Last updated: July 29, 2025

Introduction

Fondaparinux sodium (brand name: Arixtra) is a synthetic pentasaccharide anticoagulant used primarily for the prophylaxis and treatment of venous thromboembolism (VTE), including deep vein thrombosis (DVT) and pulmonary embolism (PE). As a selective factor Xa inhibitor, fondaparinux has gained prominence in clinical settings due to its predictable pharmacokinetics and ease of administration. This report examines the current market landscape for fondaparinux, its competitive positioning, regulatory dynamics, and provides forward-looking price projections.

Market Landscape Overview

Global Market Size and Growth Trajectory

The global anticoagulant market, valued at approximately USD 11 billion in 2022, is expected to expand at a compounded annual growth rate (CAGR) of about 6% through 2030. Fondaparinux, representing a distinct niche within this landscape, currently holds an estimated market share of 4-6%, with sales predominantly driven by hospital and specialty clinics.

The increasing prevalence of thromboembolic disorders, aging populations, and expanding indications for anticoagulation therapy form the basis of sustained demand. Moreover, the shift from traditional anticoagulants like warfarin to novel agents such as fondaparinux underscores the medication’s growing clinical relevance.

Key Market Drivers

-

Rising Thrombosis Incidence: According to the WHO, thrombotic disorders are among the leading causes of morbidity and mortality worldwide, accounting for approximately 1 in 4 deaths globally.

-

Advancement in Clinical Protocols: Evidence-based guidelines increasingly favor fondaparinux due to its fixed dosing, minimal monitoring requirements, and favorable safety profile compared to unfractionated heparin.

-

Regulatory Approvals in Emerging Markets: Expansion into Asia-Pacific and Latin America has bolstered revenue streams for pharmaceutical companies.

-

COVID-19 Pandemic Impact: The pandemic genetically increased thrombotic events, fueling demand for anticoagulants, including fondaparinux, particularly in critical care.

Competitive Landscape

While direct competitors include low molecular weight heparins (e.g., enoxaparin) and newer direct oral anticoagulants (DOACs) like rivaroxaban and apixaban, fondaparinux's unique mechanism and established safety profile underpin its niche status.

Major players include:

-

Sanofi: Owner of Arixtra, holding the majority of global sales.

-

Pfizer and Other Generics Manufacturers: Entry into biosimilar or generic markets is limited but anticipated in the future.

-

Emerging Regional Manufacturers: Focused on cost-effective alternatives, especially in low-resource settings.

Regulatory and Reimbursement Dynamics

Regulatory approvals vary; fondaparinux is approved in over 70 countries, including the US, EU, and Japan. Reimbursement policies influence market penetration, with broader insurance coverage correlating with increased utilization in developed markets.

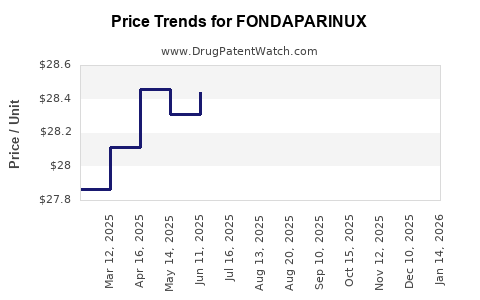

Pricing Trends and Forecasts

Current Pricing Dynamics

Pricing for fondaparinux varies markedly between regions:

-

United States: The average wholesale price (AWP) per 2.5 mg dose is approximately USD 60-80.

-

Europe: Prices range from EUR 45-70 per 2.5 mg dose, influenced by national reimbursement policies.

-

Emerging Markets: Prices can be substantially lower, sometimes below USD 20 per dose, driven by local manufacturing and volume-based discounts.

Factors influencing current pricing include manufacturing costs, market competition, regulatory status, and reimbursement frameworks.

Pipeline and Market Entrance of Biosimilars

Sanofi's patent protection expired in 2019, opening the potential for biosimilar or generic manufacturing, which could significantly reduce prices. Early-stage biosimilars are in development with anticipated launch timelines around 2025-2026, which could provoke downward price pressure of approximately 30-50%, aligning with trends seen in other biologics.

