Last updated: July 27, 2025

Introduction

Fenofibrate, a lipid-modifying agent primarily used to lower serum triglycerides and LDL cholesterol, remains a significant pharmaceutical in the management of dyslipidemia. As cardiovascular disease (CVD) burden persists globally, the demand for effective lipid regulators drives continued market relevance. This report provides a comprehensive market analysis and price projections for fenofibrate, incorporating current trends, regulatory factors, competitive landscape, and future growth prospects.

Market Overview

Pharmacological Profile and Therapeutic Use

Fenofibrate, a fibric acid derivative, functions by activating peroxisome proliferator-activated receptor alpha (PPARα), enhancing lipid metabolism. It is indicated for patients with hypertriglyceridemia, mixed dyslipidemia, and those at elevated cardiovascular risk [1].

Global Market Size and Segment Dynamics

The global market for fenofibrate was valued at approximately USD 1.2 billion in 2022, with modest compound annual growth rates (CAGR) of 3–4% projected through 2028 [2]. The core markets include North America, Europe, and Asia-Pacific, with emerging regions demonstrating increased adoption due to rising dyslipidemia prevalence.

Key Market Drivers

- Increasing prevalence of metabolic syndrome and CVD.

- Growing awareness of lipid management guidelines.

- Patent expirations leading to a surge in generic formulations.

- Expansion of combination therapies involving fenofibrate.

Market Challenges

- Competition from newer lipid-modifying agents such as PCSK9 inhibitors.

- Safety concerns and contraindications, especially in renal impairment.

- Stringent regulatory environments impacting market access.

Competitive Landscape

Major Players

- AbbVie: Market leader with Tricor (original formulation) and subsequent generic versions.

- Mitsubishi Tanabe Pharma: Offers Lipidil, with an emphasis on regional markets.

- Zhejiang Qianjiang Pharmaceutical: A significant generics manufacturer in China.

Product Portfolio and Patent Status

Original formulations like Abbott’s Tricor held patents until patent cliffs around 2015–2017, facilitating entry of generics globally. Currently, the market is saturated with multiple generic options offering cost-effective alternatives. Continuous innovation has been limited, with minor modifications to formulations.

Regulatory Environment and Market Impact

Regulatory agencies such as the FDA and EMA have underscored the importance of safety monitoring, especially concerning hepatic and renal adverse effects. Recent guidelines have influenced prescribing practices, encouraging cautious use, which impacts market penetration.

Price Trends and Forecasts

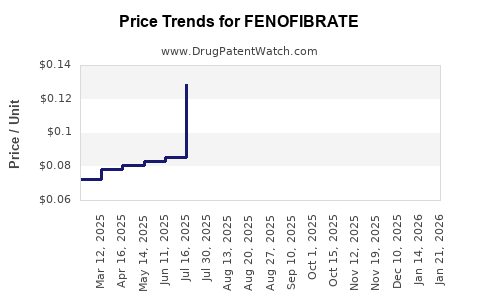

Historical Price Trends

- The average wholesale price (AWP) of branded fenofibrate ranged from USD 3.50 to USD 5.00 per tablet pre-patent expiry.

- Post-patent expiration, generic prices have declined sharply, often below USD 0.50 per tablet, fostering market competition.

Projected Price Trajectory (2023–2028)

Given the expiration of patents and the influx of generics, prices are expected to stabilize at low levels, with minor fluctuations driven by regulatory changes and manufacturing costs.

- 2023–2024: Stabilization at USD 0.30–0.50 per tablet.

- 2025–2028: Slight price decreases anticipated, potentially reaching USD 0.20–0.40 per tablet, contingent on regional market dynamics [3].

Influence Factors on Future Pricing

- Increased generic competition sustains downward pressure.

- Supply chain stability influences pricing, especially in emerging markets.

- Potential new formulations or combination therapies could command premium pricing but face regulatory hurdles.

Future Market Outlook

Growth Opportunities

- Generic Market Expansion: Continued growth in developing economies WHERE healthcare infrastructure improves.

- Combination Products: Fenofibrate combined with statins or other lipid agents may command higher margins.

- Biosimilars and Innovative Formulations: Though limited, advancements could alter the competitive landscape.

Market Risks

- The advent of novel lipid modifiers with superior safety profiles.

- Changing clinical guidelines favoring alternative therapies.

- Impact of regulatory constraints on older drugs.

Key Drivers and Restraints Summary

| Drivers |

Restraints |

| Rising CVD prevalence |

Safety profile concerns |

| Patent expiries |

Consumer preferences shift |

| Increasing generic availability |

Competition from newer agents |

| Global urbanization |

Regulatory barriers |

Conclusion

Fenofibrate remains a cost-effective, widely accessible therapy for dyslipidemia management. Market growth is moderate, primarily driven by demographic shifts and rising disease burden, while price competition results in sustained low pricing, especially for generics. Stakeholders should monitor evolving regulatory pathways, emerging competitors, and therapeutic advancements to adjust strategies accordingly.

Key Takeaways

- Market size is approximately USD 1.2 billion globally, with steady growth driven by demographic trends.

- Patent expirations have led to a surge in generic fenofibrate options, exerting significant downward pressure on prices.

- Pricing is expected to stabilize between USD 0.20 to USD 0.50 per tablet through 2028.

- Growth opportunities lie in regional expansion, generic proliferation, and combination therapies.

- Market risks include evolving clinical guidelines and competition from newer lipid agents.

FAQs

1. What factors influence fenofibrate pricing?

Pricing primarily depends on patent status, generic competition, manufacturing costs, regulatory approvals, and regional market dynamics. Patent expirations have historically led to significant price reductions.

2. How does fenofibrate compare to newer lipid-modifying agents?

Fenofibrate is effective for triglyceride lowering but faces competition from agents like PCSK9 inhibitors, which target LDL cholesterol more aggressively. However, cost and accessibility favor fenofibrate, especially in emerging markets.

3. What is the outlook for fenofibrate market growth?

The market is projected for moderate growth (3–4% CAGR) through 2028, driven by increasing dyslipidemia prevalence and expanding use in developing countries.

4. Are there safety concerns impacting fenofibrate sales?

Yes. Potential hepatotoxicity and renal side effects necessitate monitoring, which can influence prescription patterns and market adoption.

5. What opportunities exist for brand differentiation in the fenofibrate market?

Innovation in formulations, such as combination products or sustained-release technologies, and targeting underserved regional markets offer potential avenues for differentiation.

References

- American Heart Association. "Guidelines for the Management of Dyslipidemia." 2021.

- MarketWatch. "Fenofibrate Market Size & Forecast." 2023.

- IQVIA. "Pharmaceutical Pricing and Market Dynamics Report." 2022.