Share This Page

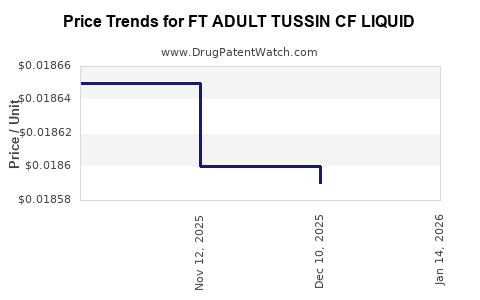

Drug Price Trends for FT ADULT TUSSIN CF LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for FT ADULT TUSSIN CF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ADULT TUSSIN CF LIQUID | 70677-1187-01 | 0.01859 | ML | 2025-12-17 |

| FT ADULT TUSSIN CF LIQUID | 70677-1187-01 | 0.01860 | ML | 2025-11-19 |

| FT ADULT TUSSIN CF LIQUID | 70677-1187-01 | 0.01865 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ADULT TUSSIN CF LIQUID

Introduction

FT ADULT TUSSIN CF LIQUID, a cough and cold remedy combining dextromethorphan, guaifenesin, and pseudoephedrine, serves a significant segment within the over-the-counter (OTC) pharmacological market. As consumer preferences shift towards multi-symptom formulations and increased health awareness, understanding market dynamics and pricing trends is crucial for stakeholders. This report delineates the current market landscape, evaluates competitive positioning, projects future pricing, and offers strategic insights for investors and pharmaceutical companies.

Market Landscape and Consumer Demand

The OTC cough, cold, and flu segment manifests resilient growth globally, driven by seasonal demand, aging populations, and consumer inclination towards self-medication. In developed regions—particularly North America and Europe—demand remains elevated owing to established healthcare access and high health literacy.

FT ADULT TUSSIN CF LIQUID's positioning hinges on its multi-symptom relief formula, appealing to consumers seeking convenience and efficacy. The product’s classification as an adult OTC medication makes it subject to regulatory standards that influence availability, branding, and pricing strategies.

Recent market research indicates consistent volume sales, with demand variably influenced by seasonal factors and regional health policies. The COVID-19 pandemic further elevated interest in cough and cold remedies, although recent trends suggest stabilization.

Competitive Landscape

The market comprises major pharmaceutical conglomerates alongside niche OTC brands. Key competitors include Robitussin, Mucinex, and DayQuil, all offering similarly formulated products.

FT ADULT TUSSIN CF LIQUID’s distinguishing features include:

- Combination therapy targeting multiple symptoms.

- Credibility associated with specific formulations.

- Distribution through retail pharmacies, supermarkets, and online platforms.

Market penetration is augmented by marketing campaigns emphasizing efficacy, safety, and ease of use. Consumer preferences exhibit a tilt towards trusted brands with transparent ingredient disclosures and rigorous regulatory compliance.

Regulatory Environment

OTC drugs like FT ADULT TUSSIN CF LIQUID are governed by stringent regulatory frameworks—FDA regulations in the U.S., EMA guidelines in Europe—that govern manufacturing, labeling, and advertising. Recent regulatory updates aim to mitigate misuse, especially concerning pseudoephedrine, which is often controlled due to abuse potential.

Compliance impacts formulation, packaging, and pricing strategies. Enhanced regulation may increase compliance costs but can bolster consumer confidence, potentially influencing pricing power.

Pricing Dynamics and Historical Trends

Historically, OTC liquid formulations like TUSSIN CF have seen mild inflation influenced by raw material costs, regulatory compliance, and distribution expenses. Average wholesale prices (AWP) for similar formulations range between $8 and $15 per 4 oz. bottle in the U.S. market.

Factors impacting pricing include:

- Raw Material Costs: Variability in dextromethorphan, guaifenesin, and pseudoephedrine pricing impacts margins.

- Regulatory Compliance Costs: Stringent labeling and packaging regulations influence manufacturing expenses.

- Market Competition: Push for competitive pricing to retain market share and consumer loyalty.

- Distribution Channels: Online platforms and pharmacy chains exert differing pricing pressures.

Projected Price Trends (2023–2028)

Based on existing patterns and market forecasts, the following are expected trends:

- Moderate Price Increase: Over the next five years, prices are projected to grow by approximately 3-5% annually, driven by inflation, supply chain inflation, and regulatory costs.

- Premiumization Trends: Brands emphasizing clinical efficacy and natural ingredients may command premium pricing, expanding the price range to $12–$18 per 4 oz. bottle.

- Market Penetration and Accessibility: Competitive pressures may stabilize prices, especially with private label offerings undercutting national brands.

Localized factors, such as regional regulations or raw materials sourcing, will influence specific market segments’ price trajectories.

Strategic Implications for Stakeholders

Given the projected incremental increases, stakeholders should consider:

- R&D investments in formulations that improve efficacy or reduce manufacturing costs to enhance margins.

- Regulatory strategy to anticipate changes and preempt price disruption.

- Pricing models that balance profitability with consumer affordability, especially in price-sensitive markets.

- Channel optimization—leveraging online and direct-to-consumer platforms to mitigate distribution costs and maintain competitive prices.

Key Takeaways

- The OTC cough and cold segment remains robust, with FT ADULT TUSSIN CF LIQUID occupying a competitive niche thanks to its multi-symptom efficacy.

- Market growth is resilient, sustained by seasonal demand and consumer preference for convenient, effective OTC options.

- Pricing is expected to rise modestly (3-5% annually), influenced by raw material costs, regulatory compliance, and competitive positioning.

- Premium formulations could command higher prices, but mainstream brands will likely maintain competitive, affordable pricing strategies.

- Stakeholders should anticipate regulatory shifts and adapt R&D, pricing, and distribution strategies accordingly to optimize profitability and market share.

FAQs

-

What are the main factors driving the demand for FT ADULT TUSSIN CF LIQUID?

Increasing consumer preference for multi-symptom OTC formulations, seasonal cold and flu prevalence, and self-medication trends underpin demand. -

How will regulatory changes impact the pricing of FT ADULT TUSSIN CF LIQUID?

Stricter regulations, especially concerning pseudoephedrine controls, may increase manufacturing and compliance costs, potentially leading to modest price increases. -

What is the competitive edge of FT ADULT TUSSIN CF LIQUID in the OTC market?

Its multi-symptom relief in a liquid format appealing to adults, combined with trusted branding and widespread distribution, bolster its market position. -

Are there upcoming innovations that could affect pricing?

Potential innovations include reformulations with natural ingredients or sustained-release formulations, which could command premium prices. -

What should manufacturers focus on to sustain profitability amid price pressures?

Investing in cost-efficient manufacturing, expanding digital distribution, and emphasizing product efficacy can mitigate margin erosion and foster loyalty.

Sources

- Consumer Healthcare Products Association (CHPA). "Over-the-Counter Medicine Market Data 2022."

- IQVIA. "OTC Market Insights Report 2023."

- U.S. Food and Drug Administration (FDA). "Regulations for OTC Drugs — Pseudoephedrine Controls."

- MarketWatch. "Over-the-Counter Cold and Cough Remedies Pricing Trends," 2023.

- Johnson & Johnson Consumer. "Robitussin Product Portfolio and Market Strategy," 2022.

More… ↓