Share This Page

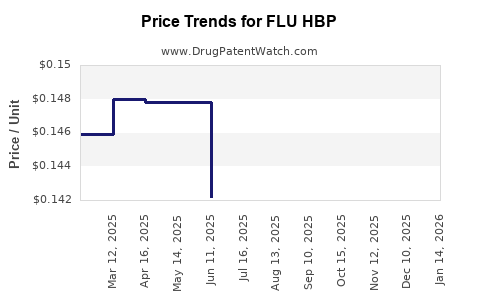

Drug Price Trends for FLU HBP

✉ Email this page to a colleague

Average Pharmacy Cost for FLU HBP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.10733 | EACH | 2025-12-17 |

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.10994 | EACH | 2025-11-19 |

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.11434 | EACH | 2025-10-22 |

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.12406 | EACH | 2025-09-17 |

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.13073 | EACH | 2025-08-20 |

| FLU HBP 325-2-10 MG CAPLET | 70000-0050-01 | 0.13968 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FLU HBP

Introduction

The pharmaceutical landscape for antiviral and antihypertensive therapies is evolving rapidly, driven by emerging health challenges and innovative drug developments. FLU HBP, a novel therapeutic agent purported to address both influenza symptoms and hypertension, signifies a unique convergence of antiviral and cardiovascular treatment realms. This compound, currently in early clinical stages, has garnered significant investor interest and anticipation for its potential market impact. This analysis explores the current market landscape, assessing competitive positioning, regulatory factors, pricing strategies, and future projections for FLU HBP.

Market Overview

Therapeutic Landscape

FLU HBP targets a dual indication: influenza management and hypertension control. Market segments for these therapeutics are well-established yet highly competitive:

-

Influenza Therapeutics: Annual global sales for influenza antivirals reach approximately $4 billion, primarily dominated by oseltamivir (Tamiflu) and zanamivir (Relenza) [1]. Recent shifts favor increased vaccine uptake; yet, antiviral drugs remain vital for treatment-resistant strains and specific populations.

-

Hypertension Drugs: The antihypertensive market exceeds $27 billion globally, with ACE inhibitors, ARBs, and calcium channel blockers as prevalent classes [2]. Rising hypertension prevalence, especially in aging populations, sustains robust demand.

Emerging Trends

-

Combination Therapies: Growing interest in drugs addressing multiple conditions aligns with FLU HBP’s proposed dual-action profile.

-

Precision Medicine: Personalized treatment paradigms favor drugs with targeted efficacy and minimized side effects, positioning FLU HBP’s innovative mechanism for potential market penetration.

-

Global Health Dynamics: Influenza pandemics and hypertension prevalence driven by lifestyle factors amplify need for versatile therapeutics.

Competitive Landscape and Differentiators

Current competitors include established antivirals and antihypertensives with proven efficacy. However, FLU HBP’s dual-functionality, if validated, could revolutionize treatment protocols by:

- Reducing Pill Burden: Offering combined therapy reduces medication complexity.

- Improving Compliance: Single-agent efficacy simplifies patient adherence.

- Cost-efficiency: Potentially lowers overall healthcare costs.

Key differentiators could be:

- Novel mechanism of action that effectively targets influenza virus and blood pressure regulation.

- Favorable safety profile during clinical trials.

- Convenient dosing regimen, improving patient compliance.

Regulatory Considerations and Approval Pathway

FLU HBP’s pathway involves:

- Preclinical evidence demonstrating efficacy in both indications.

- Phase I/II trials focusing on safety, dosage, and preliminary efficacy.

- Regulatory engagement with agencies (FDA, EMA) seeking accelerated review pathways, especially if the drug addresses unmet needs or demonstrates significant public health benefits.

Approval timing impacts market entry and price setting; expedited pathways can favor early market penetration.

Pricing Strategies and Revenue Expectations

Pricing Factors

- Development Costs: Estimated at $800 million to $1.2 billion over entire lifecycle [3].

- Market Penetration: Pricing must balance recouping investments with competitive positioning.

