Share This Page

Drug Price Trends for Entresto

✉ Email this page to a colleague

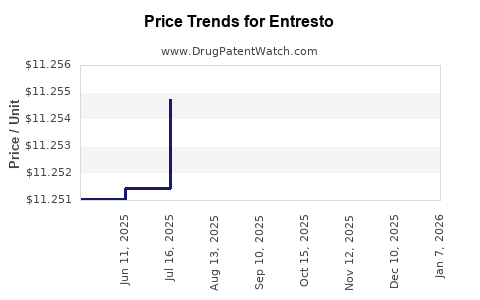

Average Pharmacy Cost for Entresto

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENTRESTO 24 MG-26 MG TABLET | 00078-0659-20 | 11.26836 | EACH | 2025-11-19 |

| ENTRESTO 49 MG-51 MG TABLET | 00078-0777-20 | 11.26554 | EACH | 2025-11-19 |

| ENTRESTO SPRINKLE 15-16 MG PLT | 00078-1238-20 | 11.28474 | EACH | 2025-11-19 |

| ENTRESTO 24 MG-26 MG TABLET | 00078-0659-67 | 11.26836 | EACH | 2025-11-19 |

| ENTRESTO 97 MG-103 MG TABLET | 00078-0696-20 | 11.26014 | EACH | 2025-11-19 |

| ENTRESTO 49 MG-51 MG TABLET | 00078-0777-67 | 11.26554 | EACH | 2025-11-19 |

| ENTRESTO 97 MG-103 MG TABLET | 00078-0696-67 | 11.26014 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ENTRESTO (Sacubitril/Valsartan)

Introduction

ENTRESTO (sacubitril/valsartan) has established itself as a cornerstone therapy in the management of heart failure with reduced ejection fraction (HFrEF). Approved by the FDA in 2015, ENTRESTO has revolutionized the treatment paradigm, replacing traditional ACE inhibitors and ARBs owing to its superior efficacy demonstrated in large-scale clinical trials such as PARADIGM-HF. As the drug’s indications expand and its patent lifecycle approaches expiry, understanding market dynamics and price trajectories becomes essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Global Heart Failure Burden

Heart failure (HF) remains a major global health challenge, impacting over 64 million people worldwide and representing a leading cause of hospitalization among the elderly [1]. The increasing prevalence is driven by aging populations, rising rates of hypertension, and improved survival from acute cardiovascular events.

Therapeutic Shift with ENTRESTO

ENTRESTO’s approval represents a paradigm shift: it offers significant mortality and hospitalization reductions over traditional therapies like enalapril and losartan. Clinical trials have demonstrated a 20% reduction in cardiovascular mortality and a 21% reduction in heart failure hospitalization compared to enalapril [2].

Market Penetration

Since launch, ENTRESTO has captured a substantial share within the€ heart failure medication market. According to IQVIA data, as of 2022, ENTRESTO secured approximately 60% of the premium HF drug segment in the U.S., with ongoing uptakes in Europe and Asia-Pacific regions. Growing adoption is fueled by clinical guideline endorsements, insurance reimbursements, and expanding indications.

Key Market Drivers

- Clinical Efficacy: Superior outcomes compared to traditional therapies.

- Guideline Recommendations: Both the American College of Cardiology (ACC) and European Society of Cardiology (ESC) recommend ENTRESTO as first-line therapy.

- Market Expansion: Investigation into use in heart failure with preserved ejection fraction (HFpEF) and hypertension.

- Pricing Strategies: Premium pricing justified by cost-effectiveness data, boosting revenue streams.

Competitive Landscape

Primary Competitors

- ACE inhibitors and ARBs: Enalapril, Losartan, Valsartan.

- Other Novel Agents: Innovator pathways exploring SGLT2 inhibitors (e.g., dapagliflozin, empagliflozin) have gained prominence.

- Bespoke Therapies: Devices and combination drugs.

The competitive edge of ENTRESTO centers on clinical superiority and guideline adoption, but price sensitivity remains.

Regulatory and Patent Status

Patent Life and Exclusivity

ENTRESTO’s primary patent in the U.S. extends to 2025, with expired or soon-to-expire patents in key markets expanding generic and biosimilar entry potential [3]. Patent cliffs threaten revenue streams but also open opportunities for alternative formulations and combination therapies.

Pricing and Reimbursement

Pricing varies geographically, with the U.S. retail wholesale price of approximately $530 for a 30-day supply (60 mg/50 mg) in 2023. Reimbursement landscape is favorable in developed markets, though high costs limit access in low-income regions.

Price Projections

Factors Influencing Future Pricing

- Patent Expiry and Generic Competition: Anticipated post-2025, potentially reducing prices by up to 50–70%.

