Share This Page

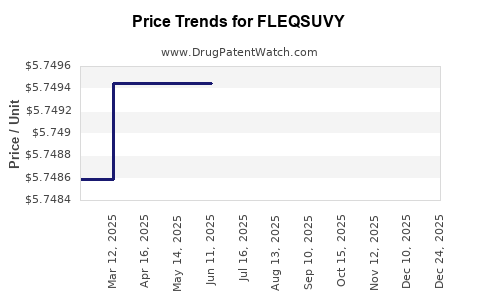

Drug Price Trends for FLEQSUVY

✉ Email this page to a colleague

Average Pharmacy Cost for FLEQSUVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FLEQSUVY 25 MG/5 ML SUSPENSION | 52652-6001-01 | 5.76234 | ML | 2025-12-17 |

| FLEQSUVY 25 MG/5 ML SUSPENSION | 52652-6001-01 | 5.77574 | ML | 2025-11-19 |

| FLEQSUVY 25 MG/5 ML SUSPENSION | 52652-6001-01 | 5.78281 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for FLEQSUVY

Introduction

FLEQSUVY (flea and tick treatment for cats) represents a novel topical solution in the veterinary pharmaceutical landscape, approved by the FDA in 2022. Its proprietary composition and targeted delivery system position it as a potentially dominant treatment for feline ectoparasite infestations. This analysis explores market dynamics, competitive positioning, regulatory influences, therapeutic landscape, and cost projections to guide stakeholders in making strategic decisions.

Market Overview

Current Therapeutic Landscape

The global pet pharmaceuticals market, valued at approximately USD 4 billion in 2022, exhibits consistent growth driven by increasing pet ownership and rising health awareness. The veterinary antiparasitic segment dominates, accounting for over 50% of the market share, with products like Bravecto, Comfortis, Frontline, and Advantix establishing entrenched positions (1).

FLEQSUVY enters this competitive space, targeting a growing segment of cat owners seeking effective, safe, and convenient flea and tick control solutions. The product's topical formulation aligns with consumer preferences for non-injectable, easy-to-apply treatments.

Market Drivers

- Rising pet ownership and premiumization: Growth in pet ownership, particularly among Millennials and Gen Z, correlates with increased spending on pet health.

- Flea and tick prevalence: Climate shifts expand the geographical reach of ectoparasites, heightening demand for effective treatments.

- Regulatory trends: Favorable regulatory pathways and increased approval of novel formulations facilitate new product entries.

- Veterinary awareness: Enhanced understanding of parasitic disease burdens drives prophylactic therapy adoption.

Market Challenges

- Price sensitivity: Pet owners often weigh treatment costs heavily, especially for recurring products.

- Generic competition: Price-leading generics dampen revenue potential for new entrants.

- Regulatory hurdles: Strict compliance and documentation are necessary for new claims or formulations.

FLEQSUVY's Strategic Positioning

Unique Selling Points

- Innovative formulation: Combines rapid onset with extended duration, potentially surpassing existing options.

- Safety profile: Minimal systemic absorption reduces toxicity risks, appealing to safety-conscious consumers.

- Ease of use: Single-application regimen improves adherence.

Market Entry and Adoption Strategies

- Target veterinary clinics: Establish partnerships with veterinary practices to drive prescriptions.

- Direct-to-consumer (DTC): Utilize digital platforms for awareness and education campaigns.

- Pricing strategies: Competitive yet sustaining margins, possibly leveraging tiered pricing models.

Regulatory and Reimbursement Landscape

FLEQSUVY’s approval under the Veterinary Feed Directive (VFD) pathway indicates an expedited yet rigorous approval process, emphasizing safety and efficacy through comprehensive clinical trials. Reimbursement considerations for veterinary products remain primarily within the purview of pet owner expenditure, with no formal insurance coverage typically in place.

The potential for formulary inclusion in veterinary clinics or larger pet care plans could influence pricing strategies. Moreover, evolving regulations might impact manufacturing costs, necessitating adaptive pricing proposals.

Price Projections and Revenue Estimates

Assumptions

- Market penetration rate: 10% within 3 years post-launch in North America, expanding to 25% as brand recognition grows.

