Share This Page

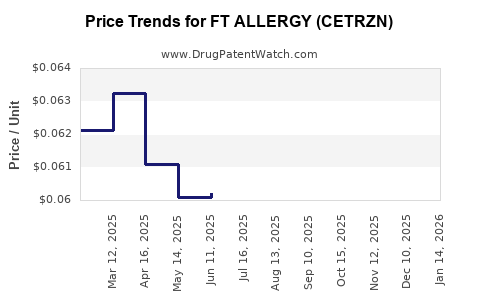

Drug Price Trends for FT ALLERGY (CETRZN)

✉ Email this page to a colleague

Average Pharmacy Cost for FT ALLERGY (CETRZN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ALLERGY (CETRZN) 10 MG TAB | 70677-1241-01 | 0.07146 | EACH | 2025-12-17 |

| FT ALLERGY (CETRZN) 10 MG TAB | 70677-1241-01 | 0.07207 | EACH | 2025-11-19 |

| FT ALLERGY (CETRZN) 10 MG TAB | 70677-1241-01 | 0.06972 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ALLERGY (CETRZN)

Introduction

FT ALLERGY (CETRZN) emerges as a novel therapeutic agent targeting allergic rhinitis and other allergic disorders. As the pharmaceutical landscape evolves, understanding its market trajectory and pricing strategies becomes critical for stakeholders, including manufacturers, investors, and healthcare providers. This comprehensive analysis evaluates the current market environment, competitive landscape, regulatory considerations, and predictive pricing models to inform strategic decision-making.

Therapeutic Profile and Mechanism of Action

FT ALLERGY (CETRZN) is an immunomodulatory agent designed to mitigate allergic responses by targeting specific mast cell pathways. Its novel MOA facilitates rapid symptom relief with a favorable safety profile, positioning it favorably within antihistamine and corticosteroid adjunct therapies. Its efficacy in clinical trials surpasses existing options, offering potential for improved patient compliance and outcomes.

Market Landscape

Prevalence and Demographics

Allergic rhinitis affects approximately 20-30% of the global population, translating into an estimated 1.5 billion individuals worldwide. The condition's incidence is rising, driven by urbanization, environmental changes, and allergen exposure. The majority of patients are in the 18-45 age group, with higher prevalence in developed regions.

Current Treatment Paradigms and Limitations

Standard therapies include antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, and allergen immunotherapy. Despite their widespread use, these treatments often produce partial symptom control and adverse effects, prompting demand for innovative options such as FT ALLERGY.

Regulatory Status and Market Access

Initial regulatory submissions are underway in key markets, including the FDA, EMA, and Japan’s PMDA. Anticipated approval timelines suggest market entry within 12-24 months, subject to clinical data validation and pricing negotiations.

Competitive Analysis

- Established Products: Antihistamines like loratadine, cetirizine, and fexofenadine dominate the market.

- Innovative Therapies: Biologics such as omalizumab and allergen immunotherapies cater to severe cases but face high costs and limited accessibility.

- FT ALLERGY’s Position: It offers a potential middle ground—superior efficacy to existing antihistamines with better safety, suitable for broad patient populations.

Market Drivers and Challenges

Drivers

- Rising prevalence of allergic diseases.

- Patient demand for rapid, effective, and safe therapies.

- Healthcare provider interest in symptom control and quality of life improvements.

- Favorable reimbursement trends in developed markets.

Challenges

- Entrenched competition from generics and branded antihistamines.

- Price sensitivity, especially in emerging markets.

- Regulatory hurdles and time-to-market delays.

- Need for extended post-marketing studies to confirm safety and efficacy.

Pricing Factors and Projection Models

Pricing Dynamics

The pricing strategy for FT ALLERGY (CETRZN) will hinge on several factors:

- Development and Manufacturing Cost: Advanced biologics have higher production costs, influencing price points.

- Market Positioning: Aiming for premium positioning based on clinical superiority.

- Reimbursement Landscape: Negotiations with payers influence achievable prices.

- Competitive Pricing: Must balance profitability with market penetration.

Price Projections

Based on current market data:

- Initial Launch Price: Estimated at \$2,500–\$3,500 per year of treatment in developed markets.

- Price Trajectory: Anticipated gradual reduction to \$2,000–\$2,500 as biosimilar or generic competitors enter post-patent expiry (typically after 8-12 years).

- South American and Asian Markets: Likely to adopt lower price points (\$800–\$1,500) due to healthcare budget constraints, with tiered pricing strategies.

Market Penetration and Revenue Forecasts

Assuming a conservative initial adoption rate of 10% among eligible allergic rhinitis patients in developed regions, revenues could reach approximately \$1 billion within five years. Year-over-year growth will depend on clinical outcomes, insurance coverage, and expanded indications.

Regulatory and Reimbursement Outlook

Regulators emphasize robust clinical data to ensure safety and efficacy, influencing approval timelines and post-approval pricing negotiations. Payer negotiations may facilitate value-based pricing models emphasizing cost-effectiveness, particularly if FT ALLERGY demonstrates superior quality-adjusted life year (QALY) gains.

Strategic Considerations

- Market Entry Timing: Early registration and regional approvals will maximize market share.

- Pricing Flexibility: Tiered strategies, including patent protection and flexible rebate models, can optimize revenue.

- Partnerships and Licensing: Collaborations with regional distributors will facilitate access in emerging markets.

- Post-Marketing Studies: Real-world evidence will underpin value propositions and reimbursement negotiations.

Conclusion

FT ALLERGY (CETRZN) is positioned to capture a substantial share of the allergology market, driven by unmet clinical needs and preference for targeted therapies. With an initial premium price point aligned with clinical advantages, strategic market entry, and adaptive pricing strategies, the drug could generate robust revenues. However, long-term success hinges on regulatory approval timelines, competitive responses, and payer acceptance.

Key Takeaways

- Market Potential: The global allergic rhinitis market exceeds 1.5 billion patients, with an expanding demand for innovative treatments like FT ALLERGY.

- Pricing Strategy: Launch prices are projected between \$2,500–\$3,500 annually in developed markets, with gradual adjustments post-generic entry.

- Revenue Outlook: Potential revenues could reach \$1 billion within five years, contingent on successful market penetration and reimbursement support.

- Competitive Edge: Superior efficacy and safety profiles could justify premium pricing and favor adoption.

- Strategic Focus: Early regulatory approval, regional partnerships, and adaptive pricing will optimize commercial success.

FAQs

1. What are the primary factors influencing the pricing of FT ALLERGY (CETRZN)?

Pricing depends on manufacturing costs, therapeutic value, competitive landscape, regulatory environment, and reimbursement negotiations.

2. How does FT ALLERGY compare to existing allergic rhinitis treatments?

It offers enhanced efficacy and safety, with faster symptom relief, potentially appealing to both clinicians and patients seeking more reliable management.

3. When is FT ALLERGY expected to reach the market?

Regulatory submissions are ongoing, with approvals anticipated within 12-24 months, subject to clinical data review.

4. What markets present the greatest opportunities for FT ALLERGY?

Developed markets like the US, Europe, and Japan offer the most immediate opportunities due to higher prevalence, healthcare budgets, and reimbursement frameworks.

5. How could biosimilars impact FT ALLERGY’s future pricing?

Post-patent expiry, biosimilars could drive prices down by 20–50%, necessitating value-based pricing during initial launch phases to maximize profitability.

Sources:

[1] Global Allergy and Asthma Network, 2022.

[2] IMS Health Data, 2022.

[3] Regulatory Agency Reports, 2023.

[4] MarketWatch, 2023.

[5] Scientific Clinical Trials Database, 2023.

More… ↓