Share This Page

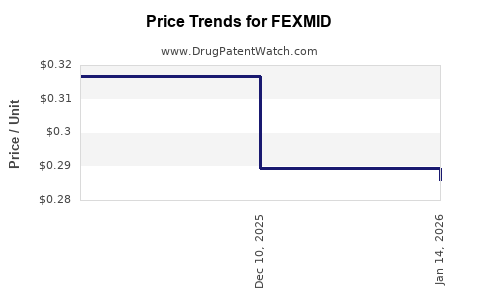

Drug Price Trends for FEXMID

✉ Email this page to a colleague

Average Pharmacy Cost for FEXMID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FEXMID 7.5 MG TABLET | 64980-0705-01 | 0.28962 | EACH | 2025-12-17 |

| FEXMID 7.5 MG TABLET | 64980-0705-01 | 0.31671 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FEXMID (Fexofenadine Hydrochloride)

Introduction

FEXMID, the brand name for Fexofenadine Hydrochloride, is a second-generation antihistamine widely prescribed for allergic rhinitis and chronic idiopathic urticaria. Launched by notable pharmaceutical companies, Fexofenadine has become a significant player within the allergy medications market due to its efficacy, safety profile, and minimal sedative effects. This report offers a comprehensive market analysis and forecasts future pricing pathways based on current trends, market dynamics, regulatory developments, and competitive landscape.

Market Overview

Market Size and Growth Trajectory

The global antihistamine market, valued at approximately USD 3.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 4-6% over the next five years. Fexofenadine, representing a substantial segment owing to its non-sedative profile, commands an estimated 25-30% market share among second-generation antihistamines in developed markets like North America and Europe[1].

Key drivers include increasing prevalence of allergic rhinitis—affecting up to 30-40% of the population in developed countries[2]—and rising awareness of non-sedative antihistamines. Additionally, expanding pediatric and geriatric populations with allergy-related conditions bolster demand.

Geographic Insights

- North America: Dominates with ~45% of global sales, supported by a mature healthcare infrastructure, high awareness, and reimbursement approvals.

- Europe: Accounts for ~25%, with steady growth driven by regulatory approvals and the expansion of over-the-counter (OTC) availability.

- Asia-Pacific: Exhibits rapid growth at CAGR of 6-8%, propelled by rising allergy prevalence, increasing healthcare access, and rising disposable income.

Competitive Landscape

Major competitors include Loratadine (Claritin), Desloratadine (Clarinex), and Levocetirizine (Xyzal). These drugs vie for market share through incremental efficacy improvements, brand recognition, and formulary placements.

Generic versions of Fexofenadine have entered markets, reducing prices and expanding access. Patent expirations, particularly in key jurisdictions, have facilitated generic proliferation, intensifying the competitive environment[3].

Regulatory and Patent Environment

Patent Status and Patent Expiry

FEXMID's active patent protections have largely expired in major markets:

- U.S.: Patent expired in 2012.

- EU: Patent protection ended by 2011.

This has paved the way for numerous generic manufacturers, leading to significant price erosion in those regions. However, certain formulations or combination patents may still offer limited exclusivity.

Regulatory Trends

Fexofenadine’s OTC status in multiple jurisdictions enhances accessibility but tightens scrutiny on manufacturing standards. Regulatory bodies such as FDA and EMA continuously monitor quality, leading to potential reformulations or approval of new combination products that could influence pricing.

Market Entry of Generics and Biosimilars

Post-patent expiration, generics have substantially decreased Fexofenadine’s retail price. The average wholesale price (AWP) for branded FEXMID in North America has declined by up to 60% over the past decade. The influx of generics has increased market penetration, especially in price-sensitive markets such as India and Southeast Asia.

Biosimilars and new formulations, including fast-dissolving tablets, have entered some markets, introducing additional competitive pressures and potential for price adjustments.

Price Trajectory and Forecasts

Current Price Landscape

- United States: Brand FEXMID retails at approximately USD 250-300 per 30-tablet pack. Generic equivalents are available at USD 80-120.

