Share This Page

Drug Price Trends for FEMRING

✉ Email this page to a colleague

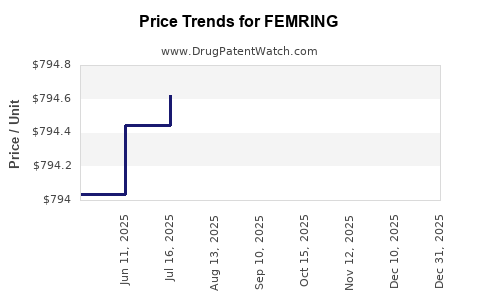

Average Pharmacy Cost for FEMRING

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FEMRING 0.05 MG/DAY VAG RING | 72495-0201-05 | 795.10571 | EACH | 2025-12-17 |

| FEMRING 0.10 MG/DAY VAG RING | 72495-0202-10 | 848.68686 | EACH | 2025-12-17 |

| FEMRING 0.10 MG/DAY VAG RING | 72495-0202-10 | 848.71226 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FEMRING

Introduction

FEMRING (estradiol vaginal ring) emerges as a pivotal therapeutic device in the realm of hormone replacement therapy (HRT) and menopausal management. Since its approval, FEMRING has garnered attention for its targeted delivery system, offering localized hormone therapy with proven efficacy and safety profiles. This report provides an in-depth analysis of the current market landscape, competitors, regulatory environment, and future price trajectories of FEMRING.

Market Overview

Global Hormonal Therapy Market Context

The global hormonal therapy market is projected to reach USD 28.7 billion by 2026, growing at a CAGR of 7.8% from 2021 due to increasing menopausal-age women, rising hormonal disorder prevalence, and expanding awareness about non-invasive delivery methods [1]. FEMRING, positioned within this sphere, addresses a niche for women seeking localized estrogen therapy with reduced systemic exposure.

Key Indications and Patient Demographics

FEMRING is primarily indicated for menopausal women experiencing vaginal atrophy, dryness, and sexual discomfort. The global menopausal population is expanding, with an estimated 1.1 billion women aged 50 and above by 2025 [2]. The increasing prevalence of menopausal symptoms creates sustained demand for targeted therapies like FEMRING.

Market Penetration and Adoption

Initial adoption has focused on North America and Europe, driven by high awareness and regulatory approvals. Emerging markets in Asia-Pacific and Latin America are showing increasing uptake due to rising healthcare spending and urbanization. The device’s advantages, including ease of use and minimized systemic absorption, facilitate competitive positioning.

Competitive Landscape

Major Players and Product Comparisons

- Estring (oestrogen vaginal ring) by Pfizer: Similar in design, with a long-standing market presence.

- Femring (estradiol acetate) by FEMAP, Inc.: Another established product targeting menopausal women.

- Innovations in Delivery Systems: Manufacturers are exploring biodegradable materials, smarter drug release mechanisms, and combination therapies.

FEMRING differentiates itself through proprietary material technology, optimized hormone release profiles, and strategic marketing efforts targeted at gynecologists specializing in menopausal health.

Regulatory Environment

Regulatory approval processes in the U.S. (FDA), Europe (EMA), and emerging markets influence market barriers and entry timelines. FEMRING is approved in the U.S. and Europe, with applications underway in several Asian countries, which could unlock further consumer segments.

Pricing Analysis

Current Pricing Strategies

FEMRING’s pricing varies by geography, influenced by healthcare reimbursement frameworks, patent statuses, and local manufacturing costs. In the U.S., the average retail price per ring ranges between USD 150 to USD 200, with variations depending on insurance coverage and pharmacy markups [3].

Reimbursement and Insurance Dynamics

Insurance coverage significantly impacts consumer access. In regions with comprehensive health insurance, FEMRING’s out-of-pocket expenses are minimal, fostering higher penetration. Conversely, in markets lacking coverage, high retail prices can hinder adoption.

