Last updated: July 27, 2025

Introduction

Fluconazole, a triazole antifungal agent, is widely prescribed for the treatment of fungal infections, including oropharyngeal candidiasis, esophageal candidiasis, systemic candidiasis, and cryptococcal meningitis. Its broad spectrum of activity, established safety profile, and oral bioavailability make it a cornerstone in antifungal therapy. The global market for fluconazole is influenced by factors such as rising fungal infection incidence, increased antifungal resistance, healthcare expenditure, and generic drug penetration. This report provides a comprehensive market analysis accompanied by price projections, offering insights essential for pharmaceutical companies, investors, and healthcare stakeholders.

Market Overview

Global Market Size and Trends

The global antifungal drugs market, valued at approximately USD 13 billion in 2022, is projected to grow at a CAGR of 4-6% over the next five years, driven primarily by fluconazole’s dominance, especially in developing economies [1]. Fluconazole accounts for a substantial share of this market, with estimates indicating a market share exceeding 45% among systemic antifungals.

Key Drivers

- Rising Burden of Fungal Infections: An aging population and increasing immunocompromised cases (e.g., HIV/AIDS, cancer, organ transplants) are driving demand for effective antifungal treatments [2].

- Expanding Healthcare Access: Growing healthcare infrastructure, particularly in Asia-Pacific and Latin America, bolsters the use of affordable antifungal agents like fluconazole.

- Generic Market Penetration: Patent expirations of branded formulations, notably Pfizer’s Diflucan, have facilitated broad availability and reduced prices.

- COVID-19 Impact: The pandemic highlighted fungal co-infections, thereby elevating antifungal drug utilization.

Geographic Market Dynamics

- North America: The largest market, driven by high healthcare expenditure and sophisticated diagnostics.

- Europe: Stable growth, with emphasis on antifungal resistance monitoring.

- Asia-Pacific: The fastest-growing segment, propelled by increasing fungal infection prevalence and expanding healthcare access.

- Latin America & Middle East/Africa: Emerging markets with increased adoption of generic fluconazole.

Competitive Landscape

Major Players

- Pfizer Inc. (brand: Diflucan) — historically leading supplier, now primarily generic.

- Sandoz (Novartis) — significant generic manufacturer.

- Mylan (now part of Viatris) — extensive global distribution.

- Sun Pharmaceuticals and other regional manufacturers — expanding presence globally.

Market Entry & Patent Landscape

Pfizer’s Diflucan held patent protection until 2014, after which generics flooded the market. The price competition among generics has been vital in reducing costs and increasing accessibility, especially in low- and middle-income countries (LMICs).

Price Analysis and Projections

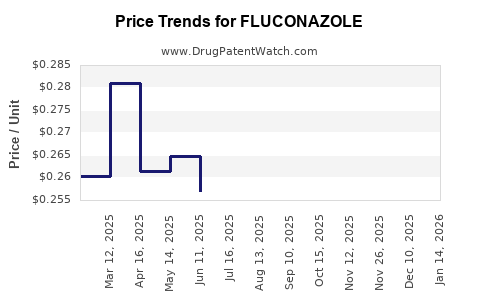

Historical Price Trends

- Brand-name Fluconazole (Diflucan): Historically priced between USD 10-20 per 150 mg tablet in developed markets.

- Generic Fluconazole: Prices decreased significantly post-patent expiration, with a typical 150 mg tablet costing USD 0.50-2.00 in LMICs.

- Wholesale and Retail Pricing: Variations exist based on distribution channels, regulatory environments, and healthcare policies.

Current Market Pricing

- Developed Markets: Average retail prices for branded fluconazole tablets range from USD 15-20, with generics sold for USD 0.50-2 per tablet.

- Emerging Markets: Prices are often subsidized or sold at lower margins, around USD 0.20-1 per dose.

Future Price Projections (2023-2028)

Factors influencing price trajectories include manufacturing costs, competition intensity, regulatory changes, and supply chain stability.

- Price Stabilization in Developed Countries: Expected to remain relatively stable due to established supply chains and low generic prices, with projected prices averaging USD 0.80-1.20 per 150 mg tablet.

- Downward Price Pressure in LMICs: Continued expansion of generic manufacturing is likely to sustain low prices, potentially decreasing to USD 0.10-0.50 per tablet.

- Premium Pricing Opportunities: In specialty formulations, such as IV presentations or combination therapies, prices could temporarily increase but will be constrained by generic competition.

Impact of Biosimilars and Alternative Treatments

Biosimilars and emerging antifungal agents may further compress prices. Strategic diversification, such as formulation innovations (e.g., long-acting injectables) or combination drugs, could alter pricing structures.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Increasing healthcare access in Asia, Africa, and Latin America presents substantial growth potential.

- Developing Novel Formulations: Liposomal or sustained-release formulations could command premium pricing.

- Increased Diagnostic Adoption: Enhanced disease detection tools may foster tailored therapy and higher treatment volumes.

Challenges

- Antifungal Resistance: Rising resistance, particularly to azoles, necessitates investment in newer agents and may restrict fluconazole use.

- Pricing Pressures: Governments and insurers continue to push for lower drug costs, especially for generics.

- Regulatory Hurdles: Stringent approval processes in developed markets can delay new formulations or indications.

Regulatory and Patent Outlook

- Patent Status: Most patents expired globally by 2014; ongoing patent filings offer opportunities for new formulations.

- Regulatory Approvals: Rapid approvals for generics and registrations in emerging markets further stimulate market volume.

Conclusion and Strategic Recommendations

The fluconazole market remains robust, buoyed by its cost-effectiveness and broad-spectrum antifungal activity. Price projections indicate continued affordability in primary markets, with slight increases in specialized formulations. Manufacturers should prioritize cost-efficient production, expand access through regional manufacturing, and innovate in formulation to maintain competitiveness.

Stakeholders should monitor antifungal resistance patterns and regulatory landscapes to adapt strategies. While challenges persist, the expanding global fungal infection landscape offers significant growth opportunities, particularly in underserved markets.

Key Takeaways

- The global fluconazole market is expected to sustain its demand driven by rising fungal infections, especially in LMICs.

- Generic drug proliferation has driven down prices, with projections indicating stability and potential further reductions in emerging markets.

- Opportunities exist in developing new formulations and expanding access, but resistance and pricing pressures pose ongoing challenges.

- Strategic investment in regional manufacturing and formulation innovation can secure market share amid intense competition.

- Monitoring regulatory developments and resistance trends is crucial for maintaining market relevance and pricing power.

FAQs

1. How has patent expiration affected fluconazole pricing?

Patent expiration around 2014 significantly increased generic competition, leading to substantial price reductions and wider accessibility worldwide.

2. What factors could impede future price reductions of fluconazole?

Growing antifungal resistance and the development of alternative therapies could limit the use of fluconazole, affecting supply and pricing dynamics.

3. Which regions present the most attractive growth prospects for fluconazole?

The Asia-Pacific region, driven by expanding healthcare access and increasing fungal infections, offers the most lucrative growth opportunities.

4. Are there any new formulations of fluconazole in development?

Yes, research into liposomal, IV, and combination formulations aims to improve efficacy and patient compliance, potentially commanding higher prices.

5. How do healthcare policies impact fluconazole market prices?

Government procurement strategies, reimbursement policies, and price controls, especially in public healthcare systems, significantly influence retail and wholesale prices.

References

[1] Market Research Future, "Global Antifungal Drugs Market," 2022.

[2] World Health Organization, "Fungal Infections: A Hidden Threat," 2021.