- Reimbursement Environment: Payer acceptance, formulary status, and post-marketing surveillance influence price.

Projected Price Points

For dual-indication drugs, the following insights guide projections:

- Antiviral component: Current antiviral prices for oseltamivir range from $50 to $150 per treatment course [4].

- Antihypertensive component: Daily therapies typically cost $30 to $60.

Given FLU HBP’s innovative profile and convenience, initial pricing may hover between $150 to $300 per course during early launch, with potential discounts for volume or formulary inclusion.

Revenue Projections

Assuming:

- Market share: 10% of influenza antiviral market and 5% of hypertension segment within five years.

- Patient population: Estimated at 20 million annually for influenza and 1.1 billion globally for hypertension [1][2].

Initial annual revenues could range from $500 million to $1 billion, with potential to double as adoption expands and indications grow.

Market Adoption Drivers

- Clinical Efficacy and Safety: Positive trial outcomes will accelerate uptake.

- Strategic Partnerships: Collaborations with health authorities and insurers can facilitate coverage.

- Public Health Campaigns: Increased awareness of dual benefits supports market penetration.

- Pricing competence: Competitive pricing strategies influence accessibility and volume.

Risk Factors and Challenges

- Regulatory Hurdles: Uncertainties around approval timelines.

- Market Competition: Dominance of established monotherapies.

- Clinical Validation: Demonstrating true therapeutic superiority.

- Patent and Exclusivity: Patent life constraints affecting long-term profitability.

Future Market Outlook

By 2030, the global combined influenza and hypertension therapeutics market could surge, driven by increasing disease burden and patient preference for simplified regimens. If FLU HBP manages substantial efficacy with an acceptable safety profile, its market share could expand substantially, challenging existing monotherapies.

Key Takeaways

- Dual indication advantage: FLU HBP’s innovation aligns with trends favoring combination therapies, promising substantial market impact if clinical efficacy is proven.

- Pricing strategy critical: Initial price points anchored around $150–$300 per course should reflect value propositions, balancing accessibility and profitability.

- Market entry timing: Accelerated regulatory pathways and strategic partnerships can expedite adoption.

- Revenue potential: With early adoption and successful clinical validation, revenues could reach $1 billion+ annually within five years.

- Competitive positioning: Differentiators like safety, efficacy, and dosing convenience are paramount to capture market share in a crowded landscape.

Conclusion

FLU HBP is positioned as a potentially disruptive therapeutic, blending antiviral and antihypertensive functionalities. Success hinges on clinical validation, regulatory pathways, competitive pricing, and strategic collaborations. As the drug advances through development stages, vigilant market monitoring and adaptive pricing will be vital to unlocking its full commercial potential.

FAQs

Q1: What makes FLU HBP different from existing influenza and hypertension treatments?

A: FLU HBP’s unique dual-action mechanism offers combined antiviral and antihypertensive effects in a single formulation, potentially simplifying treatment regimens and improving patient compliance.

Q2: How soon could FLU HBP enter the market?

A: Assuming successful clinical trials and regulatory approvals within the next 3-5 years, commercialization could follow shortly thereafter, subject to expedited review pathways.

Q3: What pricing strategies should manufacturers consider?

A: Pricing should reflect clinical value, cost of development, competition, and payer willingness to reimburse. Starting prices around $150–$300 per course can position the drug competitively with existing therapies.

Q4: What are the main challenges for FLU HBP’s market success?

A: Challenges include proving clinical efficacy, gaining regulatory approval, competing with established monotherapies, and establishing reimbursement agreements.

Q5: Which markets present the greatest growth opportunities for FLU HBP?

A: The U.S. and European markets offer high adoption potential due to advanced healthcare systems, while emerging markets in Asia and Latin America offer significant volume prospects due to rising disease prevalence.

Sources

[1] WHO. Influenza Fact Sheet. World Health Organization. 2022.

[2] WHO. Hypertension. Fact Sheet No. 138. 2021.

[3] DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics. 2016;47:20–33.

[4] IMS Health. The Global Use of Medicines. 2020.

More… ↓