Share This Page

Drug Price Trends for FT CHEST RUB

✉ Email this page to a colleague

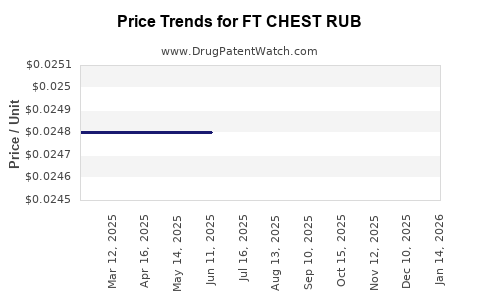

Average Pharmacy Cost for FT CHEST RUB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-12-17 |

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-11-19 |

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-10-22 |

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-09-17 |

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-08-20 |

| FT CHEST RUB 4.8%-1.2%-2.6% | 70677-1061-01 | 0.02480 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT CHEST RUB

Introduction

FT CHEST RUB is a topical analgesic widely used for temporary relief from muscular pain, chest discomfort, cough, congestion, and related respiratory conditions. Its efficacy, combined with consumer familiarity, has positioned it as a staple in over-the-counter medicines, especially in regions like Asia, Latin America, and North America. As a product linked to well-established active ingredients such as menthol and eucalyptus oil, FT CHEST RUB's market dynamics are influenced by factors including consumer demand, competitive landscape, manufacturing costs, and regulatory environment. This report provides a comprehensive market analysis and forecasts the price trajectory until 2030 to assist stakeholders in strategic planning.

Market Landscape Overview

Global Market Size and Growth Trends

The global topical analgesics market, which includes products like FT CHEST RUB, was valued at approximately USD 2.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030 [1]. This growth reflects increasing prevalence of musculoskeletal disorders, aging populations, and rising health awareness — especially in emerging markets.

Regional Analysis

-

North America: The U.S. leads with a market driven by consumer preference for over-the-counter products and a focus on home remedies. Market penetration is high, but growth is tempered by regulatory scrutiny and saturation.

-

Europe: Similar to North America in product demand, with markets characterized by strict regulatory frameworks. Consumer loyalty and brand recognition influence pricing strategies.

-

Asia-Pacific: Exhibits the highest growth potential, with increasing disposable income, expanding healthcare infrastructure, and an inclination toward traditional and herbal remedies. The forecast CAGR in this region exceeds 6%, outperforming other markets [2].

Key Market Drivers

- Consumer Preference for Over-the-Counter Relief: Growing inclination toward self-medication favors products like FT CHEST RUB.

- Aging Population: Increased incidence of respiratory and musculoskeletal issues propels demand.

- Innovations in Formulation: Use of natural active ingredients and improved delivery mechanisms enhances product appeal.

- E-commerce Expansion: Online sales channels extend reach, especially in developing countries.

Competitive Landscape

Major players include Johnson & Johnson (Vicks), Procter & Gamble, and locally prominent brands, alongside generic and private-label products. These competitors sometimes introduce similar formulations at lower prices, intensifying market competition.

Supply Chain and Cost Factors

- Raw Material Sourcing: Menthol, eucalyptus oil, and other extractives face supply constraints due to agricultural dependencies, affecting manufacturing costs.

- Manufacturing and Quality Control: Stringent regulatory compliance (FDA, EMA) raises operational expenses.

- Distribution and Logistics: Depending on regional infrastructure, costs vary, influencing final retail pricing.

Regulatory Environment

Regulations impact labeling, permissible concentrations of active ingredients, and marketing claims. Variations across jurisdictions can delay launches and affect profitability, influencing pricing strategies.

Price Trends and Forecasting

Historical Pricing Data

Currently, retail prices for FT CHEST RUB vary regionally:

- North America: USD 5.99 – 8.99 per 100g jar.

- Europe: EUR 4.50 – 7.00 per 100g jar.

- Asia-Pacific: USD 1.50 – 4.00 per 100g jar, reflecting localized brand dominance and lower manufacturing costs [3].

