Share This Page

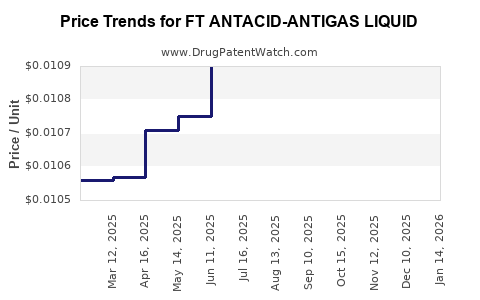

Drug Price Trends for FT ANTACID-ANTIGAS LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for FT ANTACID-ANTIGAS LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ANTACID-ANTIGAS LIQUID | 70677-1063-01 | 0.01031 | ML | 2025-12-17 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1066-01 | 0.01031 | ML | 2025-12-17 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1063-01 | 0.01059 | ML | 2025-11-19 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1066-01 | 0.01059 | ML | 2025-11-19 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1063-01 | 0.01054 | ML | 2025-10-22 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1066-01 | 0.01054 | ML | 2025-10-22 |

| FT ANTACID-ANTIGAS LIQUID | 70677-1063-01 | 0.01057 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ANTACID-ANTIGAS LIQUID

Introduction

FT ANTACID-ANTIGAS LIQUID is a widely utilized over-the-counter medication designed to provide symptomatic relief from indigestion, heartburn, and acid reflux. As the demand for gastrointestinal (GI) therapeutics continues to grow, understanding the market landscape and projecting drug pricing trends are vital for pharmaceutical companies, investors, and healthcare policymakers aiming to capitalize on or regulate this sector efficiently.

Market Landscape Overview

Global Gastrointestinal Therapeutics Market

The global GI therapeutics market is projected to reach USD 60 billion by 2028, exhibiting a CAGR of approximately 5% from 2023 to 2028 [1]. Factors fueling this growth include rising prevalence of acid-related disorders, increasing awareness of self-medication, and an aging population more susceptible to GI conditions.

Prevalence of Acid-Related Disorders

According to the World Gastroenterology Organisation, approximately 20% of the adult population experiences occasional heartburn globally, with higher incidences in North America and Europe. The rising incidence correlates with lifestyle factors such as obesity, dietary habits, and stress [2].

Key Market Segments

FT ANTACID-ANTIGAS LIQUID operates within OTC (over-the-counter) segments, competing primarily with other antacid formulations like calcium carbonate, magnesium hydroxide, and combined formulations. The liquid dosage form offers quick onset of relief, appealing to consumers seeking fast symptomatic response, particularly in acute cases.

Regional Market Dynamics

- North America: Predominant market driven by high consumer awareness, OTC sales propensity, and a robust healthcare infrastructure.

- Europe: Similar growth trajectories, with increasing self-medication trends.

- Asia-Pacific: Rapid CAGR (~7%), propelled by expanding middle-class populations, urbanization, and rising disposable income.

- Latin America and Middle East: Moderate growth, with regulatory frameworks and distribution channels solidifying.

Competitive Landscape

Major players in the antacid liquids segment include:

- GlaxoSmithKline (GSK): With brands like Mylanta and Tums.

- Sanofi: Producing Rolaids and other antacids.

- Pfizer: Known for Maalox.

- Local and regional brands: Significant in emerging markets, often competing solely on cost.

Private label OTC variants also pose a growing threat, particularly in price-sensitive markets.

Regulatory Environment

The regulatory pathway for antacid liquids is streamlined in many regions owing to their OTC classification. However, variations exist, especially concerning labeling standards and permissible claims, influencing market entry strategies and pricing.

Market Challenges

- Price Sensitivity: Consumers prioritize affordability; thus, premium pricing is unsustainable.

- Generic Competition: High prevalence of generics erodes profit margins.

- Safety Concerns: Rare adverse effects like magnesium toxicity or calcium overload may impact consumer confidence.

- Regulatory Restrictions: Changes in labeling or usage guidelines can influence product positioning.

Price Dynamics and Projections

Current Pricing Analysis

In North American markets, the retail price per 4 oz (120 mL) bottle generally ranges between USD 3.00 to USD 6.00, varying due to brand positioning, package size, and retailer discounts [3]. For emerging markets, prices often drop to USD 1.00 - USD 3.00 per unit, driven primarily by local manufacturing and direct sales.