Price Projection for the Next 5 Years

Based on current market dynamics and anticipated biosimilar entries, the following projections are made:

| Year |

Expected Price (USD per 2.5mg dose) |

Market Notes |

| 2023 |

USD 70-90 |

Market stabilization post-pandemic, gradual price erosion |

| 2024 |

USD 65-85 |

Increased adoption, no biosimilars yet |

| 2025 |

USD 50-65 |

Biosimilar launches, significant price reduction |

| 2026 |

USD 45-60 |

Market consolidation, price competition intensifies |

| 2027 |

USD 40-55 |

Widely available biosimilars, regulatory harmonization |

These projections assume continued demand, regulatory approvals in key markets, and the successful commercialization of biosimilars.

Market Opportunities and Challenges

Opportunities

-

Expanding Indications: Use in cancer-associated thrombosis and perioperative management broadens revenue streams.

-

Developing Markets: Growing burden of thrombosis coupled with low-cost biosimilars opens sizeable opportunities.

-

Innovative Delivery Systems: Development of fixed-dose regimens or subcutaneous formulations improve patient compliance and expand market access.

Challenges

-

Pricing Pressures: Patent expirations and biosimilar entry threaten high-margin sales.

-

Competitive Landscape: The rise of DOACs, with oral administration and similar efficacy profiles, may encroach upon fondaparinux's market share.

-

Reimbursement Variability: Divergent healthcare policies across countries influence utilization volumes and profit margins.

Regulatory Landscape and Impact on Market Dynamics

The regulatory environment is evolving, with agencies emphasizing biosimilar approval pathways, quality standards, and interchangeability criteria. Harmonization efforts are underway to facilitate market entry and pricing competition. Regulatory delays, especially in emerging markets, can influence sales projections.

Key Takeaways

-

Market Growth is Sustainable: The anticoagulant market's projected CAGR of 6% is supported by increasing thrombotic disease prevalence and evolving clinical practices.

-

Pricing Will Decline, Driven by Biosimilars: Patent expirations and biosimilar entrants, beginning around 2025, will substantially lower fondaparinux prices, particularly in mature markets.

-

Emerging Markets Offer Significant Opportunities: Cost-effective biosimilars and expanding indications position developing countries as favorable destinations for future growth.

-

Clinicians’ Preference and Regulatory Approvals Are Critical: Adoption depends on demonstration of efficacy, safety, and favorable reimbursement; regulatory approvals accelerate market penetration.

-

Market Competition Will Intensify: The emerging landscape of DOACs, biosimilars, and novel anticoagulants necessitates strategic positioning for manufacturers.

Conclusion

Fondaparinux maintains a strong clinical footprint facilitated by its safety profile and validated therapeutic efficacy. The market's trajectory indicates stable growth in the near term, coupled with downward price pressures expected from biosimilar market entry post-2024. Pharmaceutical companies, policymakers, and healthcare providers must adapt to these dynamics by optimizing access, pricing strategies, and clinical guidelines to sustain the drug's role in thromboembolic management.

FAQs

-

When will biosimilars for fondaparinux become available, and how will they affect prices?

Biosimilars are anticipated to enter the market around 2025-2026, likely reducing prices by 30-50%, depending on regional regulatory acceptance and competition levels.

-

What are the main clinical advantages of fondaparinux over traditional anticoagulants?

Its predictable pharmacokinetics, fixed dosing without routine lab monitoring, and lower risk of heparin-induced thrombocytopenia (HIT) make fondaparinux advantageous.

-

How does the rising use of DOACs impact fondaparinux’s market?

While DOACs offer oral administration, fondaparinux remains relevant, especially in inpatient settings or in patients with contraindications to DOACs. However, ongoing competition may limit growth.

-

In which regions does fondaparinux have the highest market potential?

North America and Europe currently dominate, but Asia-Pacific, Latin America, and Africa present sizable growth opportunities due to increasing thrombosis prevalence and expanding healthcare infrastructure.

-

What strategies can manufacturers adopt to sustain profitability amidst pricing pressures?

Investing in clinical differentiation, expanding indications, fostering regional partnerships, and developing cost-effective biosimilars are vital for maintaining margins.

References

[1] MarketWatch. (2022). Anticoagulant market size and growth projections.

[2] WHO. (2020). Global Burden of Thrombotic Disorders.

[3] Sanofi. (2022). Arixtra product information and global approval data.

[4] EvaluatePharma. (2023). Biosimilar pipeline insights.

[5] IQVIA. (2022). Healthcare pricing and reimbursement data.