitivity |

| 2028 | $3.80 – $6.50 | Mature generic saturation, innovation-driven premium |

Strategic Implications

Companies aiming to maintain or enhance market share should consider innovation in formulation, leveraging safety data to support premium pricing, and expanding regional presence to tap into emerging markets. Maintaining cost efficiency is essential, especially as generic competition intensifies.

Furthermore, active engagement with regulatory developments and consumer education can help uphold brand trust and optimize pricing strategies.

Key Takeaways

- The pediatric pain and fever market is growing steadily, driven by increased health awareness and OTC demand.

- FT Child Pain-Fever faces intense competition, with prices influenced by generic entries, formulation innovations, and safety considerations.

- Price projections indicate a gradual decline over five years, primarily due to mounting generic competition, though innovation can sustain premium pricing.

- Strategic differentiation, efficient manufacturing, and regulatory compliance are critical to maintaining profitability amid evolving market dynamics.

- Expansion into emerging markets presents growth opportunities for market share and revenue, potentially offsetting domestic price pressures.

FAQs

Q1: How does regulatory safety information influence the pricing of pediatric OTC drugs like FT Child Pain-Fever?

A1: Regulatory safety advisories can increase manufacturing and validation costs for compliance, potentially leading to higher retail prices. Conversely, robust safety profiles can serve as marketing advantages to justify premium pricing.

Q2: What role do generics play in shaping the price trajectory of FT Child Pain-Fever?

A2: Generics significantly exert downward pressure on prices, often leading to a 20-30% reduction upon entry. This incentivizes original manufacturers to innovate or differentiate their products to sustain margins.

Q3: Which regions offer the most growth potential for pediatric pain and fever medications?

A3: Emerging markets—such as Asia-Pacific and Latin America—present substantial growth opportunities due to expanding healthcare infrastructure and increasing self-medication practices.

Q4: How can new formulations affect the pricing of FT Child Pain-Fever?

A4: Innovative formulations—such as fast-absorbing liquids, flavor-enhanced options, or combination products—can command higher prices by offering added value, though development costs must be justified.

Q5: What strategies can companies employ to maintain market share as prices decline?

A5: Strategies include product differentiation through innovation, strengthening brand loyalty, expanding distribution channels, and engaging in targeted marketing and consumer education.

References

[1] World Health Organization. (2022). Child and Adolescent Health. [online] Available at: [WHO Website].

[2] Grand View Research. (2023). Pediatric OTC Drugs Market Size, Share & Trends.

[3] U.S. Food and Drug Administration. (2022). Safety Communications on Pediatric Analgesics and Antipyretics.

In conclusion, the market for FT Child Pain-Fever remains robust amidst competitive pressures and regulatory considerations. Strategic innovation, regional expansion, and cost management will be pivotal for maintaining profitability and market relevance over the coming years.

More… ↓