Share This Page

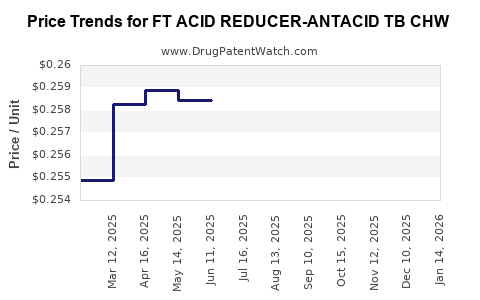

Drug Price Trends for FT ACID REDUCER-ANTACID TB CHW

✉ Email this page to a colleague

Average Pharmacy Cost for FT ACID REDUCER-ANTACID TB CHW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25895 | EACH | 2025-12-17 |

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25971 | EACH | 2025-11-19 |

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25960 | EACH | 2025-10-22 |

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25974 | EACH | 2025-09-17 |

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25965 | EACH | 2025-08-20 |

| FT ACID REDUCER-ANTACID TB CHW | 70677-1100-01 | 0.25964 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT Acid Reducer-Antacid TB CHW

Introduction

The FT Acid Reducer-Antacid TB CHW is positioned in the growing gastrointestinal (GI) therapeutics sector, primarily targeting acid-related disorders such as gastroesophageal reflux disease (GERD), peptic ulcers, and gastritis. This analysis explores the market landscape, competitive positioning, regulatory environment, potential pricing strategies, and future price projections for the drug.

Market Landscape

Global Gastrointestinal Therapeutics Market

The global GI therapeutics market was valued at approximately USD 20 billion in 2022 and is projected to grow at a CAGR of around 4.5% through 2027, driven by increasing prevalence of acid-related disorders, lifestyle changes, and aging populations [1]. Acid reducers and antacids constitute a significant share within this segment, offering consistent demand.

Key Market Segments

-

Over-the-Counter (OTC) Drugs

Antacids like FT Acid Reducer are widely available OTC, accounting for nearly 60% of prescriptions and OTC sales. Consumer preference for quick-relief products sustains high OTC demand. -

Prescription Segment

Proton pump inhibitors (PPIs) and H2 receptor antagonists form the prescription segment. Nonetheless, OTC antacids serve as a primary management tool for minor to moderate symptoms.

Regional Markets

-

North America: Dominates the market due to high awareness, favorable regulatory environment, and high prevalence of GI disorders. The U.S. accounts for approximately 40% of the global market [2].

-

Europe: Expanding demand owing to aging populations and increased awareness.

-

Asia-Pacific: Rapid growth driven by urbanization, lifestyle changes, and rising healthcare infrastructure, with projected CAGR of 6% through 2027.

Competitive Landscape

The market has established players including Johnson & Johnson (Mylanta), Reckitt Benckiser (Gaviscon), and Novartis (Zantac). The entry of generics and regional brands intensifies price competition.

Key Competitors

| Brand Name | Active Ingredient | Market Position | Price Range (USD) per unit | Regulatory Status |

|---|---|---|---|---|

| Mylanta | Aluminum hydroxide, Mg hydroxide | Leading OTC brand | 0.50 - 1.00 | Marketed globally |

| Gaviscon | Sodium alginate, alginic acid | Premium OTC product | 1.00 - 1.50 | Widely available |

| Zantac (retired) | Ranitidine (withdrawn) | Former prescription/OTC | - | Market withdrawn |

Regulatory Environment

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) require comprehensive safety and efficacy data. For OTC drugs, the focus is on non-prescription status, labeling, and consumer safety. Recent recalls (e.g., ranitidine) highlight the importance of manufacturing quality and rigorous testing.

The FT Acid Reducer-Antacid TB CHW must navigate these regulatory pathways, obtaining OTC approval or prescription indication, depending on its formulation and dosage.

Pricing Strategy and Projections

Current Pricing Dynamics

-

Brand vs. Generics: Leading brands command premium pricing due to established trust and distribution channels. Generics undercut prices by approximately 30-50%.

