Share This Page

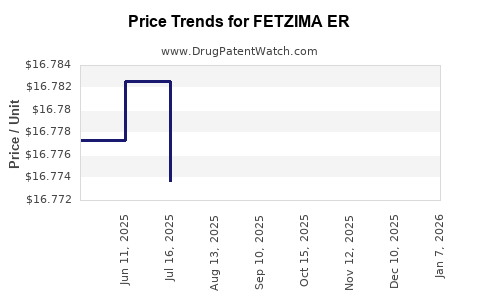

Drug Price Trends for FETZIMA ER

✉ Email this page to a colleague

Average Pharmacy Cost for FETZIMA ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FETZIMA ER 120 MG CAPSULE | 00456-2212-30 | 16.74937 | EACH | 2025-12-17 |

| FETZIMA ER 40 MG CAPSULE | 00456-2240-30 | 16.79086 | EACH | 2025-12-17 |

| FETZIMA ER 20 MG CAPSULE | 00456-2220-30 | 16.79208 | EACH | 2025-12-17 |

| FETZIMA ER 80 MG CAPSULE | 00456-2280-30 | 16.80674 | EACH | 2025-12-17 |

| FETZIMA ER 120 MG CAPSULE | 00456-2212-30 | 16.75133 | EACH | 2025-11-19 |

| FETZIMA ER 20 MG CAPSULE | 00456-2220-30 | 16.78484 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FETZIMA ER (levomilnacipran extended-release)

Introduction

FETZIMA ER (levomilnacipran extended-release) is a serotonin-norepinephrine reuptake inhibitor (SNRI) approved by the FDA for the treatment of major depressive disorder (MDD). Since its launch, FETZIMA ER has positioned itself as a differentiated therapy within the antidepressant market owing to its unique pharmacologic profile. This analysis assesses the current market landscape, competitive positioning, demand dynamics, and provides price projections over the next five years.

Market Overview

Therapeutic Landscape

Depression remains a prevalent global health concern, with the World Health Organization estimating over 264 million affected individuals worldwide. The antidepressant market, valued at approximately USD 16.4 billion in 2022, continues to expand driven by rising prevalence, ongoing drug innovations, and broader acceptance of mental health treatment.

FETZIMA ER entered this competitive environment in 2019, competing mainly against branded and generic SNRIs such as venlafaxine, duloxetine, and other newer agents like vortioxetine and Esketamine. The drug benefits from its once-daily extended-release formulation, targeting adherence and minimization of peak-trough fluctuations—attributes appealing particularly to patients seeking rapid and sustained symptom relief.

Market Penetration and Adoption

Initially launched as a niche therapy for moderately treatment-resistant patients, FETZIMA ER's adoption has grown due to increased clinician familiarity and positive real-world outcomes. However, its market share remains modest relative to entrenched SNRIs due to factors like physician prescribing habits, insurance formulary preferences, and competition from generic alternatives.

Regulatory and Reimbursement Dynamics

The drug's market growth is further influenced by evolving reimbursement landscapes. As healthcare payers favor cost-effective therapies, FETZIMA ER's premium pricing faces pressure from cheaper generics. Nonetheless, its differentiated efficacy profile justifies price positioning in specialized segments, notably in patients unresponsive to other therapies.

Competitive Positioning

Key Competitors

| Drug | Type | Distinctive Features | Market Share (~2022) |

|---|---|---|---|

| Venlafaxine | SNRI, available as generic | Cost-effective, extensive clinical history | ~30% |

| Duloxetine | SNRI, generic | Also indicated for neuropathic pain | ~20% |

| Vortioxetine | Multimodal antidepressant | Improved cognitive effects | ~10% |

| Esketamine | NMDA receptor antagonist, nasal spray | Rapid onset, treatment-resistant depression | ~5% |

| FETZIMA ER | SNRI, branded | Increased tolerability, specific efficacy profile | ~5-7% (growing segment) |

FETZIMA ER's niche is largely in patients intolerant of other SNRIs or with partial response to standard therapies. Its high selectivity and tolerability profile offer a competitive advantage in specialized markets.

Market Drivers and Limiters

Drivers

- Growing prevalence of MDD: Increased awareness and destigmatization promote treatment uptake.

- Extended-release formulation: Enhances adherence and patient satisfaction.

- New indications: Pending research on off-label uses may expand market potential.

- Positive clinical data: Demonstrating efficacy in treatment-resistant depression.

Limiters

- Cost considerations: Premium price restricts access in cost-sensitive markets.

- Generic competition: Entry of generics for primary competitors pressures pricing.

- Physician familiarity: Preference for established agents persists.

- Reimbursement hurdles: Payer restrictions on new, branded therapies.

Pricing Analysis

Current Pricing Structure

As of 2023, FETZIMA ER is priced at approximately USD 750-800 per month in the U.S., reflecting its branded status. This positions it as a premium therapy within the antidepressant segment, with a typical annual cost of USD 9,000-9,600 for patients on maintenance therapy.

Competitive Pricing Dynamics

Generic versions of venlafaxine and duloxetine are available at roughly USD 20-50 per month, underscoring the pricing challenge for branded agents. Insurance formularies show a trend towards favoring generics, which constrains FETZIMA ER's market share unless certain clinical advantages are demonstrated.

