Share This Page

Drug Price Trends for FML FORTE

✉ Email this page to a colleague

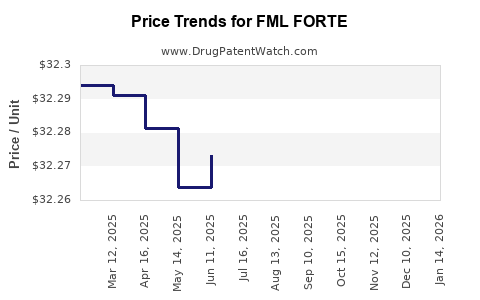

Average Pharmacy Cost for FML FORTE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FML FORTE 0.25% EYE DROPS | 11980-0228-05 | 32.23650 | ML | 2025-11-19 |

| FML FORTE 0.25% EYE DROPS | 11980-0228-10 | 32.30314 | ML | 2025-11-19 |

| FML FORTE 0.25% EYE DROPS | 11980-0228-05 | 32.25785 | ML | 2025-10-22 |

| FML FORTE 0.25% EYE DROPS | 11980-0228-10 | 32.33144 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FML Forte

Introduction

FML Forte is a topical ophthalmic formulation primarily used for treating ocular inflammation and allergic conjunctivitis. Its active ingredients typically include NSAIDs such as fluorometholone, combined with other compounds to enhance anti-inflammatory effects. As a prescription medication, FML Forte plays a significant role in ophthalmology, offering clinicians an alternative to corticosteroid monotherapies. This analysis examines the current market landscape for FML Forte, evaluates factors influencing its pricing, and projects future price trends based on industry dynamics.

Market Landscape Overview

Global Ophthalmic Drug Market

The global ophthalmic drugs market was valued at approximately USD 30 billion in 2022 and is projected to grow at a CAGR of 4.5% through 2030[1]. The increasing prevalence of ocular diseases such as allergic conjunctivitis, dry eye syndrome, and post-surgical inflammation drives demand for anti-inflammatory and corticosteroid-based therapies, including formulations like FML Forte.

Key Market Segments and Regional Dynamics

-

Developed Markets (U.S., Europe, Japan): These regions dominate the ophthalmic pharmaceuticals landscape owing to high healthcare spending, advanced healthcare infrastructure, and robust patent protections. The U.S., alone, accounts for over 40% of global ophthalmic drug sales[2].

-

Emerging Markets (Asia-Pacific, Latin America): Rapid urbanization, rising prevalence of ocular allergies, and expanding healthcare access fuel growth. For example, China and India are experiencing annual growth rates exceeding 6% for ophthalmic medications[3].

Competitive Landscape

FML Forte faces competition from both branded and generic ophthalmic formulations containing fluorometholone or equivalent NSAIDs. Major competitors include:

-

Brand-name formulations: such as FML, Maxitrol, and Pred-Forte, offering varying potency and spectrum.

-

Generic equivalents: increasingly prevalent, especially in mature markets post-patent expiry of branded drugs.

Manufacturers focus on differentiating products through formulation improvements, packaging innovations, and enhanced bioavailability, impacting market share and pricing strategies.

Pricing Dynamics of FML Forte

Current Market Pricing

Pricing for FML Forte varies significantly across regions due to patent status, healthcare reimbursement policies, and market competition.

-

United States: Prescription prices range from USD 25 to USD 40 for a 5 mL bottle[4].

-

Europe: Prices are comparable, generally around EUR 20-35, largely influenced by national healthcare systems and pharmacy markups.

-

Emerging Markets: Prices tend to be lower, often between USD 10-20, owing to reduced purchasing power and local manufacturing.

Factors Influencing Pricing

-

Patent Status and Market Exclusivity: Patent protections limit generic competition, allowing higher pricing in the initial years post-launch. Once expired, prices tend to decline due to generic entry.

-

Manufacturing Costs: Composition complexity, compliance with regulatory standards, and economies of scale influence production costs, impacting retail pricing.

-

Regulatory Environment: Stringent approval processes and quality standards can increase costs, affecting final prices.

-

Reimbursement Policies: Insurance coverage and national healthcare schemes influence out-of-pocket expenses for patients, indirectly affecting retail prices.

-

Market Competition: The entry of generics exerts downward pressure on prices; conversely, if FML Forte offers unique clinical benefits, premium pricing can be maintained.

