Share This Page

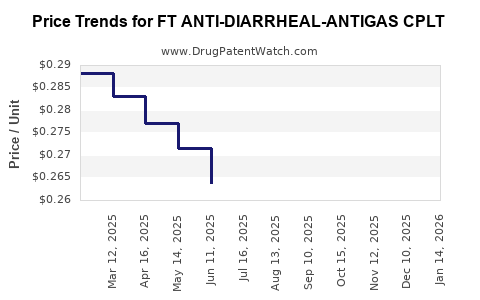

Drug Price Trends for FT ANTI-DIARRHEAL-ANTIGAS CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTI-DIARRHEAL-ANTIGAS CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.30728 | EACH | 2025-12-17 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.30323 | EACH | 2025-11-19 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.29900 | EACH | 2025-10-22 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.28826 | EACH | 2025-09-17 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.27427 | EACH | 2025-08-20 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.26442 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for FT ANTI-DIARRHEAL-ANTIGAS CPLT

Introduction

The drug FT ANTI-DIARRHEAL-ANTIGAS CPLT is a combination therapeutic targeted at managing diarrhea and associated gastrointestinal symptoms. As a multidimensional pharmaceutical product, its market positioning depends on several factors, including current demand for anti-diarrheal medications, the competitive landscape, regulatory environment, and pricing strategies. This analysis evaluates market dynamics, anticipated growth drivers, competitive forces, and provides price projections grounded in current industry trends.

Market Overview

Global Diarrheal Disease Burden

Diarrheal diseases remain a significant public health concern worldwide, particularly in developing nations. According to the World Health Organization (WHO), diarrhea accounts for approximately 1.3 million deaths annually, predominantly affecting children under five. The growing prevalence of infectious and acute diarrhea emphasizes demand for effective treatment options, including combination therapies like FT ANTI-DIARRHEAL-ANTIGAS CPLT ([1]).

Indications and Therapeutic Class

FT ANTI-DIARRHEAL-ANTIGAS CPLT likely includes active ingredients such as loperamide, bismuth subsalicylate, or other antidiarrheals combined with anti-gas agents like simethicone or probiotics. These combinations aim to reduce stool frequency, control intestinal spasms, and alleviate gas-related discomfort, positioning the product in the gastrointestinal (GI) pharmacotherapy sector predominantly serving outpatient and primary care markets.

Market Size and Growth Projections

The global anti-diarrheal market was valued at approximately USD 950 million in 2022, with a compounded annual growth rate (CAGR) of around 4.5% projected through 2030 ([2]). The increasing incidence of travel-related diarrhea, antibiotic-associated diarrhea, and rising awareness about GI health augment sector growth. The Asian-Pacific and African regions are anticipated to witness faster adoption rates owing to higher disease burden and healthcare infrastructure expansion.

Competitive Landscape

Key Players

Leading anti-diarrheal brands include OTC medications like Loperamide (Imodium), Bismuth Subsalicylate (Pepto-Bismol), and generic equivalents, with regional brands also prevalent. Combination products such as FT ANTI-DIARRHEAL-ANTIGAS CPLT compete on convenience and therapeutic efficacy, but face challenges from established monotherapies and OTC options.

Regulatory Environment

In developed markets like the US and EU, strict regulations govern combination drugs. Demonstrating safety, efficacy, and manufacturing standards is crucial for market entry. In emerging markets, regulatory hurdles might be less stringent but require robust post-market surveillance.

Pricing Strategies and Market Penetration

The pricing of combination anti-diarrheal drugs is influenced by manufacturing costs, competitive prices, and reimbursement policies. Premium pricing is feasible if clinical benefits are clearly demonstrated, especially in countries with high healthcare spending. Conversely, in price-sensitive markets, generic and OTC versions exert downward price pressure.

Price Projections and Strategic Implications

Current Price Baseline

Currently, combination anti-diarrheal drugs are priced between USD 5–15 per pack in various markets, often depending on formulation, brand recognition, and regional economics ([3]). FT ANTI-DIARRHEAL-ANTIGAS CPLT, if marketed as a differentiated product with proven efficacy and safety, can command premium pricing at the upper range of this spectrum.

Future Price Trends

Based on market growth trajectories and competitive dynamics, the following projections are anticipated over the next five years:

- Year 1–2: Launch phase with initial pricing at USD 10–12 per pack, targeting early adopters and institutional buyers.

- Year 3: Broader market acceptance may enable slight price increases or tiered pricing strategies, reaching USD 12–14 per pack, accommodated by increased production scale and cost efficiencies.

- Year 4–5: Entry of generics and OTC competitors could exert downward pressure, stabilizing prices around USD 9–11 per pack in price-sensitive markets, while maintaining premium pricing (USD 13–15) in developed regions with brand recognition.

Driving Factors for Price Dynamics

- Market Penetration and Volume Sales: Growing demand may lead to economies of scale, facilitating competitive pricing while maintaining margins.

- Regulatory Approvals: Fast-track approvals and clearances enhance market entry speed, influencing pricing strategies.

- Competitive Differentiation: Superior formulation, clinical validation, or combination benefits could justify higher prices.

- Reimbursement and Insurance Coverage: Broad coverage bolsters patient acceptance, enabling premium pricing models.

Risks and Challenges

- Regulatory Barriers: Lengthy approval processes could delay market entry, impacting initial pricing strategies.

- Pricing Pressure from Generics: Patent expiry or alternative products may force price reductions.

- Market Acceptance: Consumer preferences for generic OTC options could limit premium pricing potential.

Key Takeaways

- The FT ANTI-DIARRHEAL-ANTIGAS CPLT is positioned to capitalize on a growing global focus on GI health, with significant growth avenues in emerging markets.

- Competitive pricing will depend on manufacturing costs, regulatory approval timelines, and market education regarding product benefits.

- A phased introduction with strategic pricing—initial premium positioning followed by competitive adjustments—can optimize sales volume and profit margins.

- The evolving landscape, including regulatory and generics entry, necessitates flexible pricing strategies to sustain market share.

- Emphasizing clinical evidence and differentiated formulation will support premium pricing and brand loyalty.

FAQs

1. What are the key factors influencing the pricing of combination anti-diarrheal drugs?

Pricing is influenced by manufacturing costs, competitive landscape, regulatory requirements, perceived clinical benefits, and reimbursement policies. Brand differentiation and market acceptance also play critical roles.

2. How does the global prevalence of diarrheal diseases impact market opportunities for FT ANTI-DIARRHEAL-ANTIGAS CPLT?

High disease burden, especially in developing nations, expands market potential. Increased awareness and infrastructure improvements further support adoption of combination therapies.

3. What challenges could affect the pricing and market penetration of FT ANTI-DIARRHEAL-ANTIGAS CPLT?

Regulatory delays, aggressive competition from generics, OTC alternatives, and price sensitivity in certain markets could hinder premium pricing and rapid penetration.

4. How can companies sustain profitability amid rising competition?

Through product differentiation, clinical validation, strategic marketing, and flexible pricing models, companies can defend market share and optimize margins.

5. What role does clinical evidence play in establishing pricing power?

Strong clinical data demonstrating unique efficacy or safety positions the product for higher pricing, supporting healthcare provider preference and reimbursement success.

References

[1] World Health Organization. Diarrheal Disease Fact Sheet. 2022.

[2] Grand View Research. Anti-diarrheal Market Size & Trends. 2022.

[3] IQVIA. Global OTC Medicine Pricing Dynamics. 2021.

More… ↓