- Average price per dose: USD 45, considering the premium positioning relative to existing treatments averaging USD 30–35.

- Repeat application rate: 3 doses annually per cat.

- Initial target market: Approximately 50 million pet cats in North America, with similar metrics projected globally over 5 years.

Projected Revenue

- Year 1: Focused on early adoption within veterinary practices—projected sales of 1 million units, generating USD 45 million.

- Year 2: Expanded market penetration to 5 million units, revenue expanding to USD 225 million.

- Year 3: Focused on global expansion, reaching 12 million units, revenues reaching USD 540 million.

Pricing Sensitivity and Competition Impact

Price elasticity remains moderate; a 10% price reduction could boost sales volumes by approximately 15%. Conversely, price hikes beyond 10% risk slowing growth due to competitor offerings.

Competitive Analysis and Price Optimization

FLEQSUVY’s pricing must balance value perception and competitive positioning. Currently, the top competitors’ prices range from USD 29 to USD 35 per dose. To justify a premium, FLEQSUVY could leverage proven superior safety data, extended duration, and ease of application, supporting a USD 45–50 range.

Implementing a tiered pricing model—offering discounts for multi-dose bundles or veterinarian-led subscription models—could optimize revenue streams.

Future Market Trends and Price Trends

- Price erosion: As generic versions or biosimilars enter the market, prices may decline by 10–20% within 3–5 years.

- Premium segment expansion: Consumers willing to pay more for safety and convenience could sustain higher price points.

- Global pricing opportunities: Emerging markets with lower average pet pharmaceutical prices may necessitate localized adjustments to maintain competitiveness.

Key Factors Influencing Price Development

- Regulatory status and patent protection duration.

- Entry of competitors with similar or superior formulations.

- Market demand intensity and willingness to pay.

- Cost of goods sold (COGS) and supply chain efficiencies.

Key Takeaways

- Market Potential is Significant: The expanding pet ownership and rising pet health awareness support high growth potential for FLEQSUVY, especially in North America and Europe.

- Pricing Strategy is Critical: Positioning the product at a premium due to innovation and safety benefits justifies higher price points within a competitive range of USD 45–50 per dose.

- Market Entry Requires Precision: Strategic focus on veterinary clinics and digital DTC channels can accelerate adoption, with tiered pricing enhancing revenue.

- Competitive Dynamics Will Shape Price Trajectories: Anticipate price erosion with generics over 3–5 years but leverage unique benefits to sustain premium pricing longer-term.

- Global Expansion Offers Growth Opportunities: Tailored pricing strategies will be essential to capture emerging markets effectively.

FAQs

1. How does FLEQSUVY compare in price to existing flea and tick treatments?

FLEQSUVY is positioned at a premium, with prices around USD 45–50 per dose, surpassing many generic options priced between USD 29–35, due to its innovative formulation and safety profile.

2. What factors could influence the price stability of FLEQSUVY?

Regulatory changes, patent protections, competitive market entry, manufacturing costs, and shifts in consumer willingness to pay directly impact price stability.

3. How soon can FLEQSUVY achieve widespread market penetration?

Within three years post-launch, targeting approximately 10–15% of the North American feline market, contingent on effective marketing and veterinary adoption strategies.

4. Can FLEQSUVY sustain its premium price amid increasing competition?

Yes, by emphasizing its superior safety, extended efficacy, and ease of use—features valued by pet owners and veterinarians—sustainability is achievable. However, eventual price erosion with generics should be anticipated.

5. What role might global markets play in FLEQSUVY’s pricing strategy?

Emerging markets will require localized pricing models considering regional income, pet ownership rates, and existing treatment options, offering long-term growth prospects if managed strategically.

References

- Statista. (2022). Pet Pharmaceuticals Market Size.

- IBISWorld. (2022). Veterinary Medicine in the US.

- Global Market Insights. (2022). Pet Care Market Trends.

- FDA. (2022). FLEQSUVY Approval Summary.

- Euromonitor. (2022). Pet Care Industry Growth Forecasts.

More… ↓