Last updated: July 27, 2025

Introduction

Finasteride, a 5-alpha-reductase inhibitor primarily indicated for benign prostatic hyperplasia (BPH) and androgenetic alopecia, has established a prominent position within the pharmaceutical landscape. Since its initial approval in the late 1990s, the drug’s market dynamics have evolved, driven by expanding indications, patent statuses, competitive landscape, and regulatory shifts. This analysis dissects current market trends, competitive forces, pricing strategies, and future projections to inform stakeholders on potential growth trajectories and investment considerations.

Market Overview

Current Market Size and Segments

The global finasteride market was valued at approximately USD 2.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.8% through 2028 [1]. The primary segments include:

- Benign Prostatic Hyperplasia (BPH): Accounts for about 55% of the market, driven by aging populations in North America and Europe.

- Androgenetic Alopecia: Comprises roughly 40% of the market, with growth fueled by increased awareness and cosmetic demand, especially in Asia-Pacific.

- Other Uses: Such as precocious puberty in boys and off-label indications, although these are minor in scale.

Geographical Dynamics

North America remains the dominant market, owing to high prevalence rates, established healthcare infrastructure, and favorable reimbursement policies. The Asia-Pacific region exhibits rapid growth potential driven by increasing urbanization, higher health awareness, and expanding healthcare access. Europe maintains a steady demand trajectory, with healthcare reforms influencing market growth.

Patent and Regulatory Landscape

Finasteride's patent exclusivity has historically protected brand-name formulations like Proscar (for BPH) and Propecia (for alopecia). Pfizer’s patent on Propecia expired in 2018, leading to an influx of generic formulations that significantly impacted prices and market penetration [2]. However, patent challenges and the approval of biosimilars or alternative treatments in some regions threaten future exclusivity, impacting pricing trends.

Competitive Landscape

Key Players

The market features several established pharmaceutical entities:

- Exact Market Leaders: Merck & Co. (Proscar, Propecia), Sun Pharmaceutical Industries, and Aurobindo Pharma.

- Emerging Competitors: Innovative formulations and combination therapies are being explored to capture market share.

Generic Competition

The advent of generics post-2018 has sharply reduced prices, increasing accessibility and volume sales. For instance, generic finasteride prices in the U.S. have declined by approximately 80% since patent expiry [3]. This trend continues to exert downward pressure on brand-name prices.

Innovations and New Entrants

Although current formulations face price erosion, R&D efforts focus on:

- Legal formulations with improved bioavailability.

- Combo therapies targeting alternative or adjunct indications.

- Topical formulations for alopecia, aiming to reduce systemic side effects.

These innovations could influence future pricing strategies and segment growth.

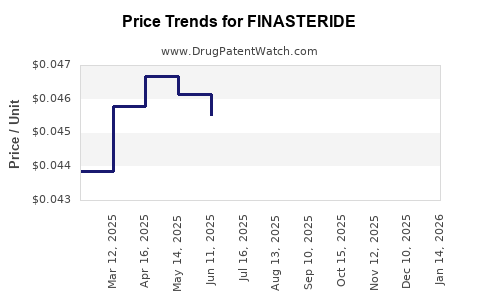

Pricing Trends and Factors Influencing Price Projections

Historical Pricing Trajectory

Brand-name finasteride has historically been priced at approximately USD 50–70 per month in the U.S., while generics are typically priced below USD 10–15 per month. The post-patent expiry era has precipitated a steep decline in prices, especially for lower-cost generics, enabling wider patient access.

Factors Impacting Future Prices

- Patent and Exclusivity Status: Ongoing patent protections or extensions could temporarily sustain higher prices.

- Market Penetration of Generics and Biosimilars: Universal acceptance of generics sustains low prices.

- Regulatory Environment: Stringent regulations and quality standards may influence pricing strategies.

- Manufacturing Costs: As production efficiencies improve, costs decline, further reducing prices.

- Demand Trends: Growth in diagnoses of BPH and alopecia, coupled with increased treatment adherence, could support moderate price stabilization in niche segments.

Projection Scenarios (2023–2028)

| Scenario |

Price Trend |

Key Assumptions |

| Optimistic (High Growth) |

Slight price stabilization or slight increase within niche segments |

Patent extensions, innovative formulations, increased adherence |

| Moderate (Most Likely) |

Continued decline in average prices, especially in generics |

Patent expiries, market saturation, regulatory pressures |

| Pessimistic (Low Growth) |

Accelerated price erosion due to increased competition |

Widespread biosimilars, rapid generic penetration, regulatory downward pressure |

Under the most probable scenario, generic prices in mature markets are projected to decline by approximately 10–15% annually. Brand-name prices, assuming patent protections or exclusivities, could stabilize but remain among the higher spectrum at USD 50–70/month for select formulations.

Future Market Drivers and Challenges

-

Drivers:

- Aging global populations increasing BPH prevalence.

- Increased awareness and diagnosis of androgenetic alopecia.

- Expansion into emerging markets with unmet demand.

- R&D innovations leading to novel delivery mechanisms.

-

Challenges:

- Price sensitivity driven by generic competition.

- Regulatory scrutiny on off-label uses and safety profiles.

- Competition from alternative treatments like dutasteride, minoxidil, or surgical interventions.

- Patent litigations impacting exclusivity duration.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on differentiation through formulation innovations to maintain margins amid declining prices.

- Investors: Consider market saturation and patent cliffs influencing revenue streams.

- Healthcare Providers: Favor low-cost generics enhancing treatment accessibility.

- Regulators: Balance between encouraging innovation and promoting affordable access.

Key Takeaways

- The finasteride market is mature, with a significant transition from brand to generic formulations, causing substantial price declines.

- Future growth hinges on demographic trends, innovation in delivery forms, and geographic expansion, particularly in Asia-Pacific.

- Pricing will predominantly trend downward due to high generic competition, with niche segments potentially maintaining higher prices through innovative formulations.

- Patent landscapes will critically shape short-term pricing stability, while biosimilar entry may accelerate price erosion.

- Strategic positioning requires balancing innovation, regulatory compliance, and cost-effective manufacturing to sustain profitability.

FAQs

1. What is the current price range for generic finasteride globally?

Generic finasteride typically retails at USD 10–15 per month in the U.S. and similar price points in other markets, representing a significant reduction compared to brand-name counterparts.

2. How does patent expiration influence finasteride pricing?

Patent expiration enables generic manufacturers to enter the market, intensifying competition and resulting in price drops of up to 80% or more, thereby increasing patient access and market volume.

3. Are there emerging therapies that threaten the finasteride market?

Yes. Alternatives like dutasteride, topical formulations, and novel non-hormonal treatments are expanding options for patients, potentially impacting finasteride’s market share.

4. What role will regional growth play in future finasteride markets?

Emerging markets in Asia and Latin America offer substantial growth opportunities due to increasing awareness, urbanization, and human capital expansion in healthcare infrastructure.

5. How might regulatory changes impact future prices?

Stricter safety assessments, off-label use restrictions, or approval of biosimilars could influence pricing, either by constraining market access or facilitating more competitive pricing through biosimilar proliferation.

References

[1] MarketWatch, "Global Finasteride Market Size, Share & Trends Analysis Report," 2022.

[2] FDA, "Patents and Exclusivities for Propecia (finasteride)," 2018.

[3] IQVIA, "Pharmaceutical Pricing and Market Trends," 2022.