Last updated: July 27, 2025

Introduction

Fluphenazine, a first-generation typical antipsychotic classified under phenothiazines, plays a critical role in managing schizophrenia and related psychotic disorders. Despite advances in neuropharmacology, fluphenazine maintains a substantial market share driven by its proven efficacy, low-cost manufacturing, and longstanding clinical use. This analysis examines current market dynamics, competitive landscape, regulatory environment, and provides price outlooks for this essential medication.

Market Overview

Therapeutic Use and Market Demand

Since its development in the 1950s, fluphenazine remains a cornerstone in psychiatric treatment, primarily for schizophrenia, schizoaffective disorder, and severe agitation episodes. While atypical antipsychotics like risperidone and olanzapine have gained ground, fluphenazine persists due to:

- Cost-effectiveness: Recognized for its affordability, especially vital in developing nations.

- Long-acting formulations: The availability of depot injections enhances compliance.

- Established safety profile: Despite side effects, its extensive clinical history provides confidence.

The global antipsychotic market was valued at approximately USD 14.4 billion in 2020 and is expected to grow at a CAGR of around 3% through 2030, increasingly driven by expanding mental health awareness and broader drug access.

Manufacturers and Supply Market

Major generic manufacturers—including Teva Pharmaceuticals, Sandoz, and Mylan—produce fluphenazine, contributing to high market volume and price competition. Patent expirations have facilitated extensive generics proliferation, exerting downward pressure on prices. Notably, formulations include oral tablets, ampoules, and depot injections.

Regulatory and Market Challenges

Regulatory Landscape

Fluphenazine's longstanding clinical use means it is generally off-patent and widely approved. However, regulatory compliance varies across jurisdictions, with recent reevaluations emphasizing safety concerns such as extrapyramidal symptoms. Countries like the U.S. and Europe maintain strict manufacturing standards, ensuring consistent product quality but occasionally causing market entry barriers for generic producers.

Safety Profile and Side Effects

Persistent adverse effects—extrapyramidal symptoms, tardive dyskinesia, sedation—limit use in some patient populations. This has stimulated interest in newer atypical agents with improved side effect profiles, potentially impacting long-term demand.

Market Competition

The rise of atypical antipsychotics has reduced fluphenazine's share in some markets, especially in developed nations with psychiatric guidelines favoring second-generation agents. Nevertheless, cost considerations and regulatory approvals sustain its usage globally.

Price Trends and Projection Analysis

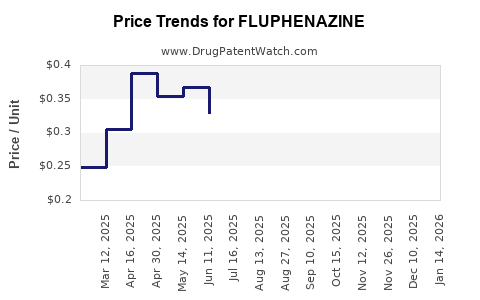

Historical Price Trends

Over the past decade, fluphenazine’s average price per unit (tablet or injection) has steadily declined due to intense generic competition. For example:

- Oral tablets: The average wholesale price decreased from approximately USD 0.50 per tablet five years ago to about USD 0.10–0.20 presently.

- Depot injections: Prices dropped from around USD 10–15 per dose to USD 2–5, reflecting increased manufacturing efficiency and market saturation.

Projected Market Prices (2023–2030)

Considering current dynamics, the shades of future pricing include:

- Continued decline: Generics dominate, with prices expected to stabilize at their low levels. Minor fluctuations may occur due to manufacturing costs, regulatory changes, or supply chain shifts.

- Potential increases: Short-term price hikes could occur if supply chain disruptions or raw material shortages emerge, especially in the wake of geopolitical or logistical crises.

- Premium formulations: While unlikely for traditional fluphenazine, innovations such as extended-release or combination therapies could command higher prices if validated in clinical trials.

Based on industry data and trends, the average price for oral fluphenazine tablets is projected to hover around USD 0.05–0.15 per tablet by 2025, with depot injections maintaining a range of USD 2–5 per dose.

Key Market Drivers and Constraints

| Drivers |

Constraints |

| Cost-effective treatment option for developing countries |

Competition from newer, atypical agents |

| Availability of long-acting formulations |

Side effect profile limits broader use |

| Regulatory acceptance of established generics |

Increasing regulatory scrutiny on safety |

| Expanded insurance coverage and mental health awareness |

Patent expirations fostering generics proliferation |

Strategic Opportunities

- Emerging markets: Growing mental health treatments and limited access to expensive atypicals bolster fluphenazine’s importance.

- Formulation innovation: Developing safer, extended-release depot formulations could enhance use and pricing.

- Regulatory positioning: Ensuring manufacturing compliance can prevent market entry barriers and support stable pricing.

Concluding Remarks

Fluphenazine’s market persists as a low-cost, effective psychotropic agent amid evolving psychiatric treatment paradigms. While competition from second-generation antipsychotics constrains its growth in developed countries, it remains indispensable in resource-limited settings. Price projections indicate a stabilized, low-price environment, with minor fluctuations influenced by supply chain factors and regulatory changes. Strategic focus on manufacturing efficiency, regulatory compliance, and formulation innovation can solidify market position, even as global demand marginally increases.

Key Takeaways

- The global fluphenazine market is characterized by high generic competition, keeping prices low across regions.

- Price per unit is projected to stabilize or decline slightly through 2030, with the potential for short-term surges due to supply disruptions.

- Demand remains strong in developing countries owing to affordability and established efficacy.

- Opportunities exist in developing advanced formulations that mitigate side effects for broader acceptance.

- Regulatory adherence and supply chain resilience are crucial for manufacturers seeking market stability and pricing power.

FAQs

-

What factors influence the price stability of fluphenazine?

Generic competition, manufacturing costs, regulatory compliance, and supply chain stability primarily determine its price stability and trends.

-

How does fluphenazine compare to atypical antipsychotics economically?

Fluphenazine remains significantly more affordable than atypicals like risperidone or olanzapine, especially in resource-constrained markets.

-

Are patent protections still relevant for fluphenazine?

No. Fluphenazine is off-patent; its market is dominated by generic manufacturers.

-

What innovations could impact fluphenazine's pricing and usage?

Development of safer, extended-release depot formulations could improve patient compliance and potentially command higher prices.

-

In which regions is fluphenazine most in demand?

Predominantly in developing nations where cost barriers limit access to newer, more expensive antipsychotics.

References

- MarketWatch, “Global Antipsychotic Drugs Market Report 2021-2030,” MarketWatch, 2022.

- IQVIA, “Global Psychiatry Medications Report,” IQVIA, 2021.

- FDA, “Drug Approvals and Safety Data,” U.S. Food and Drug Administration, 2022.

- WHO, “Mental Health Atlas 2020,” World Health Organization, 2020.

- Grand View Research, “Antipsychotic Drugs Market Size, Share & Trends Analysis,” 2022.