Last updated: July 27, 2025

Introduction

Famciclovir, a prodrug of penciclovir, is an antiviral medication primarily used to treat herpesvirus infections, including herpes zoster, genital herpes, and cold sores. Approved by the U.S. Food and Drug Administration (FDA) in the late 1990s, famciclovir's market presence has evolved with the development of newer antiviral agents and the recognition of its clinical efficacy. This report assesses the current market landscape and projects future pricing trajectories for famciclovir, providing insights crucial for stakeholders—including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Market Size and Segments

The global antiviral drugs market, encompassing treatments for herpesvirus infections, was valued at approximately $21 billion in 2022 (1). Famciclovir holds a significant position within this segment, particularly in the treatment of herpes zoster and recurrent genital herpes. North America dominates the market, driven by high herpes prevalence, advanced healthcare infrastructure, and strong patent protections.

Key Drivers

- Prevalence of Herpesvirus Infections: An estimated 536 million people worldwide aged 15–49 are infected with HSV-2, with higher rates in North and Sub-Saharan Africa (2). Herpes zoster's incidence increases with age, particularly in populations over 60.

- Clinical Efficacy and Safety Profile: Famciclovir’s once-daily dosing improves patient adherence, enhancing its utility.

- Brand Loyalty and Patent Status: Existing patents and brand recognition (e.g., Famvir) sustain market shares.

- Expanding Indications: Potential future approvals for other viral infections could bolster market size.

Market Challenges

- Generic Competition: Price erosion due to patent expirations and the introduction of generics, notably in the U.S., has diminished revenue margins.

- Competition from Alternative Agents: Valacyclovir and acyclovir offer comparable efficacy at lower costs.

- Limited Use in Emerging Markets: Access barriers and affordability issues restrict widespread adoption in low-income regions.

Current Market Dynamics

Key Market Participants

- Novartis (Famvir): The original developer, with a dominant franchise.

- Sandoz and Other Generics Manufacturers: Driving price competition post-patent expiry.

- Emerging Market Players: Increasing presence as generics penetrate developing economies.

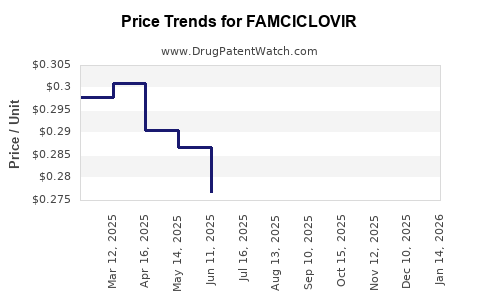

Pricing Trends

- Brand-Name Famciclovir: In the U.S., the average retail price for a 250 mg tablet ranges between $4–$7, contingent on pharmacy and insurance factors.

- Generic Versions: Prices typically range from $0.50–$2 per tablet, representing a steep decline post-patent expiration.

- Market Impact of Generics: The proliferation of generics has precipitated a price reduction of approximately 70–80% over the past decade.

Price Projection Analysis

Factors Influencing Future Prices

- Patent Expiry and Patent Challenges: The primary driver of price decline historically; patent expiration for famciclovir has occurred in multiple jurisdictions (e.g., U.S. patent expiry around 2019).

- Regulatory Approvals for Generics: Increasing filings and approvals facilitate price competition.

- Market Penetration in Emerging Economies: Lower-cost generics are anticipated to dominate these regions, influencing global average prices.

- Potential New Formulations or Indications: These could temporarily stabilize or elevate prices pending approval and market uptake.

Forecast Scenarios

- Optimistic Scenario: Continued patent expiry and widespread generic availability lead to steady price declines, approaching $0.10–$0.50 per tablet within the next 3–5 years globally.

- Moderate Scenario: Market consolidation and patent protections in select jurisdictions slow price erosion; prices hover around $1–$2 per tablet in developed markets over five years.

- Pessimistic Scenario: Introductions of biosimilars or alternative therapies significantly reduce demand for famciclovir, leading to further price drops, possibly below $0.10 per tablet globally.

Given historical trends and current market forces, a moderate scenario is most probable, with prices declining by approximately 60–80% over the next half-decade in mature markets. In emerging markets, prices are expected to stabilize at lower levels due to high generic competition and price sensitivity.

Implications for Market Participants

-

Pharmaceutical Companies: New entrants or existing firms should focus on differentiated formulations, combination therapies, or expanded indications to sustain revenue streams amid aggressive pricing.

-

Investors: Patents and regulatory exclusivity periods remain crucial; patent expirations can precipitate rapid valuation adjustments.

-

Healthcare Policymakers: Promoting generic substitution and price regulation can enhance access but may impact innovation incentives.

Conclusion

Famciclovir's market is characterized by established efficacy, intense generic competition, and diminishing brand premium pricing. While current prices reflect patent protections and brand recognition, impending patent expirations and market saturation foresee a steep decline in costs. Stakeholders must anticipate these trends, strategizing accordingly to optimize economic returns or enhance access.

Key Takeaways

- Market Size: The global antiviral market for herpes infections surpasses $21 billion, with famciclovir occupying a significant share.

- Pricing Trend: Post-patent expiry, famciclovir prices are expected to decline by 60–80% over five years.

- Competitive Landscape: The rise of generics has drastically reduced the cost of famciclovir, particularly in developed markets.

- Future Outlook: Market saturation and supply of generics will continue to exert downward pressure on prices, with emerging markets offering potential growth via low-cost alternatives.

- Strategic Focus: Companies should innovate through new formulations or indications; policymakers must balance access and innovation incentives.

FAQs

Q1: When did famciclovir's primary patents expire, and how has this affected market pricing?

Famciclovir’s key patents expired around 2019 in major markets like the U.S., leading to a surge in generic manufacturing and a consequent sharp decline in drug prices (2).

Q2: How do famciclovir’s prices compare with alternative antivirals such as valacyclovir or acyclovir?

Famciclovir is generally priced higher than acyclovir but competes closely with valacyclovir; however, the latter often commands a slight price advantage, especially in generic forms (3).

Q3: What factors could stabilize famciclovir prices in the near future?

Patent protections, limited alternative therapies for certain indications, and potential new approved formulations could temporarily sustain higher prices.

Q4: Which regions are likely to see the most significant price reductions for famciclovir?

Developed markets like the U.S., Europe, and Japan will experience notable price declines due to high generic penetration; emerging markets will see lower starting points but remain price-sensitive.

Q5: What are the implications of price trends for patients and healthcare systems?

Lower prices improve access and affordability, increasing treatment adherence and public health outcomes. Conversely, rapid price declines might reduce incentives for ongoing innovation.

References

- Market Data Forecast. (2022). Global Antiviral Drugs Market Size & Trends Analysis.

- World Health Organization. (2021). herpes simplex virus Fact Sheet.

- U.S. Food & Drug Administration. (2019). Patent and Exclusivity Data for Famciclovir.