Share This Page

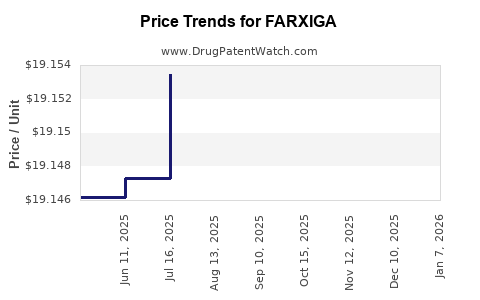

Drug Price Trends for FARXIGA

✉ Email this page to a colleague

Average Pharmacy Cost for FARXIGA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FARXIGA 10 MG TABLET | 00310-6210-30 | 19.17096 | EACH | 2025-12-17 |

| FARXIGA 10 MG TABLET | 00310-6210-90 | 19.17096 | EACH | 2025-12-17 |

| FARXIGA 10 MG TABLET | 00310-6210-39 | 19.17096 | EACH | 2025-12-17 |

| FARXIGA 5 MG TABLET | 00310-6205-90 | 19.15906 | EACH | 2025-12-17 |

| FARXIGA 5 MG TABLET | 00310-6205-30 | 19.15906 | EACH | 2025-12-17 |

| FARXIGA 10 MG TABLET | 00310-6210-30 | 19.16814 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FARXIGA (Dapagliflozin)

Introduction

FARXIGA (dapagliflozin), developed and marketed by AstraZeneca, is a first-in-class sodium-glucose co-transporter 2 (SGLT2) inhibitor approved for the treatment of type 2 diabetes mellitus (T2DM), heart failure, and chronic kidney disease (CKD). Since its FDA approval in 2014, FARXIGA has established a significant footprint within the global diabetes management market, leveraging its unique mechanism of action and expanding therapeutic indications. This analysis provides a comprehensive overview of FARXIGA’s current market environment, competitive position, and future price projections.

Market Landscape

Global Diabetes Treatment Market Dynamics

The global diabetes therapeutics market was valued at approximately $57 billion in 2022, with a compound annual growth rate (CAGR) projected at 7% through 2030 [1]. The surge is driven by increasing prevalence of T2DM, urbanization, aging populations, and rising awareness and diagnosis.

Major Indications and Therapeutic Expansion

Initially launched for T2DM, FARXIGA’s therapeutic scope has expanded substantially. It now addresses:

- Type 2 Diabetes Mellitus: The primary revenue driver.

- Heart Failure: Approved in 2020 for heart failure with reduced ejection fraction (HFrEF).

- Chronic Kidney Disease (CKD): Approved in 2021 for CKD with or without diabetes.

This diversification positions FARXIGA favorably amidst the shifting landscape toward cardioprotective and renoprotective indications, outside traditional glycemic control.

Market Position and Competitive Landscape

FARXIGA’s primary competitors include other SGLT2 inhibitors, notably:

- Jardiance (empagliflozin) by Boehringer Ingelheim and Eli Lilly.

- Steglatro (ertugliflozin) by Merck.

- Invokana (canagliflozin) by Janssen.

Among these, FARXIGA maintains a competitive edge due to its earlier market entry and broad label expansion.

Market Performance and Revenue Trends

Historical Sales Growth

FARXIGA’s annual global sales rose from $160 million in 2015 to over $2.4 billion in 2022 [2]. This rapid growth underscores its entrenched position and strong demand driven by indications beyond T2DM.

Regional Market Penetration

North America dominates sales, accounting for roughly 70% of revenues, supported by high T2DM prevalence, advanced healthcare infrastructure, and aggressive marketing. Europe and Asia-Pacific represent growing markets, with China and Japan experiencing notable upticks.

Driven Factors for Growth

- Label Expansion: The addition of heart failure and CKD indications significantly broadens the patient populations.

- Pricing Strategies: AstraZeneca’s transparent and value-based pricing has facilitated payer acceptance.

- Patent Lifecycle and Exclusivity: Patent protections extend until at least 2030, providing revenue visibility.

Future Price Projections

Pricing Structures and Reimbursement Dynamics

Current wholesale acquisition cost (WAC) for FARXIGA varies by region. In the U.S., the average monthly retail price hovers around $580–$650 [3]. However, insurance coverage, PBMs, and negotiated discounts influence patient out-of-pocket expenses.

