Last updated: July 31, 2025

Introduction

FROVA (frovatriptan) stands as a prominent medication within the triptan class, primarily prescribed for the acute treatment of migraine attacks with or without aura. Since its approval by the FDA in 2001, frovatriptan has maintained a significant position in the migraine pharmacotherapy landscape. Analyzing the current market environment and projecting future price trends involve reviewing regulatory dynamics, competitive positioning, demand drivers, pricing strategies, and broader healthcare trends influencing this niche.

Market Overview of FROVA

Therapeutic Profile and Clinical Demand

Frovatriptan is distinguished by its long half-life (~26 hours), offering extended relief and reduced recurrence of migraines, making it particularly appealing for patients with prolonged or recurrent episodes. This pharmacokinetic profile contrasts with other triptans, such as sumatriptan, which have shorter half-lives.

The migraine market has experienced consistent growth owing to increasing global prevalence and heightened awareness. The American Migraine Foundation estimates that over 39 million Americans suffer from migraines, emphasizing the substantial market size [1]. The rising adoption of triptans, including FROVA, is driven by their proven efficacy and safety profiles when used appropriately.

Regulatory and Patent Landscape

While no longer under patent exclusivity—frovatriptan's initial patents expired in the late 2000s—market dominance remains influenced by regulatory approvals, manufacturing capabilities, and formulary placements. The absence of patent barriers has led to increased competition from generic formulations, impacting pricing and market share.

Competitive Dynamics

Frovatriptan faces competition from:

- Other triptans: sumatriptan, rizatriptan, eletriptan, zolmitriptan.

- Generics: Multiple generics are now available, exerting downward pressure on prices.

- Emerging therapies: CGRP antagonists (e.g., erenumab, fremanezumab) and gepants (e.g., rimegepant, ubrogepant) are expanding the strategic landscape, especially for preventive therapy and acute treatment.

Market Size and Adoption Trends

Current Market Penetration

FROVA maintains steady prescription rates owing to physician familiarity and insurance coverage. Data from IQVIA indicates that frovatriptan's market share among triptans hovers around 5-8% globally but varies regionally based on formulary preferences and prescriber habits [2].

Patient Demographics and Prescriber Preferences

Patients seeking longer-lasting relief or those with a history of recurrence tend to favor frovatriptan. Physicians often recommend it for patients requiring sustained attack control, especially in those with contraindications to other triptans.

Impact of COVID-19

The pandemic has disrupted outpatient care and prescription patterns, but demand for effective migraine treatments persists, with telemedicine prompting increased medication renewals and prescriptions for established therapies like frovatriptan.

Pricing Analysis

Current Pricing Benchmarks

Generic frovatriptan's prices have declined considerably post-patent expiry. For example, in the U.S., a typical 9-tablet pack of frovatriptan (2.5 mg) retails at approximately $35–$45, compared to branded FROVA, which costs about $70–$100 for the same pack [3].

- Per-tablet cost (generic): approximately $4–$5.

- Per-tablet cost (branded): approximately $8–$11.

Reimbursement and Insurance Coverage

In the U.S., most insurance plans and pharmacy benefit managers (PBMs) favor generic formulations due to lower costs. This trend further suppresses company-controlled prices of branded FROVA and impacts revenue streams.

Market Drivers for Price Fluctuations

- Generic competition: Continual erosion of branded pricing.

- Formulary positioning: Inclusion in formulary tiers influences accessibility and patient out-of-pocket costs.

- Manufacturing costs: Manufacturing efficiencies and supply chain robustness influence pricing strategies.

Future Price Projection

Factors Influencing Price Trajectories

- Patent and exclusivity status: No patent protection remains, so price elevation is less likely unless tied to specific formulations or delivery devices.

- Market penetration of generics: Expected to limit upward price movements.

- Emerging therapies’ impact: Introduction of new classes (gepants, CGRP monoclonal antibodies) could shift demand patterns, indirectly affecting pricing strategies.

- Healthcare policy trends: Emphasis on cost-containment may maintain or intensify generic pricing pressures.

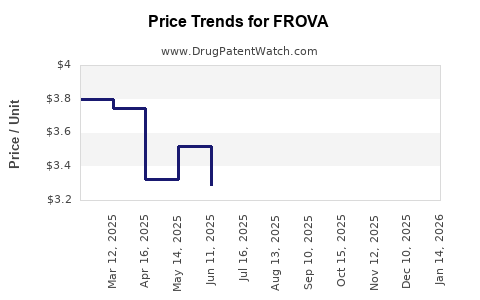

Projected Price Trends (Next 3-5 Years)

Given the current landscape:

- Branded FROVA: Prices likely will stabilize or decline marginally, as healthcare systems prioritize cost savings.

- Generic frovatriptan: Prices are expected to stay within the current range or decline further due to increasing competition. An anticipated decline of around 10–20% over the next five years is plausible, driven by market saturation and commoditization.

Any potential innovation or application of FROVA in new indications could temporarily influence pricing but is unlikely to reverse the downward trajectory of off-patent medications.

Strategic Positioning and Business Implications

Pharmaceutical companies operating in this space should focus on:

- Optimizing manufacturing efficiencies to sustain profitability amid price erosion.

- Investing in patient education and prescriber outreach to differentiate on clinical benefits, especially for those highlighting FROVA’s unique pharmacokinetics.

- Monitoring emerging therapies to adapt market strategies accordingly and assess potential opportunities or threats.

Key Takeaways

- Market Dynamics: The global migraine treatment market is expanding, with frovatriptan continuing to serve a niche segment favoring long-lasting triptan therapy.

- Competitive Pressure: The availability of generics has significantly suppressed prices, causing durable downward pressure on branded medications.

- Price Trends: Anticipate continued marginal declines in both branded and generic frovatriptan prices over the next five years, driven by increased competition and healthcare cost containment efforts.

- Strategic Focus: Companies should leverage clinical differentiation, optimize supply chains, and monitor therapeutic shifts toward novel mechanisms to maintain market relevance.

- Patient Access: Cost reductions benefit wider access, potentially expanding market size, but also challenge profit margins.

FAQs

1. Will FROVA regain exclusivity or patent protection in the future?

No. FROVA's patent protections expired in the late 2000s. Future exclusivity is unlikely unless new formulations or delivery systems are developed.

2. How does FROVA compare to other triptans in terms of pricing?

Generic triptans like sumatriptan are significantly cheaper than branded FROVA. Price differences are primarily driven by brand premiums and patent status.

3. Are there upcoming therapies that could affect FROVA's market share?

Emerging treatments such as CGRP antagonists and gepants are expanding options for migraine therapy, potentially reducing reliance on traditional triptans like FROVA.

4. What regions show the most promise for FROVA's growth?

Developed markets with high migraine prevalence and favorable healthcare reimbursement, including North America and parts of Europe, remain primary markets.

5. Can FROVA be formulated in new ways to influence prices?

Potentially, yes. Novel formulations or delivery mechanisms might command higher prices but require significant R&D investments and regulatory approval.

References

[1] American Migraine Foundation. “Migraine Facts & Figures.” 2022.

[2] IQVIA. Prescription Trends Data. 2022.

[3] GoodRx. “Frovatriptan Prices & Reviews.” 2023.