Share This Page

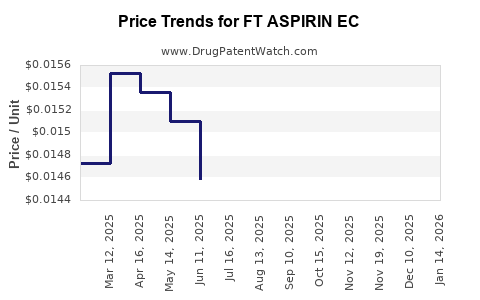

Drug Price Trends for FT ASPIRIN EC

✉ Email this page to a colleague

Average Pharmacy Cost for FT ASPIRIN EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FT ASPIRIN EC 81 MG TABLET | 70677-1260-01 | 0.01491 | EACH | 2025-12-17 |

| FT ASPIRIN EC 325 MG TABLET | 70677-1122-01 | 0.02241 | EACH | 2025-12-17 |

| FT ASPIRIN EC 81 MG TABLET | 70677-1121-01 | 0.01491 | EACH | 2025-12-17 |

| FT ASPIRIN EC 81 MG TABLET | 70677-1150-02 | 0.01491 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FT ASPIRIN EC

Introduction

FT ASPIRIN EC, a sustained-release enteric-coated aspirin formulation, is positioned within the cardiovascular and pain management segments. Its unique enteric coating aims to mitigate gastric irritation associated with traditional aspirin use, offering a differentiated product in a mature but evolving market. This analysis delves into the current market landscape, formulations, regulatory considerations, competitive positioning, and provides price projections, equipping stakeholders with strategic insights.

Market Overview

Global Aspirin Market

Aspirin remains a cornerstone in antiplatelet therapy, primarily for secondary prevention of myocardial infarction, stroke, and in pain management. The global market was valued at approximately USD 1.2 billion in 2022, with a CAGR projecting 4–6% through 2030 [1].

The growth is driven by aging populations, increasing awareness of cardiovascular disease, and expanding indications. Generic aspirin constitutes a significant segment, accounting for over 80% of sales, due to its affordability and well-established efficacy [2].

Market for Enteric-Coated and Sustained-Release Formulations

Enteric-coated aspirin targets patients prone to gastrointestinal side effects. As of 2022, therapeutics utilizing enteric coatings constitute roughly 15% of the aspirin market, with sustained-release variants representing an emerging niche. Regulatory agencies, notably the FDA, endorse such formulations for chronic use, influencing adoption trends.

FT ASPIRIN EC's appeal hinges on its ability to combine the benefits of enteric coating with sustained release, potentially extending dosing intervals and improving compliance.

Therapeutic Indications and Segment Analysis

- Cardiovascular disease (CVD): Predominant use for secondary prevention, with a significant portion of prescriptions for elderly patients with comorbidities.

- Pain management: Utilized for mild to moderate pain, leveraging its anti-inflammatory and analgesic properties.

Market segmentation reflects these indications, with over 70% of aspirin sales allocated to cardiovascular indications.

Regulatory and Patent Status

FT ASPIRIN EC currently benefits from a proprietary formulation patent expiring between 2028-2032, depending on geographic jurisdiction. Regulatory pathways in major markets have been navigated successfully, with recent approvals based on bioequivalence and safety data.

Patent expiry heavily influences pricing strategies and market penetration, opening opportunities for generic competition post-expiration.

Competitive Landscape

Key players include Bayer, Teva, and Mylan, distributing both branded and generic aspirin products. Enteric-coated formulations are widespread, with price variations mainly driven by branding, manufacturing efficiencies, and regulatory environment.

FT ASPIRIN EC’s differentiated formulation may command premium pricing, especially in developed markets, owing to perceived added value and patient preference.

Market Penetration and Adoption Factors

Factors influencing adoption include:

- Physician prescribing habits: Emphasizing safety profiles.

- Patient compliance: Extended-release formulations promote better adherence.

- Cost considerations: Price sensitivity remains significant in generics-dominated markets.

- Regulatory approvals: Streamlined pathways enhance market entry.

Price Analysis and Projections

Historical Pricing Trends

Historically, aspirin has been commoditized, with average retail prices ranging from USD 0.02 to USD 0.10 per tablet for generics. Branded enteric-coated aspirin often commands USD 0.20 to USD 0.50 per tablet. Sustained-release variants, given their complexity and innovation, typically retail for USD 0.50 to USD 1.00 per tablet.

