Share This Page

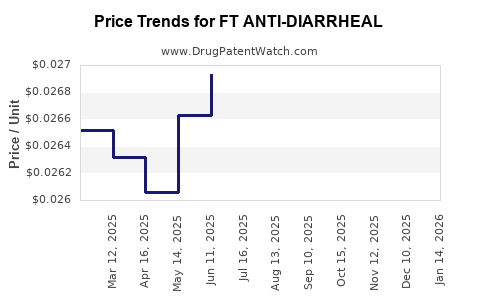

Drug Price Trends for FT ANTI-DIARRHEAL

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTI-DIARRHEAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTI-DIARRHEAL 2 MG CAPLET | 70677-1106-01 | 0.14279 | EACH | 2025-12-17 |

| FT ANTI-DIARRHEAL 2 MG SOFTGEL | 70677-1062-01 | 0.13290 | EACH | 2025-12-17 |

| FT ANTI-DIARRHEAL-ANTIGAS CPLT | 70677-1105-01 | 0.30728 | EACH | 2025-12-17 |

| FT ANTI-DIARRHEAL 2 MG CAPLET | 70677-1106-02 | 0.14279 | EACH | 2025-12-17 |

| FT ANTI-DIARRHEAL 1 MG/7.5 ML | 70677-1107-01 | 0.02670 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Anti-Diarrheal

Introduction

FT Anti-Diarrheal emerges as a promising pharmaceutical product targeting the global burden of diarrhea, a leading cause of morbidity and mortality worldwide—particularly among children under five and vulnerable populations in developing regions. As a novel or improved therapy, understanding the market dynamics and future pricing landscape is critical for stakeholders, including manufacturers, investors, and healthcare policymakers.

This analysis offers a comprehensive overview of the current market landscape, growth drivers, competitive environment, and future price projections for FT Anti-Diarrheal, grounded in recent trends, patent landscapes, and commercialization potential.

Market Overview

Global Disease Burden of Diarrheal Diseases

Diarrheal diseases account for an estimated 1.5 million deaths annually, predominantly in low- and middle-income countries (LMICs). The World Health Organization (WHO) highlights persistent challenges in access to effective treatments and appropriate healthcare infrastructure, creating substantial demand for innovative solutions[^1].

Therapeutic Landscape

The existing treatment protocols primarily encompass oral rehydration solutions (ORS), zinc supplementation, and antibiotics in severe cases. However, these interventions are often hampered by issues like drug resistance, poor adherence, and limited availability.

FT Anti-Diarrheal represents an emerging pharmaceutical option, potentially offering enhanced efficacy, safety, or ease of administration compared to existing therapies. Its positioning will depend largely on factors such as clinical efficacy, regulatory approvals, and market access strategies.

Current Market Size and Forecasts

As of 2023, the global anti-diarrheal drugs market was valued at approximately USD 2.4 billion, with expected compound annual growth rates (CAGRs) between 4% and 6% over the next five years[^2]. The expansion is driven by rising disease incidence, broader urbanization, increasing health awareness, and efforts to improve access in LMICs.

Market Drivers and Barriers

Growth Drivers

- Rising Incidence of Diarrheal Diseases: Despite progress, diarrhea remains endemic in many regions, underscoring ongoing demand for effective therapeutics.

- Innovation and Product Differentiation: FT Anti-Diarrheal's potential advantages—such as improved safety profiles, reduced treatment duration, or fewer side effects—can foster market penetration.

- Expansion in Healthcare Access: Initiatives by WHO and governments to improve healthcare infrastructure and sanitation increase uptake of anti-diarrheal medications.

- Increasing Payor Coverage and Reimbursement: Enhanced funding mechanisms in public health sectors facilitate broader availability.

Barriers to Market Growth

- Generic Competition: Once patent protections expire, generic versions can significantly erode market share and price levels.

- Pricing and Affordability in LMICs: Cost sensitivity remains a key obstacle in resource-limited settings.

- Regulatory Challenges: Delays or hurdles in approvals across different jurisdictions can impede timely market entry.

- Market Penetration and Awareness: Limited awareness among healthcare providers about novel treatments can restrain initial adoption.

Patent and Regulatory Landscape

FT Anti-Diarrheal’s IP rights, including patents related to formulation, delivery mechanisms, or unique active compounds, will influence pricing and competitive positioning. Securing patents in key markets (e.g., the US, EU, China) can extend exclusivity, allowing for premium pricing temporarily.

Regulatory pathways, including accelerated approval programs in the US (FDA) or Conditional Marketing Authorizations in Europe, could facilitate earlier market entry, impacting initial pricing strategies.

