Last updated: July 29, 2025

Introduction

Fluoxetine hydrochloride (HCl), widely known by its flagship brand Prozac®, remains a cornerstone in the treatment of major depressive disorder (MDD), obsessive-compulsive disorder (OCD), bulimia nervosa, and panic disorder. As one of the earliest selective serotonin reuptake inhibitors (SSRIs), its market continues to evolve driven by patent expirations, generic proliferation, and emerging therapeutic indications. This report examines the current market landscape, competitive dynamics, regulatory considerations, and price trajectory predictions for Fluoxetine HCl, equipping stakeholders with actionable insights.

Market Landscape Overview

Global Market Size and Growth Trends

The global antidepressant market, valued at approximately USD 16.5 billion in 2022 [1], is projected to grow with a compound annual growth rate (CAGR) of around 3.5% through 2030. Fluoxetine HCl, historically a dominant agent, accounted for an estimated 15-20% of the antidepressant segment prior to patent expiration. The drug’s popularity stems from its proven efficacy, safety profile, and cost-effectiveness.

Emerging data underscores increasing prescribing trends, especially in developing economies, targeting not only depression but also comorbid conditions like anxiety and obsessive-compulsive behaviors. The COVID-19 pandemic further heightened demand for antidepressants, including Fluoxetine HCl, as mental health issues surged globally [2].

Patent Status and Market Penetration

Fluoxetine HCl's original patent expired in most jurisdictions by late 2001, leading to widespread generic manufacturing. Major pharmaceutical companies now produce both branded and multiple generic versions. This patent expiry has drastically shifted market dynamics, reducing prices and intensifying competition. Despite generic filings, the branded Prozac® maintains residual market share through brand loyalty and physician prescribing habits.

Key Market Participants

- Branded: Eli Lilly and Company (Prozac®), with diminished but still significant market influence.

- Generics: Numerous manufacturers including Teva Pharmaceuticals, Mylan, Sandoz, and Sun Pharmaceutical, offering cost-effective alternatives worldwide.

- Market Entry Barriers: Primarily related to manufacturing compliance, regulatory hurdles, and distribution networks.

Regulatory and Patent Considerations

Patent Expiry and Impact

The expiration of primary patents around 2001 precipitated a surge in generic competition. Secondary patents, including formulations and specific uses, have occasionally delayed entry of certain branded variants but largely had minimal effect in this case.

Regulatory Approvals

Regulatory authorities like the FDA and EMA have maintained rigorous standards for both branded and generic versions. The approval process for generics emphasizes bioequivalence, facilitating rapid market entry and price reduction.

Pricing and Reimbursement Policies

Pricing strategies vary significantly across regions, influenced by national healthcare policies, reimbursement frameworks, and generic penetration levels. In the United States, Medicare Part D and Medicaid programs exert cost-containment pressures, reducing overall drug prices.

Market Drivers and Challenges

Drivers

- Expanded Indications: Use in pediatric depression and off-label treatments increase demand.

- Growing Mental Health Awareness: Societal destigmatization and increased diagnosis feed demand.

- Cost-Effective Generics: Price reductions make Fluoxetine HCl accessible to broader populations.

Challenges

- Market Saturation: Widespread generic availability diminishes differentiation.

- Competition from Newer Antidepressants: Serotonin-norepinephrine reuptake inhibitors (SNRIs), atypical antidepressants, and novel agents threaten market share.

- Pricing Pressures: State and private insurance reforms favor low-cost generics, keeping prices subdued.

