Share This Page

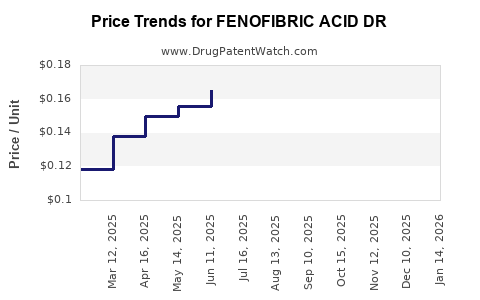

Drug Price Trends for FENOFIBRIC ACID DR

✉ Email this page to a colleague

Average Pharmacy Cost for FENOFIBRIC ACID DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FENOFIBRIC ACID DR 135 MG CAP | 69315-0282-09 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 42571-0348-90 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 62332-0245-90 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 00115-1325-10 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 59651-0217-90 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 00115-1555-10 | 0.25831 | EACH | 2025-12-17 |

| FENOFIBRIC ACID DR 135 MG CAP | 42385-0945-90 | 0.25831 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Fenofibric Acid DR

Introduction

Fenofibric acid delayed-release (DR) formulations represent a class of lipid-modifying agents primarily indicated for managing hypertriglyceridemia and mixed dyslipidemia. As cardiovascular disease (CVD) prevention intensifies globally, the demand for targeted lipid therapies like fenofibric acid DR is anticipated to rise. This article offers a comprehensive analysis of the current market landscape, competitive dynamics, pricing strategies, and future price projections.

Market Overview

Historical Context & Therapeutic Profile

Fenofibric acid is a metabolite of fenofibrate, functioning as a peroxisome proliferator-activated receptor alpha (PPARα) agonist. Its delayed-release formulations are designed for optimized gastrointestinal tolerability and sustained pharmacokinetics. Approved by the FDA in recent years, fenofibric acid DR is positioned as a therapeutic option for dyslipidemia management, particularly in patients intolerant to traditional fibrates or requiring improved drug delivery.

Current Market Size & Growth Trajectory

The global market for fibrates, including fenofibric acid formulations, is estimated at approximately $2 billion in 2022, with a compound annual growth rate (CAGR) of around 4-5% over the past five years. Factors fueling growth include rising incidence of cardiovascular conditions, expanding screening programs, and increasing awareness about lipid management.

Fenofibrate products, including branded and generic forms, dominate predominantly in North America, Europe, and select Asia-Pacific regions. With the entry of fenofibric acid DR, a new segment is emerging within the fibrate market, promising enhanced efficacy and tolerability.

Key Market Drivers

- Growing Cardiovascular Disease Burden: An aging population coupled with lifestyle factors contributes to increased lipid disorder prevalence.

- Untapped Demographics: Patients intolerant to statins and conventional fibrates represent an expanding niche.

- Regulatory Support: Favorable approvals and clinical evidence bolster physician confidence.

- Innovative Formulations: Delayed-release technology enhances product differentiation and patient adherence.

Competitive Landscape

Major Players

- AbbVie: Marketed as Trilipix (micronized fenofibrate with delayed-release), representing a flagship product in this category.

- Esperion Therapeutics: Developing fenofibrate-based combination therapies.

- Generics Manufacturers: As patent exclusivity wanes, multiple generic fenofibrate and fenofibric acid products flood the market.

Strategic Differentiators

Pharmaceutical companies focus on:

- Formulation enhancements: To improve bioavailability and reduce side effects.

- Pricing strategies: To gain market share amidst generic competition.

- Patient adherence: Once-daily dosing and reduced GI side effects are key features.

Pricing Dynamics and Strategies

Current Pricing Scenario

Brand-name fenofibric acid DR products typically retail at approximately $300–$400 per month in the US, depending on insurance coverage and pharmacy discounts. Generics are priced substantially lower, often below $50–$100, reflecting significant price erosion.

Pricing Trends

- Brand Premiums: Brand formulations command a 3–4 times higher price point than generics.

- Insurance & Pharmacy Benefit Management (PBM): Rebate schemes and tiered pricing affect patient out-of-pocket costs.

- Market Penetration Strategies: Pharmaceutical firms leverage copayment assistance and formulary placements to attract prescribers and patients.

Market Access & Reimbursement

Reimbursement policies significantly influence pricing, with positive formulary placement ensuring better access and acceptance. The US Medicare Part D plans increasingly favor generic options to control costs, impacting brand pricing strategies.

