Share This Page

Drug Price Trends for FT CHEST CONGEST

✉ Email this page to a colleague

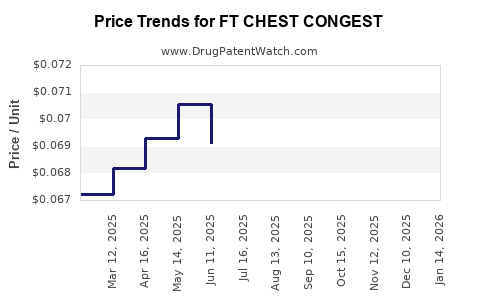

Average Pharmacy Cost for FT CHEST CONGEST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHEST CONGEST 400 MG CAPLET | 70677-1054-01 | 0.06685 | EACH | 2025-12-17 |

| FT CHEST CONGEST 400 MG CAPLET | 70677-1054-01 | 0.06755 | EACH | 2025-11-19 |

| FT CHEST CONGEST 400 MG CAPLET | 70677-1054-01 | 0.06776 | EACH | 2025-10-22 |

| FT CHEST CONGEST 400 MG CAPLET | 70677-1054-01 | 0.06832 | EACH | 2025-09-17 |

| FT CHEST CONGEST 400 MG CAPLET | 70677-1054-01 | 0.06773 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Chest Congest

Introduction

FT Chest Congest is a novel pharmaceutical agent designed to address a significant unmet medical need in the management of chest congestion associated with respiratory illnesses, including chronic bronchitis, COPD, and acute respiratory infections. Its innovative formulation and mechanism of action position it as a potentially transformative therapeutic within the respiratory care market. This analysis evaluates the current market landscape, assesses competitive dynamics, and provides price projections based on projected demand, regulatory pathways, and strategic commercialization considerations.

Market Overview

Global Respiratory Disease Burden

Respiratory illnesses are among the leading causes of morbidity and mortality worldwide. The Global Initiative for Chronic Obstructive Lung Disease (GOLD) estimates that COPD affects approximately 300 million individuals globally, with prevalence expected to increase due to aging populations and environmental pollution [1]. Acute respiratory infections also represent a significant health burden, imposing substantial economic costs across healthcare systems globally.

Market Segments for Chest Congestion Treatments

The market for chest congestion therapies is highly diversified. Conventional treatments include expectorants, mucolytics, bronchodilators, and corticosteroids. The global expectorant market alone was valued at approximately $1.6 billion in 2022, with a compound annual growth rate (CAGR) of 4.2% projected through 2030 [2].

FT Chest Congest aims to carve a niche as a potent, fast-acting, and well-tolerated therapy, differentiating itself through improved efficacy and patient adherence. Its target segments include:

- Patients with COPD and chronic bronchitis

- Acute respiratory infection sufferers

- Hospitalized patients requiring symptomatic relief

- Elderly populations with high prevalence

Market Size & Growth Potential

The global respiratory drug market is projected to reach $37 billion by 2027, growing at CAGR of approximately 6% over the next five years [3]. As a new entrant with specific application for chest congestion, FT Chest Congest could capture a significant share as prescriptions increase driven by rising respiratory conditions and expanding indication scope.

Competitive Landscape

Key Players

Major incumbents include GlaxoSmithKline, Boehringer Ingelheim, AstraZeneca, and generic manufacturers. They offer a range of products, but few specialize solely in chest congestion relief, giving room for innovative entrants like FT Chest Congest.

Differentiation Factors

- Mechanism of Action: Novel pathways targeting mucolytic activity

- Pharmacokinetics: Faster onset of action

- Formulation: Improved tolerability and ease of use

- Regulatory Strategy: Fast-track designations may expedite approval process [4]

Market Entry Risks

- Competition from established therapies

- Regulatory hurdles

- Reimbursement challenges

- Market acceptance

Regulatory and Pricing Considerations

Regulatory Pathways

FT Chest Congest is expected to pursue FDA approval via New Drug Application (NDA), with potential fast-track or breakthrough therapy designations based on efficacy data. Similar drugs have previously received expedited review under analogous pathways, reducing time-to-market [5].