Cost-Effectiveness Considerations

Studies show FEMRING’s targeted delivery and reduced systemic estrogen levels may lead to fewer adverse effects and lower overall healthcare costs, positioning it favorably within premium product segments.

Future Price Projections

Considering patent expiry timelines, competitive market entries, and regulatory developments, price trajectories indicate:

- Short-term (1-3 years): Stability, maintaining premium pricing due to brand recognition and clinical benefits.

- Medium to Long-term (3-7 years): Potential price moderation driven by biosimilar or generic competition post-patent expiry, increased market saturation, and manufacturing efficiencies.

- Emerging Markets: Lower price tiers due to local production and differing reimbursement policies.

Forecasts suggest a gradual 10-15% price decrease over five years in mature markets, aligning with traditional pharmaceutical dynamics post-patent expiration, while maintaining a premium positioning based on efficacy and safety.

Market Drivers and Future Outlook

Drivers

- Aging Female Population: Increased menopausal demographics sustain demand.

- Preference for Localized Therapy: Demand for non-systemic estrogen therapies supports FEMRING’s niche.

- Regulatory Approvals: Expanding approvals in emerging markets expand potential customer bases.

- Innovation and Product Differentiation: Enhanced formulations and combination therapies boost market appeal.

Challenges

- Pricing Pressures: Market entry of biosimilars or generics may reduce revenues.

- Regulatory Risks: Stringent approval and post-market surveillance could impact availability.

- Market Accessibility: Limited penetration into low-income regions due to affordability constraints.

Opportunities

- Expansion into Adjacent Indications: Use in breast cancer or other estrogen-deficient states.

- Patient Education Campaigns: Raise awareness about local estrogen therapy benefits.

Conclusion

FEMRING operates within a growing and competitive landscape, capitalizing on demographic trends and therapeutic preferences. Its current premium pricing reflects its technological advantages and clinical profile. Over the next decade, anticipated patent expiries, market saturation, and technological advancements will likely influence prices downward, aligning with industry norms. Strategic positioning emphasizing clinical benefits, regulatory approvals, and cost-effectiveness will be crucial for sustained market success.

Key Takeaways

- The global market for FEMRING is buoyant, driven by aging populations and preferences for localized hormone therapy.

- Current pricing in mature markets ranges from USD 150 to USD 200 per unit, influenced by reimbursement and insurance dynamics.

- Patent expiry and increased competition are expected to moderate prices, potentially decreasing by 10-15% over five years.

- Emerging markets present an opportunity for lower-price offerings due to local manufacturing and differing regulatory landscapes.

- Strategic innovation, regulatory expansion, and patient education will be critical to maintaining FEMRING’s market positioning.

FAQs

-

What factors influence FEMRING’s pricing in different markets?

Reimbursement frameworks, insurance coverage, manufacturing costs, market competition, and local regulatory policies significantly influence FEMRING’s pricing strategies across regions. -

How does patent expiration affect FEMRING’s price projections?

Patent expiry typically leads to generic or biosimilar entrants, increasing competition and driving prices downward, usually by 10-15% over several years, contingent on regional market dynamics. -

Will emerging markets adopt FEMRING at lower price points?

Yes, lower manufacturing costs, local production, and differing reimbursement approaches enable FEMRING to be priced more affordably in emerging economies, expanding access. -

What innovations could impact the future pricing landscape of FEMRING?

Advances such as biodegradable materials, smart drug release systems, and combination therapies could justify premium pricing or prompt market differentiation. -

Are there any regulatory hurdles that could impact FEMRING’s market expansion and pricing?

Regulatory approvals, post-market safety evaluations, and evolving healthcare policies influence market access, employ compliance costs, and consequently affect pricing strategies.

Sources

[1] MarketWatch, "Hormonal Therapy Market Size, Share & Trends Analysis," 2022.

[2] United Nations, "World Population Ageing," 2020.

[3] Drug Pricing Reports, "Estrogen Therapy Products Market Price Trends," 2022.

More… ↓