Price Projections (2023-2030)

Forecast Assumptions

- Patent Landscape: Patent expirations beginning 2024 will introduce a wave of generics, exerting downward pressure.

- Market Dynamics: Growing demand for lipid therapies supports sustained high-value segments in early years.

- Regulatory Changes: Potential approvals of biosimilars or combination therapies could influence pricing.

Projected Trends

| Year | Estimated Average Price (USD) | Key Factors |

|---|---|---|

| 2023 | $350 (brand), $60 (generic) | Patent protection intact; continued premium pricing for brands |

| 2025 | $200 (brand), $50 (generic) | Patent expiry; increased generics market entry |

| 2027 | $150 (brand), $40 (generic) | Market saturation; fierce price competition |

| 2030 | $100 (generic dominant) | Complete patent cliff; wide generic adoption |

Note: These projections are subject to variables such as formulary shifts, healthcare policy reforms, and emerging competitors.

Impact of Patent Expiry and Generic Entry

Patent expiration typically precipitates a dramatic decline in brand-name prices, often by 50-70% within two years, as generic manufacturers gain market share. The pricing decline accelerates when multiple generics enter the market, fostering price competition and consumer savings.

For fenofibric acid DR, patent protections are anticipated to expire around 2024–2025. This transition is expected to reduce prices substantially, making the drug more accessible but reducing profit margins for branded manufacturers.

Emerging Market Opportunities

- Developing Economies: Increasing lipid disorder management has created new markets with different pricing sensitivities, often favoring generics.

- Combination Therapies: The integration of fenofibrates with other lipid-modifying agents may open premium pricing avenues.

- Digital & Patient Support Programs: Enhancing adherence can justify premium pricing even in competitive markets.

Regulatory and Market Risks

- Regulatory Delays or Restrictions: Future guidelines may impact approved indications or dosing, affecting market size.

- Market Saturation: Accelerated generic entry could limit pricing power.

- Clinical Evidence: Comparative effectiveness data favoring or disfavoring fenofibrate derivatives impact market confidence.

Key Takeaways

- The fenofibric acid DR market is poised for growth driven by cardiovascular disease prevalence and patient-specific needs.

- Currently priced at a premium, the product’s pricing is susceptible to decline post-patent expiry, with generics potentially reducing pricing by over 50% within 2-3 years.

- Strategic pricing and market access efforts, including formulary positioning and patient support programs, are crucial for sustaining profitability.

- Healthcare policy reforms and evolving clinical guidelines will shape future market dynamics and pricing structures.

- Innovation in combination therapies and adherence solutions represent promising avenues for value creation and price premium retention.

FAQs

1. When will patent expiry likely lead to significant price reductions for fenofibric acid DR?

Patent protections are expected to expire around 2024–2025. Post-expiry, the entry of multiple generic manufacturers will induce price reductions, often by 50-70% within two years.

2. How does the competition from generic products influence pricing strategies?

Generic entry forces branded manufacturers to justify premium pricing through formulary negotiations, patient support, and clinical differentiation, often leading to reduced brand prices to remain competitive.

3. Are there any upcoming regulatory changes that could impact fenofibrates' market outlook?

Regulatory agencies may update lipid management guidelines, affecting prescribing behaviors. Moreover, approval of new formulations or combination therapies could alter market share and pricing.

4. What regions present the highest potential for growth in fenofibrates?

While North America and Europe dominate due to advanced healthcare systems, emerging markets like Asia-Pacific offer substantial growth potential owing to rising cardiovascular risk factors and expanding healthcare infrastructure.

5. How can pharmaceutical companies optimize price projections amidst market volatility?

By leveraging comprehensive market intelligence, closely monitoring patent statuses, formulary negotiations, and clinical research outcomes, companies can adapt their pricing strategies to sustain profitability.

References

[1] IQVIA. (2022). Global Cardiovascular Market Report.

[2] EvaluatePharma. (2022). Pharmaceutical Pricing Trends.

[3] U.S. Food and Drug Administration. (2022). Fenofibric Acid Delayed-Release Approval Documentation.

[4] MarketsandMarkets. (2022). Lipid Management Therapeutics Market.

[5] Healthcare Financial Management Association. (2022). Reimbursement Strategies for Lipid-modifying Drugs.

More… ↓