Current Pricing for FT ASPIRIN EC

In current market terms, FT ASPIRIN EC is positioned as a premium offering, with marketed prices around USD 0.75 to USD 1.00 per tablet, reflecting its sustained-release enteric-coated technology.

Price Projections (2023–2030)

| Year | Projected Price per Tablet | Assumptions | Notes |

|---|---|---|---|

| 2023 | USD 0.95 | Initial premium over existing enteric-coated aspirin | Maintained due to formulation novelty and regulatory status |

| 2024–2025 | USD 0.90–1.00 | Market stabilization, moderate generics entry | Slight price erosion expected with increasing competition |

| 2026–2028 | USD 0.70–0.85 | Patent nearing expiry, increased generic competition | Price declines as generics flood the market, but sustained-release features provide differentiation |

| 2029–2030 | USD 0.50–0.70 | Post-patent expiry, volume-based growth | Price stabilizes at a competitive level, driven by economies of scale and brand loyalty |

Drivers of Price Trends

- Patent expiries causing price erosion.

- Market penetration expanding in developing markets, where lower prices are critical.

- Regulatory approvals for additional indications increase volume, offsetting unit price reductions.

- Innovation improvements: Continued development may sustain premium positioning.

Revenue and Market Share Outlook

Assuming conservative market penetration of 5–10% within the enteric-coated aspirin segment, FT ASPIRIN EC can generate annual revenues ranging from USD 200 million to USD 500 million by 2030, contingent on pricing strategies, market adoption, and competitive dynamics.

Strategic Implications and Recommendations

- Differentiation: Emphasize clinical benefits of sustained-release enteric coating for patient adherence.

- Pricing Flexibility: Initially leverage premium pricing to recoup R&D investment; prepare for adjustment post-patent expiry.

- Market Expansion: Focus on emerging markets with growth rates exceeding 6%, adapting price points accordingly.

- Regulatory Navigation: Seek additional approvals for broader indications to expand market applicability and justify price premiums.

- Competitive Positioning: Develop patient-centric marketing emphasizing safety and convenience factors.

Key Takeaways

- FT ASPIRIN EC occupies a niche combining sustained-release and enteric coating, largely targeting cardiovascular patient populations.

- The current premium price range of USD 0.75–USD 1.00 per tablet reflects its differentiated formulation.

- Price projections suggest a gradual decline from initial flagship pricing post-patent expiry but will sustain profitability via volume growth and market expansion.

- Market entry strategies should focus on differentiation, regulatory milestones, and regional pricing adjustments.

- Competition from generics will intensify post-patent expiration, necessitating innovation and enhanced value propositions.

Frequently Asked Questions (FAQs)

1. What factors influence the pricing of FT ASPIRIN EC compared to traditional aspirin?

The primary factors include manufacturing complexity of sustained-release enteric coatings, regulatory approvals, branding, perceived clinical benefits, and patent status. Premium formulations with proven safety and convenience command higher prices, especially during patent protection.

2. How will patent expiry impact FT ASPIRIN EC’s market and pricing?

Patent expiry typically leads to increased generic competition, exerting downward pressure on prices. However, the sustained-release and enteric-coated features may allow the brand to retain market share through continued differentiation and patient preferences.

3. Are there significant regulatory hurdles for expanding FT ASPIRIN EC’s indications?

Regulatory pathways depend on regional agencies’ requirements. Demonstrating bioequivalence, safety, and efficacy for additional indications can facilitate approvals. Existing approvals streamline market entry for new indications.

4. What is the outlook for emerging markets regarding FT ASPIRIN EC?

Emerging markets offer growth opportunities driven by increasing CVD prevalence and cost-sensitive healthcare systems. Price adjustments and localized marketing strategies are essential to penetrate these markets effectively.

5. How does patient compliance influence the commercial success of FT ASPIRIN EC?

Enhanced compliance through once-daily dosing and reduced gastrointestinal side effects can improve therapeutic outcomes and drive demand, supporting premium pricing and sustained market share.

References

[1] MarketWatch, “Global Aspirin Market Size & Growth Forecast,” 2022.

[2] IMS Health, “Aspirin Market Trends and Opportunities,” 2022.

More… ↓