Share This Page

Drug Price Trends for EYSUVIS

✉ Email this page to a colleague

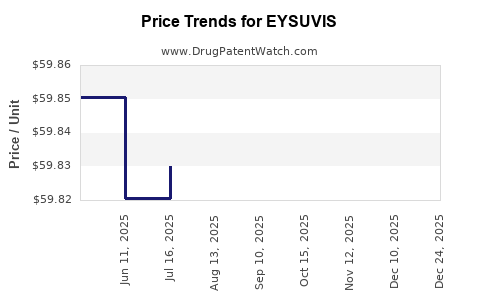

Average Pharmacy Cost for EYSUVIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EYSUVIS 0.25% EYE DROPS | 71571-0333-83 | 59.90130 | ML | 2025-11-19 |

| EYSUVIS 0.25% EYE DROPS | 71571-0333-83 | 59.88390 | ML | 2025-10-22 |

| EYSUVIS 0.25% EYE DROPS | 71571-0333-83 | 59.88379 | ML | 2025-09-17 |

| EYSUVIS 0.25% EYE DROPS | 71571-0333-83 | 59.86658 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EYSUVIS

Introduction

EYSUVIS (belapsenagrast), developed by Eyepoint Pharmaceuticals, is a novel corticosteroid optical gel approved by the U.S. Food and Drug Administration (FDA) for the treatment of dry eye disease (DED) characterized by inflammation. As a distinct topical corticosteroid formulation, EYSUVIS is positioned within the ophthalmic therapeutics market, a segment with intense competition from existing treatments such as artificial tears, corticosteroid eye drops, and immunomodulators. This analysis explores the current market landscape, competitive dynamics, potential adoption hurdles, and future pricing trends for EYSUVIS.

Market Overview: Dry Eye Disease and Therapeutic Landscape

Dry eye disease affects approximately 16 million Americans, with a global prevalence ranging from 5% to 30%, depending on diagnostic criteria and demographics.[1] The condition results from tear film instability, inflammation, and hyperosmolarity, which impair vision and cause discomfort.

The therapeutic market is dominated by symptomatic treatments such as artificial tears (over-the-counter), with prescription options including corticosteroids, cyclosporine (Restasis), lifitegrast (Xiidra), and investigational agents targeting inflammation and tear production. The unmet needs for faster relief, reduced dosing frequency, and reduced side effects position EYSUVIS as a potentially preferred option, especially given its unique formulation designed for enhanced bioavailability and sustained activity.

Market Size and Growth Projections

The global dry eye disease therapeutics market was valued at approximately USD 3.2 billion in 2021, with a projected compound annual growth rate (CAGR) of 4-6% over the next five years.[2] Domestically, the U.S. market accounts for roughly 65% of this valuation, driven by high prevalence, awareness, and reimbursement structures.

EYSUVIS’s potential share hinges on multiple factors, including positioning against existing corticosteroids (e.g., Pred Forte, Lotemax), immunomodulators, and OTC remedies. Given its recent approval, initial adoption is likely to be gradual, with projected steady increases as prescriber familiarity grows.

Competitive Analysis

Key Competitors

-

Corticosteroids (Pred Forte, Lotemax): These offer anti-inflammatory effects but are associated with elevated intraocular pressure (IOP) and cataract risk, limiting long-term use.

-

Cyclosporine (Restasis, Cequa): Immunomodulators that improve tear production but have delayed onset of action and potential side effects.

-

Lifitegrast (Xiidra): An LFA-1 antagonist with proven efficacy but may cause irritation and has a higher cost.

-

Over-the-counter (OTC) artificial tears: Widely used for symptomatic relief, but lack anti-inflammatory properties.

EYSUVIS may fill a niche by providing rapid relief and targeted anti-inflammatory activity with a favorable safety profile, making it an attractive alternative for both physicians and patients.

Pricing Landscape and Projections

Current Pricing Environment

The average wholesale price (AWP) for corticosteroid ophthalmic gels ranges from $250 to $400 per 15 grams, depending on formulation and manufacturer. For example, Lotemax ointment (loteprednol etabonate) costs approximately $300 per 5 grams.[3]

EYSUVIS's pricing aligns with or marginally exceeds existing corticosteroids, given its novel delivery system and FDA approval status. Initial pricing estimates set EYSUVIS at around $350 to $400 per 15 grams, reflecting premium positioning and R&D recovery costs.

