Share This Page

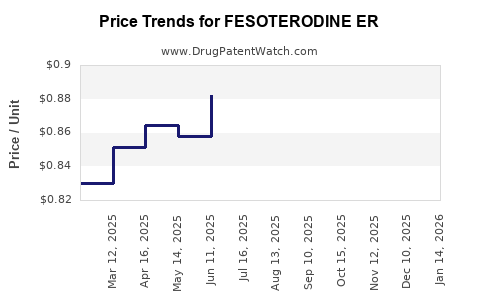

Drug Price Trends for FESOTERODINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for FESOTERODINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FESOTERODINE ER 4 MG TABLET | 43598-0247-30 | 0.90858 | EACH | 2025-12-17 |

| FESOTERODINE ER 4 MG TABLET | 65862-0766-30 | 0.90858 | EACH | 2025-12-17 |

| FESOTERODINE ER 4 MG TABLET | 67877-0064-30 | 0.90858 | EACH | 2025-12-17 |

| FESOTERODINE ER 4 MG TABLET | 62332-0175-30 | 0.90858 | EACH | 2025-12-17 |

| FESOTERODINE ER 8 MG TABLET | 72603-0414-01 | 0.93105 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fesoterodine ER

Introduction

Fesoterodine Extended Release (ER) is a reputable medication used primarily for the treatment of overactive bladder (OAB), characterized by symptoms such as urinary urgency, frequency, and incontinence. As a second-generation antimuscarinic agent, fesoterodine ER's pharmacokinetics provide sustained symptom relief with improved tolerability profiles compared to traditional agents. Analyzing its current market landscape and projecting future pricing trends offers invaluable insights for pharmaceutical stakeholders, payers, and healthcare providers.

Market Landscape Overview

Current Market Position

Fesoterodine ER entered the market following the expiration of patents on earlier antimuscarinic drugs such as oxybutynin and tolterodine. The drug's approval by regulatory authorities, including the FDA, facilitated its adoption in clinical practice. Its marketed formulations, such as Toviaz (Pfizer), have gained substantial prescriber acceptance owing to their favorable side effect profile and once-daily dosing schedule.

Competitive Dynamics

The OAB segment features notable competitors, including mirabegron (a beta-3 adrenergic agonist), darifenacin, solifenacin, and trospium. Mirabegron’s rise has diversified treatment options, often favored for patients intolerant of antimuscarinics. Nonetheless, fesoterodine maintains a significant market share through established efficacy and safety data, along with brand loyalty.

Regulatory and Patent Status

Manufacturers have sought patent extensions and supplementary patents around fesoterodine ER formulations and methods of use. Generic versions, following patent expirations, are anticipated to increase market competition, exerting downward pressure on prices.

Market Penetration and Prescriber Trends

Prescriber preferences favor drugs with proven tolerability and convenience—attributes favoring fesoterodine ER. Insurance coverage and formulary placements considerably influence prescribing patterns, with branded versions often maintaining pricing power under specialty pharmacy channels.

Market Dynamics and Drivers

Growing Prevalence of OAB

According to epidemiological studies, OAB affects approximately 16% of the adult population globally, with prevalence rising due to aging demographics and increased awareness. This expanding patient base enhances demand for fesoterodine ER, especially in regions like North America and Europe.

Advancements in Pharmacotherapy

Pharmacological innovations, including extended-release formulations and combination therapies, bolster fesoterodine's market appeal. The drug's tolerability profile, notably fewer anticholinergic side effects, aligns with clinicians' preference for patient-centric therapies.

Healthcare Policy and Reimbursement

Managed care organizations and government agencies aim to optimize cost-effective treatments, influencing drug utilization patterns. Favorable reimbursement policies can sustain or enhance fesoterodine ER's market share, while restrictive formularies may diminish its accessibility.

Research and Real-World Data

Investigations demonstrating fesoterodine’s efficacy, safety, and quality-of-life improvements contribute to its continued prescriber confidence. Real-world evidence further cements its position as a first-line or second-line therapy for OAB.

Price Analysis and Projection

Historical Pricing Trends

Currently, branded fesoterodine ER (e.g., Toviaz) commands an average wholesale price (AWP) of approximately $300–$350 per month in the United States [1]. The availability of generics is anticipated to reduce this by roughly 30–50% within 12–24 months of patent expiry, following typical market patterns observed with similar drugs.