Factors Influencing Pricing Trends

- Patent Expiry and Generic Entry: Although FARXIGA’s patents are largely in effect until 2030, potential biosimilar or generic competition could pressure prices post-expiry.

- Market Penetration of Expanded Indications: Greater use in heart failure and CKD populations tends to sustain or increase pricing power, especially with value-based reimbursement models.

- Regulatory and Payer Negotiations: Growing emphasis on cost-effectiveness may lead to value-based pricing and risk-sharing agreements.

Forecasted Price Trajectory (2023–2030)

Based on current trends and competitive dynamics, the following projections are reasonable:

- Short-term (2023–2025): Stable pricing with minor fluctuations (~+1% to +3%) driven by inflation, healthcare policies, and regional variations.

- Mid-term (2026–2028): Slight downward pressure (~-2% to -5%) contingent on patent cliff concerns and increased biosimilar entries in select markets.

- Long-term (2029–2030): Potential stabilization or decline (~-5% to -10%) if biosimilars or generics enter the market; alternatively, sustained pricing if expanded indications drive demand.

Market Drivers and Challenges

Drivers

- Growth in Cardiovascular and Renal Indications: Broadened clinical utility enhances market size and pricing power.

- Regulatory Support: Favorable approvals and label updates reinforce competitive advantage.

- Enhanced Patient Outcomes: Demonstrated benefits in hospitalization reduction and renal preservation elevate perceived value.

Challenges

- Patent Litigation and Competition: Entry of biosimilars and generics could erode market share and pricing.

- Pricing Pressure: Payer push for lower drug costs may lead to tiered or restricted access.

- Market Saturation: Increased adoption within existing indications could slow growth, impacting revenue streams.

Regulatory and Reimbursement Outlook

The ongoing evolution of healthcare reimbursement policies will influence pricing strategies. Value-based contracting, especially in countries emphasizing outcomes-based reimbursement, could lead to tiered pricing aligned with patient benefits. Furthermore, global health initiatives aim to enhance access in emerging markets, potentially impacting price points and profit margins.

Key Takeaways

- FARXIGA has rapidly expanded its market share since 2014, driven by broadening indications and expanding global access.

- Revenue growth remains robust, with over $2.4 billion in global sales in 2022, supported predominantly by North American markets.

- Competitive pressures, patent protections until at least 2030, and evolving indications shape a cautiously optimistic price outlook.

- Short-term stability is expected, with potential price declines after patent expiration; however, clinical efficacy and indication expansion will sustain demand.

- Strategic pricing and reimbursement negotiations will play critical roles in maintaining profitability and market share, especially amidst biosimilar entry in the future.

FAQs

1. How might patent expiration impact FARXIGA’s pricing and market share?

Patent expirations, anticipated around 2030, could introduce biosimilars or generics, exerting downward pressure on prices and eroding market share. However, extensive clinical evidence, expanded indications, and brand loyalty may temper immediate declines.

2. What distinguishes FARXIGA from its competitors?

FARXIGA’s early entry into the SGLT2 inhibitor space, broad indication approvals including heart failure and CKD, and demonstrated cardiovascular and renal benefits position it advantageously against competitors like Jardiance and Invokana.

3. How do healthcare policies influence FARXIGA’s future pricing?

Policies favoring value-based care and cost-effectiveness evaluations could lead to negotiated discounts or tiered pricing models, especially in publicly funded healthcare systems, influencing future price trajectories.

4. What emerging markets present growth opportunities for FARXIGA?

Asia-Pacific, Latin America, and parts of Africa are emerging as significant growth markets, driven by rising diabetes prevalence and increasing healthcare infrastructure investments.

5. Will expanded indications significantly alter FARXIGA’s pricing strategy?

Yes. Demonstrated benefits in cardiovascular and renal outcomes may justify premium pricing due to increased value perception, supported by payer willingness to reimburse for improved health outcomes.

References

[1] Market Research Future, "Diabetes Therapeutics Market," 2022.

[2] AstraZeneca Annual Reports (2015–2022).

[3] GoodRx, "Average Wholesale Price Data for FARXIGA," 2023.

More… ↓