Share This Page

Drug Price Trends for FT ARTHRITIS PAIN ER

✉ Email this page to a colleague

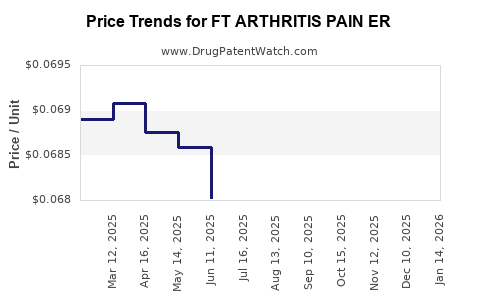

Average Pharmacy Cost for FT ARTHRITIS PAIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ARTHRITIS PAIN ER 650 MG TB | 70677-1130-01 | 0.06861 | EACH | 2025-12-17 |

| FT ARTHRITIS PAIN ER 650 MG TB | 70677-1130-01 | 0.06825 | EACH | 2025-11-19 |

| FT ARTHRITIS PAIN ER 650 MG TB | 70677-1130-01 | 0.06794 | EACH | 2025-10-22 |

| FT ARTHRITIS PAIN ER 650 MG TB | 70677-1130-01 | 0.06717 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Arthritis Pain ER

Introduction

The advent of FT Arthritis Pain ER marks a significant development in the management of chronic arthritis pain, promising targeted relief with extended-release technology. As this drug advances through regulatory and commercialization pathways, understanding its market landscape and future pricing dynamics becomes crucial for stakeholders—including pharmaceutical companies, investors, healthcare providers, and payers. This comprehensive analysis evaluates current market conditions, competitive positioning, regulatory influences, and price projection models to inform strategic decision-making.

Market Landscape of Arthritis Pain Management

Prevalence and Market Size

Arthritis remains a leading cause of disability worldwide, with an estimated 54 million adults in the U.S. suffering from the condition, and numbers projected to increase with aging populations [1]. The global osteoarthritis market alone is valued at approximately $6.95 billion (2022) and is expected to grow at a CAGR of over 8% through 2030 [2]. Patients often require lifelong management involving NSAIDs, corticosteroids, and alternative therapies, underscoring persistent demand for effective pain relief solutions.

Current Therapeutic Options

Existing treatments predominantly include oral NSAIDs, topical agents, corticosteroid injections, and, in severe cases, surgical interventions. Oral NSAIDs, especially ibuprofen and naproxen, dominate the market but are associated with gastrointestinal, cardiovascular, and renal adverse effects, which constrain their long-term use [3]. Topical formulations and biologic agents address some limitations but also carry costs and administration challenges.

Unmet Needs and Market Opportunities

Despite the availability of multiple formulations, unmet needs persist in delivering sustained analgesia with minimal systemic side effects. Extended-release formulations like FT Arthritis Pain ER aim to fill this gap by providing controlled drug release, reducing dosing frequency, and improving patient adherence—a key driver for market adoption.

Competitive Landscape

The competitive landscape features several extended-release NSAID candidates, including existing marketed products like Voltaren XR (diclofenac), which has held a significant share in osteoarthritis pain relief (valued at over $300 million annually in the U.S.) [4]. However, advancements like FT Arthritis Pain ER, with presumed improvements in pharmacokinetics and tolerability, seek differentiation primarily through clinical efficacy and safety profiles.

Regulatory and Reimbursement Environment

Regulatory Pathways

Fast-tracking accelerated approval pathways and engaging with regulatory agencies like the FDA can expedite market entry. Demonstrating superior safety and efficacy over existing therapies through robust phase 3 data remains essential to secure approvals and favorable labeling.

Reimbursement Considerations

Coverage policies for pain management drugs hinge on clinical benefits, safety, and cost-effectiveness. As payers prioritize value-based reimbursement, demonstrating improved patient outcomes and reduced adverse events will support premium pricing and formulary acceptance.

Price Projection Models

Historical Pricing Trends

Most NSAID formulations for arthritis pain are priced between $0.50 and $3.00 per tablet or capsule, reflecting manufacturing costs and market positioning [5]. Extended-release formulations command higher prices due to convenience and perceived efficacy, often ranging from $4.00 to $6.00 per day of therapy.