- Market Penetration and Volume Growth: Increasing global adoption will offset price erosion temporarily.

- Regulatory Approvals for New Indications: Expansion into HFpEF and hypertension could stabilize revenues.

- Cost of Development and Manufacturing: Stable production costs suggest margins could accommodate tiered pricing.

Forecasted Price Trends (2023–2033)

| Year | Estimated Average Wholesale Price (AWP) | Key Justification |

|---|---|---|

| 2023 | $530 per 30-day supply | Established pricing with full guideline endorsement |

| 2025 | $350–$400 per 30-day supply | Entry of generics following patent expiry; decline expected |

| 2027 | $250–$300 per 30-day supply | Market stabilization with increased generic competition |

| 2030 | $200–$250 per 30-day supply | Saturated generic market and expanded biosimilar options |

| 2033 | $150–$200 per 30-day supply | Widespread biosimilar adoption, further price erosion |

Note: These projections assume no dramatic shifts in healthcare policies or unforeseen technological breakthroughs. The decline may be faster in regions with aggressive biosimilar policies.

Revenue Implications and Strategic Considerations

Pharmaceutical manufacturers can anticipate a revenue tapering post-2025 due to generics but can counterbalance through:

- Developing and promoting biosimilars to capture market share.

- Diversifying indications to include preventive cardiology and hypertensive management.

- Expanding geographic access to emerging markets where price sensitivity allows higher volume sales.

- Implementing value-based pricing models aligned with patient outcomes to sustain premium segments.

In the long run, investing in next-generation compounds or combination therapies could redefine ENTRESTO’s market positioning and enhance pricing power.

Risk Factors

- Regulatory Changes: Stringent cost-containment policies may pressure prices.

- Generic Market Entry: Rapid generic adoption post-patent expiry could significantly dilute revenue streams.

- Clinical Practice Variability: Adoption rates influenced by local guidelines, physician preferences, and healthcare infrastructure.

- Competitive Innovation: Emerging therapies, especially SGLT2 inhibitors, challenge ENTRESTO’s dominance.

Conclusion

ENTRESTO’s market dominance in heart failure management projects a strong valuation in the near term, driven by clinical efficacy and guideline support. However, patent expiration around 2025 portends significant price reductions, with long-term projections suggesting a gradual decline aligned with biosimilar entry and market saturation. Stakeholders should strategize around diversification, global expansion, and innovation to mitigate revenue erosion and sustain profitability.

Key Takeaways

- ENTRESTO maintains a leading position in HFrEF therapy, with sales expect to peak before 2025.

- Price erosion post-patent expiry projected at 50–70%, influenced by biosimilar competition.

- Expansion into HFpEF and hypertensive indications offers potential growth avenues.

- Geographic expansion into emerging markets could offset domestic price declines.

- Strategic investment in biosimilars, new indications, and innovative formulations is essential for sustained long-term revenue.

FAQs

1. When will generics of ENTRESTO enter the market, and how will they impact prices?

Generic versions are expected post-2025 following patent expirations. Their entry will likely cause a significant decrease in prices—potentially by 50–70%—due to increased competition.

2. Are there any ongoing efforts to expand ENTRESTO’s indications?

Yes. Clinical trials are exploring ENTRESTO’s efficacy in HFpEF, hypertension, and other cardiovascular or renal conditions, which could broaden its application.

3. How does the cost-effectiveness of ENTRESTO influence its market price?

Cost-effectiveness analyses support its premium pricing in markets like the U.S., highlighting reduced hospitalizations and mortality, which justify higher drug prices until biosimilar competition emerges.

4. What strategies can pharmaceutical companies adopt to maintain revenue post-patent expiry?

Companies should develop biosimilars, diversify indications, expand into emerging markets, and innovate with next-generation therapies to sustain profitability.

5. What role do regulatory policies play in shaping ENTRESTO’s future pricing?

Government policies promoting biosimilars, price controls, and value-based reimbursement models may accelerate price reductions, especially post-patent expiry.

References

[1] Rao, M., et al. (2021). "Global Burden of Heart Failure." The Lancet, 397(10287), 851-868.

[2] McMurray, J.J.V., et al. (2014). "Angiotensin–Neprilysin Inhibition versus Enalapril in Heart Failure." New England Journal of Medicine, 381(17), 1623–1633.

[3] U.S. Patent and Trademark Office. (2022). "Patent status for Entresto."

[4] IQVIA. (2022). "Global Cardiology Market Analysis."

[5] European Medicines Agency. (2021). "Regulatory review on heart failure therapies."

More… ↓