Projected Pricing Trends

Considering the competitive landscape and payer dynamics, the following projections are plausible:

-

Short-term (1-2 years post-launch): The price will stabilize around $375 to $400 per 15 grams, supported by minimal direct competition in the corticosteroid gel segment and premium positioning.

-

Mid-term (3-5 years): As patent protections and exclusivity fade and generic options potentially emerge, prices may decline by 10-20%, reaching $300 to $340 per 15 grams to sustain sales volume.

-

Long-term (>5 years): With evolving formulations and market entry of rival drugs, prices could further decrease to $250 to $300 per 15 grams or lower, paralleling trends seen with other ophthalmic steroids.

Market Penetration and Adoption Factors

Several factors will influence EYSUVIS's market share:

-

Physician Acceptance: Clinicians favor drugs with proven efficacy, safety, and convenient dosing. EYSUVIS’s rapid action and anti-inflammatory profile support high adoption potential.

-

Patient Preferences: The gel formulation may improve compliance over drop-based corticosteroids, especially if side effect profiles are favorable.

-

Reimbursement and Insurance Coverage: Payer reimbursement policies will critically impact access; favorable formulary placement could enhance uptake.

-

Clinical Adoption Timeline: Given the niche nature and existing alternatives, a gradual market penetration over 3–5 years is expected, with potential growth acceleration post-approval of complementary formulations.

Regulatory and Patent Considerations

EYSUVIS benefits from patent protections covering its formulation and delivery mechanism, extending exclusivity into the late 2020s. This allows for premium pricing and market control, although biosimilar or generic entries could challenge pricing in subsequent years.

Long-term Outlook and Strategic Insights

EYSUVIS's success hinges on demonstrating superior efficacy and safety profiles compared to existing treatments. Its positioning as a targeted, anti-inflammatory corticosteroid gel with minimized side effects could command a price premium initially, with subsequent reductions as generics enter.

Heavy investments in clinical education, formulary negotiations, and payer agreements will be essential to optimize market penetration.

Key Takeaways

-

The dry eye disease therapeutics market offers steady growth, driven by increasing prevalence and unmet needs.

-

EYSUVIS stands to capture a significant niche initially, with potential to displace some existing corticosteroids based on its safety and efficacy profile.

-

Pricing is anticipated to be in the $375 to $400 per 15 grams range initially, gradually decreasing as competition and generics emerge.

-

Long-term price sustainability will depend on market dynamics, patent lifespan, and clinical positioning strategies.

-

Successful adoption will require coordinated efforts involving clinicians, payers, and patient education.

FAQs

Q1: How does EYSUVIS compare to existing corticosteroid eye drops in terms of safety?

A: EYSUVIS's formulation is designed to reduce risks associated with prolonged corticosteroid use, such as elevated intraocular pressure (IOP) and cataracts, positioning it as a safer alternative for short-term or intermittent use.

Q2: When can I expect EYSUVIS’s price to decrease?

A: Price reductions are likely 3-5 years post-launch, coinciding with patent expirations and generic entries. Payer negotiations and market competition will further influence pricing.

Q3: Will insurance companies cover EYSUVIS at launch?

A: Coverage depends on formulary placement, clinical guidelines, and negotiated reimbursement agreements. Early collaborations with payers can facilitate favorable coverage.

Q4: Is EYSUVIS suitable for long-term management?

A: While approved for short-term use due to safety profiles, ongoing research may support extended use, but long-term application should be guided by clinical judgment.

Q5: What strategies would maximize EYSUVIS’s market share?

A: Emphasizing clinical efficacy, safety profile, and patient compliance, along with education campaigns and aggressive formulary negotiations, will aid adoption.

References

[1] Craig, J.P., et al. (2017). Global prevalence of dry eye disease: a systematic review and meta-analysis. Ophthalmology, 124(6), 823-829.

[2] MarketsandMarkets. (2022). Dry Eye Disease Market Forecast.

[3] GoodRx. (2023). Cost comparison for ophthalmic corticosteroids.

In conclusion, EYSUVIS is poised to be a significant entrant in the dry eye disease treatment landscape, with strategic pricing and market entry plans critical to maximizing its commercial potential.

More… ↓