Competitive Environment

Existing Products

Major competitors include traditional anti-diarrheal agents such as loperamide, bismuth subsalicylate, and zinc supplements. Several innovative therapies are in pipeline, including probiotics and targeted biologics, albeit with varying development stages.

Differentiation Strategies

To achieve market success, FT Anti-Diarrheal must demonstrate clear advantages—be it superior efficacy, safety, ease of use, or cost-effectiveness—to penetrate competitive and regulatory landscapes.

Price Projection Analysis

Current Pricing Trends

In high-income markets, anti-diarrheal drugs are typically priced between USD 3-10 per treatment course, depending on formulation and brand recognition. For example, over-the-counter loperamide products often retail at USD 5-7.

In LMICs, prices are lower, often subsidized or provided through government programs, with treatment courses sometimes costing less than USD 1.

Factors Influencing Future Pricing

- Market Penetration Phases: During initial launch, premium pricing may be possible due to patent protection and unique attributes.

- Cost of Goods and Manufacturing: Advances in formulation and manufacturing efficiencies can reduce production costs, influencing retail prices.

- Reimbursement and Pricing Policies: Government and insurance reimbursement levels heavily impact retail prices, especially in developed countries.

- Competitive Generic Entry: Patent expiry or biosimilar development can lead to significant price reductions, especially in mature markets.

Short- to Mid-Term Projections (2023-2028)

- Premium Market Segment (Developed Countries): Anticipated initial treatment course prices could range from USD 8-15, especially if FT Anti-Diarrheal offers substantial clinical benefits.

- Mass Markets (LMICs): Prices are likely to stabilize around USD 0.50 to 2.00 per treatment course, driven by generic competition, procurement mechanisms, and public health programs.

Long-Term Outlook (2028 and Beyond)

Post-patent expiry or if biosimilars enter, prices could decrease by 30-60%, aligning with typical generic market trends. Innovative formulations or combination therapies could sustain higher prices if they demonstrate significant clinical benefits.

Pricing Strategy Recommendations

Manufacturers should tailor pricing based on regional income levels, reimbursement landscapes, and competitive dynamics. Early-stage premium pricing can recover R&D investments, followed by tiered pricing as patent protections lapse.

Market Entry Considerations

Key to capturing value is balancing pricing strategies with regulatory timelines, clinical evidence for differentiation, and partnership opportunities with local distributors, especially in emerging markets.

Regulatory and Health Policy Impacts

Adoption of international health guidelines endorsing FT Anti-Diarrheal could enhance market acceptance. Additionally, inclusion in national essential medicines lists (EMLs) would facilitate procurement and influence pricing negotiations.

Summary

The FT Anti-Diarrheal market combines high unmet medical needs with an increasingly competitive landscape. Favorable growth drivers in both developed and emerging markets support a positive revenue trajectory. Strategic patent management, clear differentiation, and region-specific pricing approaches are vital to maximize value and market access.

Key Takeaways

- The global anti-diarrheal drugs market is projected to grow at a CAGR of approximately 4-6% through 2028, driven by persistent disease burden and innovation efforts.

- Early-stage pricing may range from USD 8-15 per treatment in developed markets, with significantly lower prices in LMICs due to generics and procurement programs.

- Patent protections and regulatory pathways will play critical roles in establishing initial high-price strategies, with subsequent decline following patent expiration or increased generic competition.

- Differentiation through improved efficacy, safety, or formulations can support premium pricing and market share capture.

- Collaboration with health authorities, inclusion in essential medicines lists, and strategic regional pricing are crucial for expanding access and optimizing revenues.

FAQs

1. How does patent status impact FT Anti-Diarrheal pricing?

Patent protection allows exclusivity, enabling higher pricing for the innovator product. Once patents expire, generic manufacturers can introduce similar therapies at reduced prices, leading to significant market price declines.

2. What are key regional factors influencing pricing strategies?

In developed countries, reimbursement policies and healthcare infrastructure support higher prices, whereas in LMICs, affordability and procurement mechanisms drive lower prices with emphasis on volume-based access.

3. How can differentiation influence competitive pricing?

Unique clinical benefits, reduced treatment duration, or improved safety profiles enable premium pricing and higher market acceptance, balancing affordability and profitability.

4. What role do regulatory approvals play in price projections?

Faster or streamlined approvals can facilitate earlier market entry and initial premium pricing; delays can suppress early revenue projections and affect overall financial forecasts.

5. How might future market trends affect long-term price levels?

Approaching patent expiry and increasing generic competition typically lead to substantial price reductions, emphasizing the importance of lifecycle management and innovation in maintaining profitability.

Sources:

[1] World Health Organization. Diarrhoeal Disease. Published 2022.

[2] MarketWatch. Anti-Diarrheal Drugs Market Size, Share & Trends Analysis Report. 2023.

More… ↓