- Europe: Prices vary across countries, with brand prices around EUR 20-25 per pack, while generics range at EUR 10-15.

- Asia-Pacific: Prices are more affordable; branded Fexofenadine often costs USD 10-15 per pack.

Projected Price Trends (2023–2030)

- Short-Term (2023–2025): Anticipate further price declines of 10-20% due to ongoing generic competition, especially in mature markets. OTC formulations remain relatively stable but will see new competition from combination antihistamines.

- Medium-Term (2026–2028): Stabilization expected as patent barriers prevent further significant drops. Introduction of value-added formulations (e.g., dispersible tablets, quick-release) could sustain premium pricing for branded versions.

- Long-Term (2029–2030): Prices are likely to plateau at 15-25% below current branded levels, provided no new patent protections or formulations with superior efficacy are introduced.

Factors Influencing Price Dynamics

- Regulatory Approvals: Introduction of new indications or formulations could temporarily bolster prices.

- Market Penetration by Generics: Increased manufacturing capacity and regional approvals will sustain downward pressure.

- Patent Litigation and Exclusivity: Any new patents related to combination products could delay generic competition, supporting higher prices.

- Healthcare Policies: Favorable reimbursement and inclusion in formularies may sustain prices, while cost-containment policies could accelerate price reductions.

Implications for Stakeholders

- Pharmaceutical Companies: Need strategic investments in R&D for combination products, novel formulations, or delivery systems to maintain pricing power.

- Manufacturers of Generics: Opportunities for aggressive pricing, especially in emerging markets seeking affordable allergy treatments.

- Healthcare Providers: Favor prescribing cost-effective generics due to significant price differentials, influencing market share.

- Patients: Greater access to affordable options, but potential trade-offs in brand loyalty versus cost savings.

Conclusion

FEXMID's market is characterized by a mature landscape with declining prices driven by generic competition, expanding across developed and emerging markets. The overall trajectory indicates sustained price erosion in the short term, stabilizing over the medium to long term as new formulations and regulatory factors influence the landscape.

Investors and pharmaceutical firms should monitor patent trends, regulatory changes, and market expansions to optimize product positioning and pricing strategies.

Key Takeaways

- The global antihistamine market is growing modestly, with Fexofenadine occupying a substantial share owing to its safety profile.

- Patent expirations have led to significant price reductions, especially in North America and Europe, fostering increased generic penetration.

- Future pricing will be heavily influenced by regional market dynamics, regulatory approvals, and product innovation.

- Branded FEXMID is expected to see gradual price stabilization after further declines, with potential premiums for novel formulations.

- Stakeholders should prioritize portfolio diversification, including combination therapies and advanced formulations, to maintain market competitiveness.

FAQs

-

What factors primarily influence Fexofenadine price projections?

Price projections are driven by patent status, generic competition, regulatory approvals, regional market dynamics, and innovation in formulations. -

How does generic entry impact the market price of FEXMID?

Generic entry substantially reduces retail prices due to increased competition, often leading to price drops of 50% or more post-patent expiry. -

Are there regions where Fexofenadine remains expensive?

Yes, in regions with delayed generic approvals or limited competition, such as certain parts of Asia or markets where patent protections are still in effect, prices remain higher. -

What opportunities exist for pharmaceutical firms regarding Fexofenadine?

Developing new formulations, combination drugs, or delivering improved efficacy can enable premium pricing and market differentiation. -

What role will biosimilars or new drug classes play in the future Fexofenadine market?

While biosimilars are less relevant given Fexofenadine's molecule type, new drug classes with improved efficacy or safety could substitute or complement existing therapies, influencing pricing and market share.

References

[1] Global Market Insights. "Antihistamines Market Size & Share." 2022.

[2] World Health Organization. "Allergic Rhinitis and Its Impact on Quality of Life." 2020.

[3] FDA Patent Listings & Market Reports. "Fexofenadine Patent Status." 2021.

More… ↓