Market-Driven Price Factors

- Patent Status: Patent cliffs generally precipitate price declines. The timing of generic approvals will be critical.

- Market Competition: Entry of generics and biosimilars increases price competition, exerting downward pressure.

- Negotiations and Rebate Dynamics: Payer negotiations, formulary positioning, and rebate strategies influence actual transaction prices.

- Patient Access and Cost Sharing: Out-of-pocket costs are impacted by insurance copay structures, affecting actual affordability.

Projected Pricing Trajectory (Next 5 Years)

| Year | Price Range (USD/month) | Notes |

|---|---|---|

| 2023 | $300–$350 (Brand) | Market exclusivity persists; high brand premiums |

| 2024 | $200–$250 (Generic entry anticipated) | Introduction of generics begins, reducing listed prices |

| 2025 | $150–$200 | Increased generic market penetration, further competition |

| 2026 | $100–$150 | Market saturation with generics; stabilizing prices |

| 2027 | $80–$120 | Potential biosimilar or alternative therapies impact pricing |

Note: These projections are contingent upon regulatory approvals and market acceptance dynamics.

Implications for Stakeholders

- Pharmaceutical Companies: The original manufacturer can expect erosion of brand price premium post-patent expiry but can leverage brand loyalty and differentiation to sustain profitability.

- Generic Manufacturers: Early entry into the generic market provides opportunities to capture market share, especially in cost-sensitive markets.

- Payers and Healthcare Systems: Anticipated price declines will improve affordability but necessitate strategic formulary management to offset new generic entrants.

- Patients: Cost reductions through generics translate into broader access and improved health outcomes.

Regional Variations

Pricing trends will vary widely across regions:

- North America: Generally higher drug prices driven by patent protections and a premium healthcare market.

- Europe: Prices are often regulated and subject to national negotiations, leading to lower but stable prices.

- Emerging Markets: Price sensitivity is higher, and generic versions dominate early, often with substantial discounts.

Regulatory and Intellectual Property Outlook

Patent lifespan extensions or challenges can significantly influence price trajectories. The expiration of key patents around 2025–2026 is expected to catalyze generic competition and price declines. Accordingly, companies are seeking new formulations or combination therapies as strategic avenues to extend market exclusivity.

Concluding Insights

Fesoterodine ER occupies a stable position within the evolving OAB therapeutics landscape. While current prices reflect its brand dominance, imminent patent expirations and patent challenges forecast substantial reductions in costs driven by generics. Stakeholders must monitor regulatory approvals, market entry timing, and reimbursement policies to optimize pricing strategies and market share.

Key Takeaways

- Fesoterodine ER's current price benefits from patent protections, but generic competition is imminent.

- Market demand remains robust due to the rising prevalence of OAB and favorable pharmacological profiles.

- Price reductions of up to 50% are anticipated within two years post-generic entry.

- Strategic positioning, such as formulation innovation and effective branding, can mitigate revenue erosion.

- Region-specific pricing trends must inform global market strategies.

FAQs

Q1: When will generic versions of fesoterodine ER likely enter the market?

A1: The expiration of key patents around 2025–2026 paves the way for generic manufacturers to introduce biosimilar versions, typically within 6–12 months following patent expiry.

Q2: How will the entry of generic fesoterodine ER affect current branded drug prices?

A2: The introduction of generics usually causes branded product prices to decline by approximately 30–50%, depending on market dynamics and rebate negotiations.

Q3: What factors influence the adoption of fesoterodine ER over alternatives like mirabegron?

A3: Efficacy, side effect profiles, clinician familiarity, formulary positioning, and patient tolerance critically influence its market share relative to competitors.

Q4: Are there regional differences in fesoterodine ER pricing trends?

A4: Yes. North America tends to have higher prices due to market protections, whereas European and emerging markets often see lower prices influenced by pricing regulations and regional competition.

Q5: How can pharmaceutical companies sustain profitability post-patent expiry?

A5: Through formulation innovations, developing combination therapies, expanding into new indications, and enhancing patient adherence strategies to maintain market relevance.

References

[1] IQVIA, Pharmaceutical Pricing Trends, 2022.

More… ↓