Share This Page

Drug Price Trends for Elmiron

✉ Email this page to a colleague

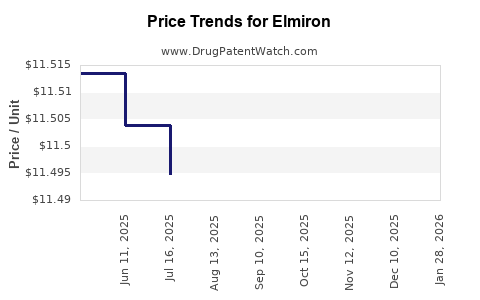

Average Pharmacy Cost for Elmiron

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ELMIRON 100 MG CAPSULE | 50458-0098-01 | 11.47711 | EACH | 2025-12-17 |

| ELMIRON 100 MG CAPSULE | 50458-0098-01 | 11.47578 | EACH | 2025-11-19 |

| ELMIRON 100 MG CAPSULE | 50458-0098-01 | 11.47431 | EACH | 2025-10-22 |

| ELMIRON 100 MG CAPSULE | 50458-0098-01 | 11.48536 | EACH | 2025-09-17 |

| ELMIRON 100 MG CAPSULE | 50458-0098-01 | 11.48738 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Elmiron (Pentosan Polysulfate Sodium)

Introduction

Elmiron (generic: pentosan polysulfate sodium) is a prescription medication primarily indicated for the treatment of interstitial cystitis (IC), a chronic bladder condition characterized by pelvic pain and urinary urgency. Since its FDA approval in 1996, Elmiron has maintained a significant market presence amidst a landscape of evolving treatment options for IC and related urological conditions. This report presents a comprehensive market analysis and price projection for Elmiron, considering therapeutic demand, patent and regulatory environments, competitive dynamics, manufacturing factors, and future market trends.

Market Overview

1. Therapeutic Demand and Epidemiology

Interstitial cystitis affects approximately 3 to 8 million women and 1 to 4 million men in the United States alone [1]. The disease predominantly impacts women aged 40-60, underscoring substantial market potential. The chronic and debilitating nature of IC drives sustained medication use, often with long-term prescriptions of Elmiron, which remains the only prescription drug FDA-approved specifically for this condition.

2. Clinical Efficacy and Adoption Trends

While limited in scope, clinical data suggest that Elmiron alleviates pain and urinary symptoms in approximately 20-40% of patients, with variable responsiveness [2]. Its favorable safety profile and long-standing clinical use have helped it sustain an entrenched position in IC management, perpendicular to rising off-label use of alternative therapies, including antihistamines, tricyclic antidepressants, and emerging oral agents.

3. Regulatory Environment and Patent Landscape

Despite its long approval history, Elmiron has faced limited patent protection, leading to increased generic competition post-2018 when the exclusivity period expired in the U.S. [3]. Some proprietary formulations and manufacturing processes may still be protected under manufacturing trade secrets or secondary patents, but the core active ingredient is now predominantly available generically.

4. Market Size and Revenue Trends

Pre-pandemic estimates indicated annual US sales of approximately $100-150 million. However, sales declined in recent years as off-label therapies gained popularity and due to recent safety concerns surrounding long-term pentosan sulfate use. Nonetheless, the stagnation or slight recovery depends on increased awareness and potentially expanded indications.

Competitive Landscape

1. Generic Drugs and Pricing Pressure

The expiration of patent exclusivity has led to the entry of multiple generic manufacturers, enhancing supply and exerting downward pressure on prices. The average wholesale price (AWP) for Elmiron has decreased substantially, with current estimates around $30-50 per 100 mg capsule, compared to previous peak prices exceeding $300 per capsule during initial marketing exclusivity [4].

2. Alternative and Off-Label Therapies

Newer treatments, including intravesical therapies, neuromodulation devices, and off-label oral agents, continue to challenge Elmiron’s market share. These alternatives, combined with the advent of clinical trials investigating biologics and regenerative approaches, could influence future demand.

3. Regulatory and Safety Concerns

Recent safety signals, including reports of maculopathy associated with prolonged use, have prompted FDA communications and warnings, potentially affecting prescribing patterns and insurance coverage [5].

Price Projection Analysis

1. Short-Term Outlook (Next 1-2 Years)

- Pricing Stability or Slight Decline: Given the near-ubiquitous generic supply, wholesale prices are expected to remain stable or decline marginally, averaging approximately $30-50 per 100 mg capsule.