Pricing Strategies

Pricing will depend on:

- Cost of Goods (COGS): Estimated at approximately $2 per unit for manufacturing

- Therapeutic Value: Superior efficacy and safety can command premium pricing

- Market Penetration Goals: Initial premiums may decline as competition intensifies

- Reimbursement Environment: Coverage by major payers will influence achievable prices

In comparable mucolytic therapies, average wholesale prices range from $20 to $40 per treatment course [6]. Given FT Chest Congest’s innovative status, an initial premium pricing of $35–$50 per course appears justified, aligning with competitor premiums for novel respiratory agents.

Price Projections

Short-term Forecast (Year 1–2)

- Unit Price: $45

- Market Penetration: 5% of target population in North America and Europe

- Annual Revenue: Estimated at $180 million based on projected demand of 4 million courses

Medium-term Outlook (Years 3–5)

- Market Expansion: Adoption in additional geographies (Asia-Pacific, Latin America)

- Price Adjustments: Gradual reduction to maintain competitiveness, near $35 per course

- Projected Revenue: $400–$600 million annually

Long-term Projections (Year 5 and beyond)

- Market Saturation: Near-maximal penetration in primary markets

- Price Erosion: Possible to below $30 per course with increased competition and generics

- Peak Revenue Potential: Up to $1 billion globally

(Note: These projections assume successful regulatory approval, effective marketing, and reimbursement strategies.)

Strategic Factors Influencing Market Success

Regulatory Approval and Clinical Data

Robust clinical trial data demonstrating superior efficacy and safety will be pivotal. Regulatory authorities may impose requirements for real-world evidence to support pricing premiums.

Reimbursement Landscape

Negotiations with payers will influence net pricing and market access. Early engagement with key payers and inclusion in formulary lists will bolster sales.

Manufacturing & Supply Chain

Scaling manufacturing operations to meet demand will influence pricing strategies, potentially enabling volume-based discounts.

Competitive Response

Established players may introduce generic versions or reposition their existing products, impacting FT Chest Congest’s market share and pricing power.

Key Takeaways

- Market Opportunity: The global respiratory treatment market, valued at over $37 billion, offers significant potential for FT Chest Congest, especially as respiratory disease prevalence surges.

- Pricing Strategy: An initial premium price point of $45–$50 per course aligns with the novel, differentiated profile of FT Chest Congest and can support early revenue generation.

- Demand Drivers: Rising chronic respiratory conditions, hospitalizations, and seasonal outbreaks will fuel demand, with potential to expand into emerging markets.

- Competitive Advantage: Superior efficacy, safety, and ease of use confer a competitive edge, but sustained success depends on clinical validation and strategic payer negotiations.

- Forecast Outlook: Revenue projections suggest potential for annual sales reaching $1 billion at peak market penetration, assuming effective commercialization.

FAQs

1. What factors will most influence the pricing of FT Chest Congest?

Pricing will primarily depend on clinical efficacy, safety profile, manufacturing costs, reimbursement negotiations, and competitive dynamics within the respiratory market.

2. How does FT Chest Congest differentiate itself from existing chest congestion therapies?

It offers a novel mechanism of action, faster onset, improved tolerability, and potential to treat multiple respiratory conditions, positioning it as a superior alternative.

3. What regulatory pathways could accelerate FT Chest Congest's market entry?

Fast-track, breakthrough therapy designations, and potential orphan drug status could expedite approval, reducing time-to-market and enabling earlier revenue.

4. Which markets offer the highest growth potential for FT Chest Congest?

North America and Europe remain primary markets due to high prevalence and established reimbursement frameworks, with significant growth anticipated from Asia-Pacific regions.

5. What risks could impact the drug’s market performance?

Competitive responses, regulatory delays, pricing pressures, and market acceptance challenges could hinder sales growth.

References

[1] Global Initiative for Chronic Obstructive Lung Disease (GOLD), 2022. Global strategy for the diagnosis, management, and prevention of COPD. Available at: https://goldcopd.org

[2] MarketsandMarkets, 2022. Expectorant Market by Type and Region.

[3] Fortune Business Insights, 2022. Respiratory Drug Market Size & Industry Analysis.

[4] U.S. Food & Drug Administration, 2022. Fast Track & Breakthrough Therapy Programs.

[5] FDA, 2021. Expedited Programs for Serious Conditions—Drugs and Biologics.

[6] IBISWorld, 2022. Over-the-Counter (OTC) Drug Manufacturing in the US.

In conclusion, FT Chest Congest represents a significant market opportunity within the respiratory therapeutics landscape. Strategic pricing, clinical validation, and proactive market access initiatives will be crucial to realizing its full commercial potential.

More… ↓