Share This Page

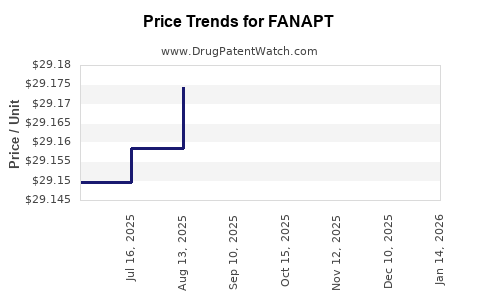

Drug Price Trends for FANAPT

✉ Email this page to a colleague

Average Pharmacy Cost for FANAPT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FANAPT 10 MG TABLET | 43068-0110-02 | 57.97870 | EACH | 2025-11-19 |

| FANAPT 6 MG TABLET | 43068-0106-02 | 36.31434 | EACH | 2025-11-19 |

| FANAPT 12 MG TABLET | 43068-0112-02 | 57.80622 | EACH | 2025-11-19 |

| FANAPT 8 MG TABLET | 43068-0108-02 | 36.02250 | EACH | 2025-11-19 |

| FANAPT 4 MG TABLET | 43068-0104-02 | 29.28907 | EACH | 2025-11-19 |

| FANAPT 2 MG TABLET | 43068-0102-02 | 29.40796 | EACH | 2025-11-19 |

| FANAPT 1 MG TABLET | 43068-0101-02 | 29.43122 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FANAPT (Iloperidone)

Introduction

FANAPT (iloperidone) is an atypical antipsychotic approved by the U.S. Food and Drug Administration (FDA) in 2009 for the treatment of schizophrenia. Developed by Vanda Pharmaceuticals, FANAPT has established a niche within the broader psychiatric medication market. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, pricing dynamics, and projected future trends influencing FANAPT’s commercial trajectory.

Market Landscape and Therapeutic Context

Schizophrenia Market Overview

Schizophrenia affects approximately 20 million people globally, with a significant burden in North America and Europe. The treatment landscape primarily comprises atypical antipsychotics, which have largely replaced typical antipsychotics due to improved side effect profiles. The global schizophrenia treatment market was valued at USD 8.2 billion in 2021 and is projected to reach USD 10.5 billion by 2028, growing at a CAGR of around 3.5% [1].

Key Competitors

FANAPT competes within a dense portfolio of second-generation antipsychotics (SGAs), including:

- Risperdal (risperidone)

- Zyprexa (olanzapine)

- Seroquel (quetiapine)

- Latuda (lurasidone)

- Abilify (aripiprazole)

- Cariprazine and brexpiprazole— newer agents with similar indications

FANAPT’s differentiators include its receptor binding profile, tolerability, and dosing regimen. However, its market share remains moderate owing to stiff competition and prescribing inertia.

Market Penetration and Patient Demographics

FANAPT's sales predominantly stem from adult schizophrenia patients, with limited expansion into bipolar disorder or off-label uses. Its prescription rates have experienced modest growth, buoyed by clinician familiarity and favorable side effect profile, especially in terms of metabolic effects, compared to older agents like olanzapine.

In the United States, approximately 70% of antipsychotic prescriptions are generics, highlighting a significant price sensitivity. FANAPT remains a brand-name drug, positioning it at a price premium over generic competitors.

Pricing Dynamics

Current Pricing

The wholesale acquisition cost (WAC) for FANAPT typically ranges between USD 25–35 per day for a standard therapeutic dose, translating into an annual cost of approximately USD 9,125–12,775 [2]. These prices are higher than many generic SGAs but are justified by the drug’s patent exclusivity and unique pharmacologic profile.

Reimbursement and Market Access

Insurance coverage, including Medicaid and commercial payers, influences patient access. Prior authorization and formulary placement significantly impact sales volume. Notably, FANAPT’s pricing is aligned with other branded SGAs, which often command a 20–30% premium over generics.

Impact of Biosimilars and Generics

No biosimilars or generics of iloperidone are available currently, providing a window for market exclusivity until patent expiry. However, patent challenges or new formulations targeting improved delivery could influence pricing strategies.

Regulatory and Patent Landscape

FANAPT’s initial patent protection has expired or is nearing expiry in key markets, exposing it to generic competition globally. In the U.S., patent challenges and the potential for abbreviated new drug applications (ANDAs) could erode market exclusivity within the next 5–7 years.