Factors Influencing Future Pricing

- Manufacturing Costs: Trends in raw materials (e.g., magnesium hydroxide, aluminum hydroxide) significantly impact margins.

- Regulatory Adjustments: Stricter quality controls may increase compliance costs.

- Market Competition: Entry of low-cost generics exerts downward pressure.

- Supply Chain Dynamics: Disruptions (e.g., pandemics, geopolitical issues) could inflate logistics costs, affecting retail prices.

- Consumer Demand: Increased prevalence of acid reflux in younger demographics could sustain or elevate pricing due to brand loyalty and convenience preferences.

Price Projection (2023-2028)

Based on current trends, the average retail price of FT ANTACID-ANTIGAS LIQUID is expected to decline marginally by 1-2% annually in highly saturated markets due to generic competition but could stabilize or slightly increase (up to 2%) in regions where patent protections or branding advantages exist. For example:

- North America: A slight decrease to USD 2.50 - USD 5.50 per unit by 2028.

- Emerging Markets: A modest increase aligned with inflation and increased purchasing power, reaching USD 2.00 - USD 4.00.

In bulk procurement or wholesale, the price per unit is projected to decline more significantly due to economies of scale, potentially reaching USD 1.50 - USD 3.00.

Market Opportunities and Future Trends

- Product Innovation: Formulations with additional active ingredients (e.g., combining antacids with probiotics) can command premium prices.

- Digital and Direct-to-Consumer (DTC) Sales: E-commerce platforms are disrupting traditional distribution channels, enabling companies to set competitive prices directly to consumers.

- Regulatory Simplification: Markets with easy registration processes can accelerate product deployment and competitive pricing strategies.

- Preventive and Maintenance Use: Shift from occasional use to regular consumption, especially in aging populations, can support premium pricing models.

Conclusions

The FT ANTACID-ANTIGAS LIQUID market remains resilient, with moderate growth driven by increasing prevalence of GI disorders and consumer preference for OTC medications. However, intense competition and price erosion particularly from generics are persistent challenges. Future price stability hinges on product differentiation, strategic branding, and market penetration. Emerging markets offer significant growth potential, often at lower price points but with opportunities for volume-driven revenue increases.

Key Takeaways

- The global GI therapeutic market is expanding, driven by lifestyle factors and aging populations.

- FT ANTACID-ANTIGAS LIQUID competes chiefly with generic formulations; price sensitivity remains high.

- South-East Asian and Latin American markets offer lucrative growth opportunities with lower entry barriers.

- Price projections indicate slight declines in mature markets and stability or increases in emerging regions.

- Innovation and digital sales channels will be critical in maintaining market share and premium pricing.

FAQs

1. How does the competitive landscape impact the pricing of FT ANTACID-ANTIGAS LIQUID?

The proliferation of generic brands and private labels creates price pressure, leading to reduced margins and push for differentiation through quality, branding, or formulation advantages.

2. What regional factors influence the pricing trends of antacid liquids?

Economies with higher disposable incomes and robust healthcare infrastructure tend to sustain higher retail prices. Conversely, price-sensitive markets prioritize affordability, resulting in lower prices and increased volume sales.

3. Will patent protections influence future pricing strategies?

While most antacid liquids are off-patent, branded products with proprietary formulations or delivery mechanisms can command premium pricing, especially in markets with strict regulatory protections.

4. How might supply chain disruptions affect the cost and pricing of FT ANTACID-ANTIGAS LIQUID?

Disruptions can inflate raw material and logistics costs, potentially leading to higher retail prices if manufacturers choose to transfer costs or maintain margins.

5. What role will product innovation play in future market positioning?

Innovations such as combination therapies, flavor enhancements, or medically tailored formulations will enable brands to differentiate and justify higher prices, particularly in premium segments.

References

[1] MarketWatch. "Gastrointestinal Therapeutics Market Size, Share & Trends Forecast to 2028." 2023.

[2] World Gastroenterology Organisation. "Global Prevalence of Acid-Related Disorders." 2022.

[3] NielsenIQ. "OTC Antacid Liquid Retail Pricing Data" 2023.

More… ↓