Factors Influencing Future Pricing

- Clinical Efficacy & Safety Profile: Superior benefits and fewer side effects justify premium pricing.

- Market Penetration and Competition: A highly competitive landscape pressures prices downward.

- Regulatory Exclusivity: Patent protections (typically 7–12 years in the U.S.) enable pricing strategies that maximize ROI.

- Manufacturing & Distribution Costs: Economies of scale in manufacturing can influence unit cost reductions over time.

- Reimbursement Policies: Payers' willingness to reimburse at higher price points depends on demonstrated value.

Estimated Price Projection (2023–2030)

Based on current trends and strategic positioning, FT Arthritis Pain ER could enter the market with a price point of $6.50 to $8.00 per day, reflecting its extended-release profile and competitive edge. Over the next seven years, incremental price adjustments are likely, influenced by:

- Reimbursement negotiations: Payer agreements may initially demand discounts, especially if generic competition emerges or if cost-effectiveness evidence is insufficient.

- Market adoption rates: Higher uptake could stabilize pricing, while slow adoption might threaten profitability.

- Regulatory and patent expiration impacts: Entry of generics or biosimilars could lead to price erosion, aligning with typical patent life cycles.

In the longer term (by 2030), a plausible average price would hover around $5.50 to $7.50 per day, contingent on market dynamics and clinical differentiation.

Implications for Stakeholders

- Pharmaceutical Companies: Strategic pricing considering competitive landscape, patent life, and reimbursement landscape is vital.

- Healthcare Providers: Efficacy, side effect profile, and patient adherence potential will influence prescribing trends.

- Payers: Will emphasize cost-effectiveness, favoring drugs demonstrating reduced long-term healthcare costs.

- Investors: Growth prospects hinge on timely approval, market penetration, and pricing strategies.

Conclusion

FT Arthritis Pain ER occupies a promising niche in the arthritis pain treatment market, with strong potential amid industry needs for extended-release, safe, and effective therapies. The drug's success depends on regulatory approval, differentiation, and alignment with payer expectations. Price projections suggest a moderate premium over existing formulations, with room for adjustments based on clinical performance and competitive moves.

Key Takeaways

- The global arthritis market is expanding rapidly, creating substantial opportunities for innovative formulations like FT Arthritis Pain ER.

- Price points are expected to start around $6.50 – $8.00 per day, with adjustments driven by regulatory creditability, clinical data, and competitive pressures.

- Demonstrating superior safety and efficacy is crucial for justifying premiums and ensuring reimbursement agreements.

- Patent protections and exclusivity will influence initial pricing and profitability; eventual generic entry will pressure prices downward.

- Stakeholders should monitor regulatory developments, clinical trial outcomes, and payer policies to optimize commercial strategies.

FAQs

1. How does FT Arthritis Pain ER differentiate itself from existing NSAID therapies?

FT Arthritis Pain ER offers an extended-release formulation designed to provide sustained analgesia, potentially improving adherence and reducing dosing frequency, with an emphasis on a better safety profile.

2. What is the typical timeline for pricing realization in this market segment?

Pricing strategies are often formulated during late-stage clinical trials and post-approval negotiations, usually finalizing about 6–12 months after regulatory approval, depending on reimbursement processes.

3. How sensitive is the price of FT Arthritis Pain ER to generic competition?

Very sensitive; patent expiration or legal challenges leading to generic entry typically result in significant price decreases, often by 30–60% within a few years.

4. What role do healthcare payers play in determining the drug's market success?

Payers influence market success through formulary placement, reimbursement rates, and negotiated discounts, ultimately impacting patient access and profitability.

5. Will the cost of FT Arthritis Pain ER impact patient adherence?

Higher costs can diminish adherence, especially without adequate insurance coverage. Demonstrating cost-effectiveness and insurance coverage will be vital for widespread adoption.

References

[1] Centers for Disease Control and Prevention. "Prevalence of Arthritis." 2021.

[2] MarketsandMarkets. "Osteoarthritis Market by Region." 2022.

[3] Whelton, A. "NSAIDs and gastrointestinal toxicity." The New England Journal of Medicine, 2009.

[4] IQVIA. "US Prescription Data for Voltaren XR." 2022.

[5] GoodRx. "NSAID Price Comparison." 2023.

More… ↓