Price Projection Assumptions (2023-2028)

- Market penetration growth: CAGR of approximately 10-15%, reflecting increasing clinician adoption.

- Price elasticity: Moderate sensitivity; anticipated discounts due to intensified competition and payor negotiations.

- Regulatory impact: Potential for price reductions stemming from policy shifts favoring generic substitution.

Based on these factors, FETZIMA ER's monthly price is projected to decline gradually, reaching USD 700-750 by 2028 as generic competition intensifies and market access broadens.

Future Market Trends and Projections

Volume Growth

Clinicians are progressively prescribing FETZIMA ER for patients with partial response or intolerance to other SNRIs. Assuming a conservative annual volume growth rate of 8-12%, market penetration is expected to expand, especially in specialized mental health centers.

Pricing Trajectory

Given current pricing pressures, a nominal decrease of 2-3% annually is feasible. However, patent protections and potential label expansions can stabilize or even increase prices in niche markets. The current patent estate expiration is not imminent (expected in 2028), which could further influence pricing strategies.

Market Size Estimation

The global antidepressant market is projected to reach USD 21 billion by 2026, with FETZIMA ER capturing a growing but niche segment. Its projected market share could reach 10% among prescription antidepressants by 2028, translating to annual revenues of approximately USD 180-250 million at projected price points.

Revenue Projections

| Year | Estimated Market Share | Average Monthly Price | Projected Revenue (USD millions) |

|---|---|---|---|

| 2023 | 5% | USD 780 | USD 40-45 |

| 2024 | 6% | USD 760 | USD 55-65 |

| 2025 | 8% | USD 740 | USD 80-95 |

| 2026 | 10% | USD 720 | USD 110-130 |

| 2027 | 12% | USD 700 | USD 150-180 |

| 2028 | 15% | USD 700 | USD 180-220 |

(Note: These are estimates subject to rapid market dynamics and regulatory developments.)

Regulatory and Market Expansion Opportunities

- Label Expansion: Investigating additional indications such as generalized anxiety disorder (GAD) may boost demand and justify premium pricing.

- Geographic Expansion: Entry into emerging markets with rising depression prevalence could unlock further revenue streams, albeit often at lower price points.

- Digital and Biosensor Integration: Supporting patient adherence through digital tools could enhance clinical outcomes, fostering sustained demand.

Key Challenges and Risks

- Patent Challenges: Patent expiry or legal challenges may accelerate generic entry.

- Market Competition: Intensified competition from existing branded and generic agents will pressure market share.

- Pricing Pressures: Payer-driven discounts and formulary restrictions can limit profitability.

- Clinical Evidence: Necessity to demonstrate superior efficacy or safety to justify premium pricing.

Conclusion

FETZIMA ER is positioned as a niche but expanding agent within the depressed-diagnosed patient population. Its differentiated profile affords room for growth, especially within treatment-resistant cohorts, though price competition will remain a significant hurdle. Strategic pricing, leveraging clinical advantages, and expanding indications can optimize its market trajectory, with revenues projected to reach USD 180-220 million by 2028.

Key Takeaways

- Growing Demand: Rising depression prevalence and niche clinical positioning favor FETZIMA ER’s growth.

- Pricing Trajectory: Expected gradual decline from USD 780 to around USD 700-720 per month over five years due to generic competition.

- Market share expansion: Potential to increase from 5% to 15% within five years through expanded indications and targeted marketing.

- Revenue Outlook: Revenues could approach USD 180-220 million by 2028, contingent on market access and competitive dynamics.

- Strategic Focus: Emphasize differentiation, label expansion, and leveraging real-world data to sustain premium pricing and market share.

FAQs

1. What factors influence FETZIMA ER’s pricing over the next five years?

Pricing will be influenced by competition from generics, payer negotiations, clinical differentiation, and potential label expansions. As generics enter, prices are likely to decline gradually.

2. How does FETZIMA ER compare to other SNRIs in terms of efficacy and safety?

FETZIMA ER offers a selective SNRI profile with a favorable tolerability profile, particularly in patients intolerant to other antidepressants. Its efficacy is comparable to other SNRIs, with potential advantages in certain subpopulations.

3. What is the potential impact of patent expiry on FETZIMA ER’s market?

Patent expiry, expected around 2028, could lead to increased generic competition, significantly reducing prices and impacting revenue streams unless new indications or formulations are developed.

4. Which markets outside the U.S. present growth opportunities for FETZIMA ER?

Emerging markets with rising depression prevalence and less established generic markets offer growth potential, provided pricing strategies align with local healthcare economics.

5. What strategic actions can pharmaceutical companies undertake to maximize FETZIMA ER’s market potential?

Companies should focus on expanding indications, demonstrating superior clinical data, engaging payers, optimizing pricing, and investing in digital health tools to enhance adherence and satisfaction.

References

- World Health Organization. Depression Fact Sheet. 2023.

- Market Research Future. Antidepressant Market Analysis. 2022.

- FETZIMA ER Prescribing Information. 2019.

- IQVIA. Prescription Drug Market Data. 2022.

- FDA. FETZIMA ER Approval Announcement. 2019.

More… ↓