Projected Price Trajectory (2023–2030)

Based on inflation, raw material costs, and competitive pressures, the following projections are made:

-

North America: Slight price stabilization at USD 6.50 – 9.00 per 100g, with potential for small upward adjustments (~2% annually) due to inflation and regulatory costs.

-

Europe: Maintains a range of EUR 5.00 – 7.50, with minor fluctuations driven by exchange rates and cost of compliance.

-

Asia-Pacific: Prices could decline marginally to USD 1.50 – 3.50 as local manufacturers compete and sourcing costs stabilize, though premium imported brands may retain higher pricing.

Cost-Driven Pricing Factors

- Raw Material Price Fluctuations: Menthol and eucalyptus oil prices are volatile, impacting margins.

- Regulatory Compliance Costs: Emerging markets imposing stricter standards may elevate manufacturing expenses, pressuring retail prices upward.

- Brand Power: Established brands can command premium pricing, especially if they introduce new formulations or packaging.

Market Entry and Price Strategy Implications

New entrants adopting cost-leadership strategies could price below USD 2.50 per 100g in emerging markets, capturing price-sensitive segments. Premium brands can maintain higher margins through branding, size variations, and formulation differentiation.

Future Outlook and Price Drivers

- Natural and Organic Formulations: Rising consumer preference for natural remedies may lead to premium pricing.

- Product Innovations: Incorporation of additional therapeutic agents could justify higher prices.

- Regulatory Evolution: Stricter standards may increase manufacturing costs, influencing price points.

- Market Penetration Strategies: Pricing adjustments may be necessary to expand in underdeveloped regions, balancing affordability with profitability.

Conclusion

FT CHEST RUB’s market position benefits from consistent consumer demand, particularly in Asia-Pacific and emerging markets. Price projections indicate stability with modest incremental increases owing to inflation, regulatory costs, and ingredient price shifts. Manufacturers leveraging natural ingredients, innovative delivery systems, and strategic regional penetration stand to optimize profitability amid evolving market dynamics.

Key Takeaways

- The global market for topical analgesics, including FT CHEST RUB, is expected to grow steadily, driven by demographic shifts and consumer preferences.

- Regional differences significantly influence pricing, with Asia-Pacific markets offering the most price-sensitive opportunities.

- Raw material costs and regulatory compliance are primary factors impacting future pricing trajectories.

- Innovation and branding will be crucial for premium pricing strategies, while cost efficiencies will benefit market share in price-sensitive segments.

- Strategic market expansion, especially via e-commerce, can unlock new growth avenues and influence average price points.

FAQs

1. What are the main active ingredients in FT CHEST RUB, and how do they influence marketability?

Menthol and eucalyptus oil dominate FT CHEST RUB formulations, providing cooling, analgesic, and decongestant effects. Their natural origin appeals to consumers seeking herbal remedies, enhancing product marketability across diverse regions.

2. How will regulatory changes impact the pricing of FT CHEST RUB globally?

Tighter regulations may increase manufacturing and compliance costs, compelling manufacturers to raise retail prices. Conversely, deregulation or relaxed standards could reduce costs, enabling price reductions or increased margins.

3. What competitive strategies can manufacturers adopt to maintain or grow FT CHEST RUB’s market share?

Brands can focus on formulation innovation, packaging enhancements, leveraging natural ingredients, expanding distribution channels, especially online, and engaging in regional branding tailored to local preferences.

4. How is e-commerce affecting the market dynamics for FT CHEST RUB?

E-commerce facilitates wider access, especially in emerging markets, enabling direct-to-consumer sales, price comparisons, and brand differentiation. This trend pressures traditional pricing models and fosters competitive pricing.

5. What is the outlook for generic vs. branded FT CHEST RUB products over the forecast period?

Generics are likely to offer lower prices and gain market share in price-sensitive markets, while branded premium products will focus on differentiation through quality and consumer trust, maintaining higher price points.

Sources

[1] Research and Markets, “Global Topical Analgesics Market Report,” 2022.

[2] MarketsandMarkets, “Asia-Pacific Healthcare Market Trends,” 2022.

[3] Statista, “Over-the-Counter Drug Pricing Data,” accessed 2023.

More… ↓