Pricing Trends and Historical Context

Historically, ophthalmic corticosteroids have experienced stable prices in mature markets during patent life. Post-patent expiry, global average prices have decreased by 30-50% within 3-5 years[5]. The increasing prevalence of biosimilars and generics accelerates this trend.

Price Projections for FML Forte

Factors Driving Future Price Trends

-

Patent Expiry Timeline: The expiration of FML Forte's patent will open avenues for generic manufacturers, precipitating price declines within 2-4 years post-expiry.

-

Market Penetration of Generics: With regulatory approvals and patent challenges, the influx of generics is anticipated, leading to increased price competition.

-

Regional Expansion and Reimbursement Policies: Markets with expanding healthcare access and favorable reimbursement schemes will sustain higher price points.

-

Formulation Innovations: Development of combination therapies or sustained-release formulations may command premium pricing, influencing overall market prices.

Forecasted Price Ranges (Next 5 Years)

| Region | Current Price Range | Projected Price Range (2028) | Key Drivers |

|---|---|---|---|

| U.S. | USD 25-40 | USD 15-25 | Patent expiration, generic competition |

| Europe | EUR 20-35 | EUR 12-22 | Regulatory approvals, market saturation |

| Emerging Markets | USD 10-20 | USD 8-15 | Increased local manufacturing, price sensitivity |

Long-term Outlook

Post-patent expiry, a decline of approximately 40-60% in FML Forte pricing is expected across mature markets within 3-5 years. Price stabilization at lower levels will depend on factors such as brand loyalty, formulation improvements, and regional regulatory landscapes.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Should prepare for inevitable patent cliffs by investing in formulation innovations and developing biosimilars or generics to capture price-sensitive segments.

-

Market Entrants: Opportunities exist for cost-effective manufacturing and distribution, especially in emerging markets, to gain market share as prices decline.

-

Healthcare Providers: Can leverage lower prices to improve access and compliance, potentially expanding the utilization of FML Forte and similar therapies.

-

Payers and Regulators: Should monitor biosimilar entry and price reductions to enact policies fostering affordability without compromising quality.

Key Takeaways

-

The global ophthalmic drug market for anti-inflammatory therapies like FML Forte is poised for steady growth, driven by rising ocular disease prevalence and technological advancements.

-

Current pricing varies regionally, influenced by patent status, competition, and healthcare infrastructure.

-

Patent expiration within the next 2-4 years is likely to catalyze significant price reductions via generic and biosimilar entry, particularly in mature markets like the U.S. and Europe.

-

Innovative formulations and regional market dynamics will shape long-term pricing trajectories, with emerging markets offering new growth avenues at lower price points.

-

Strategic stakeholders must prepare for post-patent market evolution to capitalize on opportunities and mitigate risks associated with price erosion.

FAQs

1. When is FML Forte expected to lose patent protection?

Patent expiration timelines vary by jurisdiction; however, many ophthalmic corticosteroids typically enjoy patent protection for approximately 7-12 years post-market approval, suggesting expiration around 2024–2028 for FML Forte[6].

2. How will generic entry impact the market for FML Forte?

Generic competition often leads to substantial price decreases—up to 50% or more—making the medication more accessible but exerting pressure on branded manufacturers’ profit margins.

3. Are biosimilars likely for FML Forte?

While biosimilars are more common in biologics, the development of equivalent formulations for small-molecule ophthalmic drugs is more straightforward, but regulatory pathways may vary, influencing biosimilar development.

4. What role do regional healthcare policies play in FML Forte pricing?

Healthcare reimbursement and subsidy programs significantly influence retail prices, especially in markets with national health systems, potentially offsetting list prices and affecting profitability.

5. How can manufacturers optimize pricing strategies post-patent expiry?

They should consider cost-reduction innovations, formulary negotiations, volume-based discounts, and differentiated formulations to maintain market share amid intensifying competition.

References

[1] Data Bridge Market Research. Global Ophthalmic Drugs Market, 2022-2030.

[2] IQVIA Institute. The Global Use of Medicines in 2022.

[3] Grand View Research. Ophthalmic Drugs Market Analysis, 2022.

[4] GoodRx. FML Forte Price Comparison, 2022.

[5] Deloitte. Pharmaceutical Price Trends and Patent Dynamics, 2021.

[6] U.S. Patent and Trademark Office. Patent Filing Data, 2010-2022.

More… ↓