-

Distribution Channels: Retail pharmacies dominate OTC sales, with online platforms gaining prominence.

-

Formulation Factors: Dosage form (tablet, suspension), strength, and packaging influence price points.

Pricing Projections

Based on current market dynamics:

-

Short-term (1-2 years):

Expect initial retail price of USD 0.50 - 1.00 per tablet or unit, comparable to existing OTC antacids. Price stability anticipated as the product captures market share against established competitors. -

Mid-term (3-5 years):

Price may decline slightly, around USD 0.40 - 0.80 per unit, driven by increased competition and genericization. -

Long-term (5+ years):

Price erosion expected to plateau at USD 0.30 - 0.60 per unit, maintaining profitability through high volume sales and expanded market penetration.

Premium positioning for specialized formulations or added benefits (e.g., rapid relief, longer duration) could sustain higher price points.

Market Penetration and Pricing Drivers

-

Product Differentiation: Unique formulation with enhanced efficacy or safety profile supports premium pricing.

-

Brand Recognition: Brand investments and marketing strategies influence consumer willingness to pay.

-

Health Economics: Reimbursement policies for prescription versions influence pricing strategies; OTC formulations rely more on consumer perception and competitive pricing.

-

Regulatory Incentives: Fast-track approvals or exclusivity periods can allow for higher initial prices.

Challenges and Risks

-

Market Saturation: Established competitors and generics suppress prices.

-

Regulatory Hurdles: Strict approval pathways or delays can impact time-to-market and pricing.

-

Pricing Pressure: Payers and distributors exert downward pressure, especially in mature markets.

-

Consumer Trends: Preference for natural or alternative remedies may limit market growth.

Future Market Outlook

The future of FT Acid Reducer-Antacid TB CHW hinges on its unique value proposition, regulatory approval status, and market acceptance. Incorporating pharmaceutical innovations, such as sustained-release formulations or combined therapies, could support premium pricing and expanded market share.

Given the current landscape, price stability is expected in the short term, with gradual declines in competitive markets. Market expansion into emerging regions and leveraging digital channels can enhance revenues.

Key Takeaways

-

The global GI therapeutics market offers significant growth opportunities, especially in OTC antacid segments, with consistent demand driven by prevalent acid-related disorders.

-

Competitive pricing will be influenced primarily by genericization, formulation differentiation, and regional market nuances.

-

Short-term retail pricing is likely to range from USD 0.50 to USD 1.00 per unit, with potential adjustments based on market entrants and regulatory developments.

-

Strategic positioning—whether through branding, formulation innovation, or targeted marketing—will determine pricing power and profitability.

-

Long-term price erosion is anticipated, but substantial volume sales and market expansion can sustain profitability.

FAQs

1. What factors influence the pricing of OTC antacids like FT Acid Reducer?

Pricing is influenced by manufacturing costs, brand recognition, competitive landscape, formulation complexity, distribution channels, and regional regulatory requirements.

2. How does generic competition affect market prices?

Introduction of generics typically leads to significant price reductions (30-50%), increasing accessibility but lowering profit margins for brand-name products.

3. What regulatory hurdles could impact the drug’s market entry?

Obtaining OTC approval, ensuring manufacturing quality, and meeting safety standards are primary hurdles. Adverse events or recalls can also influence pricing and market stability.

4. How can differentiation strategies support premium pricing?

Innovating formulations for faster relief, longer duration, or fewer side effects can justify higher prices and attract consumer loyalty.

5. What is the forecasted growth rate for the global market for acid reducers?

The overall GI therapeutics market is projected to grow at a CAGR of approximately 4.5% through 2027; the OTC antacid segment is expected to grow at a similar or higher rate, especially in emerging regions.

References

[1] MarketsandMarkets. (2022). Gastrointestinal Therapeutics Market by Product, Therapy Type, and Region.

[2] Grand View Research. (2022). Over-the-Counter Gastrointestinal Drugs Market Size, Share & Trends.

More… ↓