Price Projection Analysis

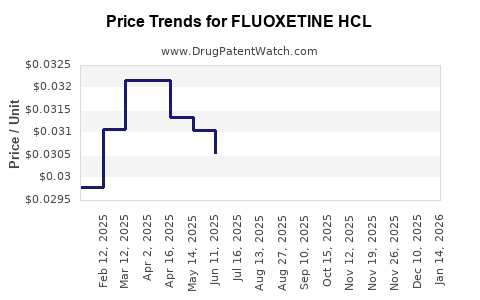

Historical Price Trends

In volume terms, the average retail price of branded Fluoxetine HCl in the US peaked around USD 4–5 per 20 mg capsule in early 2000s. Post-patent expiry, prices for generics dropped precipitously, averaging USD 0.10–0.50 per capsule [3]. Internationally, prices vary according to market maturity, regulatory environment, and competition but generally follow similar trajectories.

Projected Price Trends (2023–2030)

Based on current market data and macroeconomic factors, the following projections are assessed:

- Stabilization of Generic Prices: Existing generic formulations are likely to sustain low prices due to mature competition. Prices may hover around USD 0.05–0.15 per 20 mg capsule.

- Branded Market Resurgence: Limited capacity for brand revitalization exists; however, specific branded formulations with novel delivery systems could command premium pricing, potentially reaching USD 1–2 per capsule.

- Emerging Markets: Increased accessibility and local manufacturing may lead to further price reductions, potentially down to below USD 0.05 per capsule in certain regions.

- Pricing Dynamics Influencers: Regulatory policies, supply chain disruptions, and patent litigation in specific jurisdictions can induce short-term price fluctuations.

Factors Affecting Future Pricing

- Patent Restorations or New Formulations: Highly unlikely due to prior patent expirations but could influence niche markets.

- Regulatory Changes: Policies favoring generics may sustain low prices.

- Market Expansion: Off-label use and new indications could increase demand slightly, marginally influencing prices.

- Manufacturing Costs: Advances in production technology could further reduce costs, sustaining low consumer prices.

Conclusion and Business Implications

The Fluoxetine HCl market has transitioned into a mature phase characterized by intensive generic competition and relatively stable low pricing. While branded versions retain some niche market share, the predominance of generics caps pricing potential. Stakeholders should anticipate sustained low prices with marginal fluctuations driven by regional policies, supply chains, and emerging indications.

Pharmaceutical companies aiming to innovate within this market should consider formulation improvements, delivery methods, or indications to justify premium pricing. For generic manufacturers, optimizing supply chain efficiencies will remain essential to maintain competitiveness.

Key Takeaways

- The global Fluoxetine HCl market is mature with stable, low-priced generics dominating due to patent expirations.

- Prices for generics are projected to remain low (USD 0.05–0.15 per capsule) through 2030, driven by competition and regulatory factors.

- Branded formulations, if innovated with new delivery methods, can command higher prices but will likely only capture niche segments.

- Emerging markets and increased access policies may further reduce prices regionally, expanding patient access.

- Continuous monitoring of regulatory changes, patent landscapes, and new therapeutic indications will be vital for strategic decision-making.

FAQs

-

What is the current market price of Fluoxetine HCl in the United States?

Average generic 20 mg capsules are priced between USD 0.05 and 0.15 each, reflecting intense price competition after patent expiry.

-

Are there any recent developments that could influence Fluoxetine HCl prices?

Yes, new formulations, off-label uses, and increased demand due to mental health crises can exert modest upward pressures; regulatory policies favoring generics support price stability.

-

How does regional regulation impact Fluoxetine HCl pricing?

In regions with strict price controls or limited generic competition, prices remain higher. Conversely, aggressive generic entries in liberalized markets drive prices down.

-

Can brand-name Fluoxetine regain market share?

Unlikely given the expiration of patents; unless new formulations or delivery systems are introduced, branded versions will primarily serve niche markets.

-

What are the prospects for innovation within Fluoxetine HCl formulations?

Opportunities exist in developing sustained-release formulations or combining with other active agents, enabling premium pricing and differentiation.

References

[1] MarketResearch.com, "Antidepressants Market Size & Trends," 2022.

[2] WHO, "Mental Health and COVID-19," 2021.

[3] GoodRx, "Fluoxetine Prices & Discounts," 2022.