Vanda Pharmaceuticals has undertaken patent extensions through formulations and delivery methods, but these are frequently challenged or invalidated in court, as seen with other branded antipsychotics.

Market Drivers and Barriers

Drivers:

- Growing awareness of side effect profiles influencing prescribing patterns

- Disease prevalence and the need for personalized therapies

- Off-label use expansion in bipolar disorder and treatment-resistant schizophrenia

Barriers:

- Competition from well-established generics

- Price sensitivity among payers and patients

- Physician familiarity with other agents

- Patent expiration risks, leading to possible generics

Price Projections (Next 5 Years)

Scenario 1: Continued Branded Market Presence

Assuming Vanda sustains its current market share and no generic entries, FANAPT’s price basket may reduce gradually due to market forces but remains relatively stable at around USD 20–25 per day, considering inflation and payer negotiations. Sales revenues could see a compound annual growth rate (CAGR) of 2–3%, driven by increased diagnosis rates and formulary placements.

Scenario 2: Entrance of Generics (Post-Patent Expiry)

Once patent challenges succeed or patents expire, generic iloperidone could enter the market at a price reduction of approximately 50–70%. This drop would significantly impact revenues, with daily prices plummeting to USD 5–10, and a corresponding steep decline in profitability for Vanda. The timeline for this transition is approximated at 5–7 years, depending on patent litigation outcomes.

Impact of New Formulations and Indications

Potential development of long-acting injectable (LAI) formulations or expanded indications could sustain or even elevate pricing, adding a premium for innovation. Such features may also accelerate market penetration among adherence-challenged populations.

Future Market Trends Influence

- Increased adoption of personalized medicine could favor FANAPT if its receptor profile offers benefits for specific subpopulations.

- Health policy shifts toward cost-effective therapies might favor generics, pressuring brand pricing.

- Payer strategies and formulary negotiations will likely tighten, further reducing net prices.

- Global expansion into emerging markets remains constrained by pricing and regulatory hurdles.

Regulatory Outlook and Challenges

Patent cliffs, combined with ongoing patent challenges, are the chief regulatory factors shaping the future pricing environment. The expiration of key patents will open the door for generics, pressuring brand prices, unless Vanda introduces new formulations or indications to extend exclusivity.

Key Takeaways

- The global schizophrenia treatment market offers sustained growth but is highly competitive and price-sensitive.

- FANAPT currently holds a niche with differentiated pharmacology, commanding premium pricing over generics.

- Patent expiries within the next 5–7 years pose significant threats, with potential price reductions of 50–70% upon generic entry.

- Innovative formulations or expanded indications could preserve higher price points and market share.

- Long-term revenue projections should incorporate patent-related risks, competitive dynamics, and evolving reimbursement policies.

FAQs

1. What factors influence FANAPT’s pricing compared to other antipsychotics?

FANAPT’s pricing is influenced by its patent protection, therapeutic niche, manufacturing costs, and competitive landscape. Its differentiated receptor binding profile and side effect profile enable a premium over generics, but market entry of biosimilars or generics could significantly lower prices.

2. When is patent expiration expected for FANAPT?

The primary patents for FANAPT are expected to expire between 2025 and 2027 in the U.S., after which generic companies may introduce equivalents, leading to substantial price reductions.

3. How does the competitive environment affect FANAPT’s market share?

The presence of multiple established SGAs and increasing availability of generics limit FANAPT’s market share. Prescriber preferences and formulary positioning further influence its utilization.

4. What opportunities exist to extend FANAPT’s market life?

Developing long-acting injectable formulations, exploring new indications (e.g., bipolar disorder), and leveraging personalized medicine approaches could extend its competitive relevance and justify premium pricing.

5. How do reimbursement policies impact FANAPT’s pricing and accessibility?

Reimbursement negotiations, formulary placements, and prior authorization requirements can influence patient access and net prices. Payers tend to favor cost-effective generics, pressuring brand prices.

References

[1] Global Market Insights. Schizophrenia Treatment Market Size and Forecast. 2022.

[2] GoodRx. FANAPT (Iloperidone) Price and Cost Data. 2023.

More… ↓