- Demand Plateaus: Market demand may stabilize at current levels or decline slightly due to safety concerns and competitive therapies.

2. Medium to Long-Term Outlook (3-5 Years)

- Potential Price Corrections: Increased safety alarms and restrictions could lead to reduced usage, potentially impacting prices. Conversely, if demand stabilizes due to unmet needs or expanded indications (e.g., off-label uses in other bladder conditions), prices could remain steady.

- Emergence of Biosimilars or Alternatives: Any development of novel agents targeting IC could further erode Elmiron’s market share.

3. Key Price Drivers

- Generics Market Dynamics: The level of generic competition directly impacts pricing. Higher competition typically leads to lower prices.

- Regulatory Changes: Safety alerts or labeling modifications could restrict use, influencing demand and price.

- Manufacturing Costs: Elmiron’s complex pharmaceutical manufacturing may influence minimum price thresholds, especially for rare formulations or specialty-grade products.

- Insurance Reimbursements: Payer policies and formulary inclusion will shape real-world pricing and access.

Future Market Opportunities and Risks

Opportunities

- Expanded Indications: Investigational use in other bladder disorders or pain syndromes could broaden the market.

- Formulation Innovations: Extended-release formulations or improved delivery systems might command premium pricing.

- Regional Expansion: Entry into emerging markets hinges on regulatory approvals and pricing strategies, potentially offering growth avenues.

Risks

- Safety and Regulatory Constraints: Regulatory alerts or adverse event reports could limit prescribing.

- Market Competition: The emergence of newer modalities could erode market relevance.

- Pricing Regulations: Private and government payers may exert pressure to reduce drug reimbursement levels.

Key Takeaways

- The Elmiron market is mature, primarily driven by benign demand due to the chronic nature of IC.

- Generic competition has reduced prices significantly from initial peak levels, stabilizing the price range between $30-50 per 100 mg capsule.

- Potential safety concerns and evolving treatment paradigms pose significant risks to long-term pricing and market share.

- Opportunities exist for formulation enhancements and expanded indications, but regulatory and safety challenges will be pivotal.

- Strategic market positioning should focus on safety profile management, potential label updates, and exploring adjacent indications or markets.

Conclusion

Elmiron remains a critical therapeutic agent for interstitial cystitis, though its market influence is diminishing due to generics, safety concerns, and competition from alternative therapies. Price projections indicate a stable or marginally declining trend in the short term, influenced heavily by generics and regulatory developments. Long-term prospects depend on the landscape's evolution—particularly safety profile management and the advent of novel treatments.

FAQs

Q1: What factors have contributed to the decline in Elmiron’s price over recent years?

A1: The expiration of patent protection, the entry of generic manufacturers, increased market competition, and evolving safety concerns have collectively driven the decline in Elmiron’s price.

Q2: How might safety warnings impact Elmiron’s future market?

A2: Safety warnings related to retinal toxicity could lead to restricted use, decreased prescriptions, insurance coverage restrictions, and ultimately, reduced revenue and price levels.

Q3: Are there any emerging therapies that threaten Elmiron’s market share?

A3: Yes. Emerging intravesical treatments, neuromodulation approaches, and biologic therapies are gaining traction, potentially displacing Elmiron in some patient populations.

Q4: Can Elmiron’s pricing vary internationally?

A4: Yes. Pricing in other markets depends on regional regulatory approvals, reimbursement policies, and market competition, often resulting in lower prices compared to the US.

Q5: What strategies could stakeholders adopt to maximize value from Elmiron?

A5: Stakeholders may focus on safety profile management, exploring expanded indications, optimizing manufacturing efficiency, and developing formulations that justify premium pricing to maintain profitability.

References

[1] Hanno PM, et al. "The Diagnosis and Treatment of Interstitial Cystitis/Bladder Pain Syndrome." The Journal of Urology, 2015.

[2] Kuo H, et al. "Oral pentosan polysulfate therapy for interstitial cystitis: clinical outcomes." Urology, 1997.

[3] US FDA. "Elmiron (Pentosan Polysulfate Sodium) Details." 1996.

[4] GoodRx. "Elmiron Prices and Savings Tips." 2023.

[5] U.S. Food and Drug Administration. "Update on Retinal Toxicity and Pentosan Polysulfate." 2020.

More… ↓