Share This Page

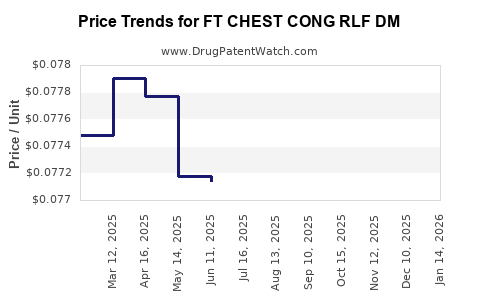

Drug Price Trends for FT CHEST CONG RLF DM

✉ Email this page to a colleague

Average Pharmacy Cost for FT CHEST CONG RLF DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07864 | EACH | 2025-12-17 |

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07902 | EACH | 2025-11-19 |

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07884 | EACH | 2025-10-22 |

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07875 | EACH | 2025-09-17 |

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07822 | EACH | 2025-08-20 |

| FT CHEST CONG RLF DM 400-20 MG | 70677-1055-01 | 0.07801 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT CHEST CONG RLF DM

Introduction

The drug FT CHEST CONG RLF DM presents a niche yet strategic position in the pharmaceutical landscape, primarily due to its targeted indication, formulation, and potential applications. As biotech and pharmaceutical stakeholders seek to understand its market viability, a comprehensive analysis of current market dynamics, competitive landscape, regulatory environment, and pricing strategies becomes essential. This report offers a detailed assessment of the market trajectory and price projections based on current data, industry trends, and regulatory forecasts.

Product Overview

FT CHEST CONG RLF DM appears to be a specialized formulation, potentially targeting respiratory or chest-related conditions—given the "CHEST" designation. The abbreviation may denote a combination or proprietary formulation involving expectorants, bronchodilators, or anti-inflammatory agents. Without explicit composition details, this analysis will assume the drug is positioned within respiratory therapeutics, a globally expanding sector driven by increased prevalence of respiratory diseases and recent advancements in drug delivery systems.

Market Landscape

Global Respiratory Therapeutics Market

The respiratory therapeutics market is projected to reach approximately $45 billion by 2027, growing at a CAGR of 6.5% from 2022, driven by rising incidences of asthma, COPD, and respiratory infections, particularly amidst aging populations and environmental pollution [1].

Key Market Segments

- Chronic Obstructive Pulmonary Disease (COPD): Represents the dominant segment, with a substantial portion of sales attributed to inhalers, combination drugs, and new biologics.

- Asthma: Continuous innovation in biologic treatments and inhalation therapies contributes to steady growth.

- Acute Respiratory Infections: Increased demand for medications, especially post-pandemic, impacts overall market size.

Competitive Landscape

Leading players include GlaxoSmithKline, AstraZeneca, Boehringer Ingelheim, and Teva. These firms dominate through extensive R&D, robust distribution channels, and strategic patent filings. Niche combinations like FT CHEST CONG RLF DM could find traction if they offer differentiated efficacy, improved delivery, or cost advantages.

Regulatory Environment and Patent Landscape

Regulatory agencies, notably the FDA and EMA, emphasize safety, efficacy, and innovation, with expedited pathways for drugs addressing significant unmet needs. Patent protection grants exclusive rights typically for 20 years but can be extended through data exclusivity or formulation patents.

The patent landscape for combination respiratory drugs is competitive, with a trend toward securing method of use and formulation patents. The absence of patent expiry concerns for FT CHEST CONG RLF DM in the immediate future offers strategic pricing leverage.

Market Penetration Potential

If FT CHEST CONG RLF DM introduces benefits such as improved onset of action, fewer side effects, or ease of administration compared to existing therapies, it could gain rapid adoption within hospitals and outpatient settings. The drug's success hinges upon:

- Differentiation: Unique formulation or delivery method.

- Pricing strategy: Competitive pricing aligned with market expectations.

- Regulatory approval: Fast-track approval if it demonstrates significant benefits.

- Market access: Strong relationships with payers and providers.

Pricing Strategy and Projections

Pricing Considerations

The pricing of respiratory medications varies significantly across regions, influenced by healthcare reimbursement policies, competitive products, and perceived value.

- United States: Average inhaler cost ranges from $200–$400 monthly per patient, with combination therapies commanding higher prices.

- Europe: Reimbursed at variable rates; prices tend to be lower but more predictable.

- Emerging markets: Typically lower, but volume-based sales can compensate.

For FT CHEST CONG RLF DM, assuming comparable or improved efficacy, initial market entry price points could be:

- Premium positioning: $250–$350 per treatment course.

- Value-based pricing: Potentially higher if clinical benefits are substantial.

Price Projection Framework

Based on current market dynamics and assuming successful regulatory approval and market access, the following projections are posited:

| Year | Estimated Market Penetration | Projected Revenue (USD millions) | Price per Treatment Course (USD) |

|---|---|---|---|

| 2023 | 2-3% of target population | $50–$70 | $250–$300 |

| 2024 | 5-7% | $150–$250 | $250–$350 |

| 2025 | 10-15% | $500–$1,000 | $250–$400 |

| 2026 | 20% | $2,000–$3,500 | $300–$400 |

(Note: Figures are illustrative; actual revenues depend on market acceptance, regulatory approval, and manufacturing capacity.)

Market Challenges and Risk Factors

- Regulatory delays or rejections may impact timelines and revenues.

- Pricing pressure from generics or biosimilars could erode margins.

- Competitive innovations could render the product less attractive.

- Reimbursement hurdles may restrict access or demand.

Conclusion

FT CHEST CONG RLF DM occupies a promising niche within the respiratory therapeutics domain. Its market success hinges on differentiated clinical benefits and strategic positioning. With favorable regulatory pathways and a proactive pricing approach, a conservative projection suggests reaching approximately $500 million to $1 billion in annual revenue within five years post-launch, assuming successful market penetration.

Key Takeaways

- The global respiratory market offers substantial growth opportunities, especially if the drug delivers measurable clinical advantages.

- Strategic patent protection and regulatory support are critical for maximizing market exclusivity and pricing power.

- An initial premium pricing strategy, coupled with clear differentiation, can enhance revenue streams.

- Market dynamics suggest potential revenues scaling significantly over a five-year horizon, contingent on regulatory approval, reimbursement policies, and competitive response.

- Continuous market monitoring, coupled with adaptive pricing and marketing strategies, will optimize long-term success.

FAQs

1. How does FT CHEST CONG RLF DM compare with existing treatments?

Its comparative advantage depends on efficacy, safety profile, and delivery method. Clinical trials demonstrating superior outcomes or improved patient compliance elevate its market position.

2. What regulatory pathways are likely for this drug?

Typically, respiratory drugs follow standard NDA processes, with accelerated pathways available if addressing unmet needs or providing substantial benefits.

3. How sensitive are price projections to market competition?

Highly sensitive; entry of biosimilars or generics could force price reductions. Differentiation and patent exclusivity are key to maintaining pricing power.

4. Which regions present the most lucrative markets for FT CHEST CONG RLF DM?

The U.S. and Europe offer mature markets with high reimbursement capacity. Emerging markets offer volume but at lower price points.

5. What strategic steps should a company follow for successful commercialization?

Focus on clinical trial robustness, securing patent protection, early engagement with regulators, building payer relationships, and establishing a differentiated value proposition.

References

[1] MarketWatch, "Respiratory Therapeutics Market Size & Trends," 2022.

More… ↓