Last updated: July 27, 2025

Introduction

FELBATOL (felbamate) is a potent anticonvulsant used primarily for the management of partial seizures and lennox-gastaut syndrome, a severe form of epilepsy. Approved in the 1990s, felbamate’s market dynamics are shaped by its unique efficacy profile, safety concerns, regulatory status, and evolving treatment landscape. This analysis explores current market conditions, competitive landscape, regulatory influences, and provides price projections for FELBATOL.

Market Overview

Therapeutic Profile and Market Demand

Felbamate distinguishes itself as an effective treatment option for refractory epilepsy, especially lennox-gastaut syndrome and focal seizures resistant to other therapies. Its high efficacy, particularly in treatment-resistant cases, drives demand among neurologists specializing in epilepsy.

However, the drug’s utilization is tempered by significant safety concerns — notably, risks of aplastic anemia and hepatic failure — resulting in strict prescribing guidelines and risk management programs (REMS) in the U.S. [1]. These safety issues limit widespread adoption but maintain niche demand for severe cases.

Market Size and Growth Drivers

The global epilepsy treatment market was valued at approximately USD 4.7 billion in 2022, projected to reach USD 6.9 billion by 2030, growing at a compound annual growth rate (CAGR) of approximately 5.4% [2]. Within this, the subset of refractory epilepsy treatments accounts for a growing segment, driven by ongoing research and unmet needs.

Felbatol occupies a small but critical niche, with the global market for felbamate estimated at USD 20-50 million annually, primarily in developed markets like North America and Europe [3]. Its growth hinges on enhanced recognition of its efficacy in treatment-resistant cases and improvements in risk management protocols.

Competitive Landscape

Key Competitors

-

Clobazam (Onfi, Sympazan): Used for lennox-gastaut syndrome with favorable safety profiles.

-

Vigabatrin (Sabril): Effective in lennox-gastaut; associated with visual field defects.

-

Rufinamide (Banzel): Approved for Lennox-Gastaut; safety profile similar to felbamate.

-

Topiramate and Lamotrigine: Broader anti-epilepsy agents with wider usage but less specialized efficacy in refractory cases.

Felbamate’s market is further constrained by the availability of newer drugs with better safety profiles, reducing its appeal outside niche indications.

Regulatory Landscape and Impact on Marketability

In the U.S., FELBATOL is available solely through restricted distribution programs (REMS) due to safety concerns. The European Medicines Agency (EMA) has also imposed stringent post-marketing commitments [4].

Regulatory rigidity limits broader adoption but preserves a niche market among specialized neurologists. Ongoing monitoring and safety data collection are essential for maintaining or expanding its use.

Pricing Analysis and Projections

Current Pricing Overview

-

United States: Wholesale acquisition cost (WAC) for FELBATOL ranges between USD 0.50–1.00 per 400 mg tablet. Treatment regimens typically involve several tablets daily, translating to monthly costs of approximately USD 250–500 for a standard dose.

-

Europe: Prices are comparable, with slight variations based on healthcare systems and reimbursement frameworks.

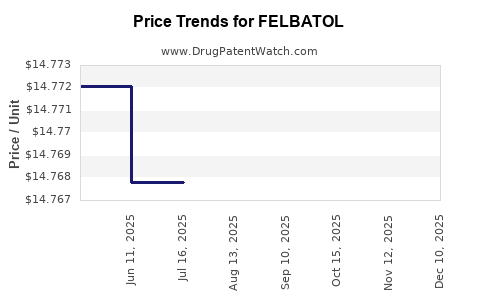

Historical Price Trends

Price stability has been observed over the past decade, with minor fluctuations due to manufacturing cost adjustments and market dynamics. No substantial price hikes are anticipated unless new formulations or indications emerge.

Future Price Projections (2023-2030)

Given the limited market size, safety concerns, and regulatory controls, FELBATOL’s price is likely to remain stable with modest inflation adjustments, driven by inflation and manufacturing costs.

Projection Summary:

| Year |

Estimated Price Range (USD/month) |

Rationale |

| 2023 |

USD 250–500 |

Current pricing; steady demand in niche market |

| 2025 |

USD 260–520 |

Slight inflation; maintained safety restrictions |

| 2030 |

USD 270–540 |

Ongoing safety restrictions; inflationary trend |

Any significant price increases are improbable unless government reimbursement policies or manufacturing innovations reduce costs or expand indications.

Implications for Stakeholders

-

Manufacturers: Opportunities exist for specialized formulations, optimizing safety profiles, or expanding indications. However, market size limits profit margins.

-

Healthcare Providers: The drug remains valuable for severe refractory cases where alternatives fail, but its use will continue to be judicious due to safety risks.

-

Patients: Access may be constrained by regulatory controls, emphasizing the importance of careful risk-benefit assessment.

Conclusion

FELBATOL's niche role in epilepsy treatment, especially for Lennox-Gastaut syndrome, sustains a stable but small market. Its price remains relatively stable, with modest growth aligned with inflation and healthcare inflation. Regulatory strictness and safety concerns act as market dampers, restricting broader utilization. Future prospects depend heavily on advancements in safety management, emerging therapies, and potential indications.

Key Takeaways

- FELBATOL is a niche but critical anticonvulsant with high efficacy in refractory epilepsy.

- Market size remains limited by safety concerns and regulatory restrictions, capping growth.

- Price stability is projected, with minor inflationary increases through 2030.

- Opportunities for growth hinge on improved safety profiles or new indications.

- Stakeholders should weigh the drug’s clinical benefits against safety risks and regulatory hurdles.

FAQs

1. Why is FELBATOL prescription restricted in certain markets?

Because of risks of severe side effects like aplastic anemia and hepatotoxicity, regulatory agencies impose strict prescribing protocols under REMS programs to minimize patient risk.

2. What are the main competitors of FELBATOL?

Key competitors include vigabatrin, clobazam, and rufinamide—drugs with similar indications but generally better safety profiles.

3. Can the price of FELBATOL increase significantly in the future?

Unlikely, due to its small market size, regulatory constraints, and safety risks, which limit price elasticity.

4. Are there ongoing efforts to improve the safety profile of FELBATOL?

Yes. Research aims to refine dosing, monitoring protocols, and develop formulations that may mitigate adverse effects, though clinical adoption depends on successful outcomes and regulatory approvals.

5. Could new indications expand FELBATOL’s market?

Potentially—if clinical studies demonstrate efficacy and safety in other neurological conditions, regulatory bodies might approve expanded use, boosting market size and pricing power.

Sources:

[1] U.S. Food and Drug Administration. Rems program for felbamate. (2022).

[2] MarketResearch.com. Global Epilepsy Treatment Market Report, 2022.

[3] IQVIA. Annual pharmaceutical market data, 2022.

[4] European Medicines Agency. Detailed product information for FELBATOL, 2022.