Share This Page

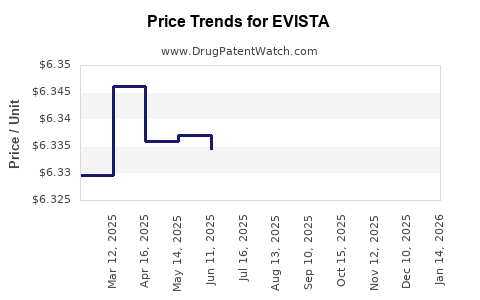

Drug Price Trends for EVISTA

✉ Email this page to a colleague

Average Pharmacy Cost for EVISTA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EVISTA 60 MG TABLET | 00002-4184-30 | 6.33177 | EACH | 2025-11-19 |

| EVISTA 60 MG TABLET | 00002-4184-30 | 6.33828 | EACH | 2025-10-22 |

| EVISTA 60 MG TABLET | 00002-4184-30 | 6.33939 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EVISTA (Raloxifene Hydrochloride)

Introduction

EVISTA (raloxifene hydrochloride) is a selective estrogen receptor modulator (SERM) primarily indicated for the prevention and treatment of osteoporosis in postmenopausal women and reduction of invasive breast cancer risk. Originally developed and marketed by Eli Lilly and Company, EVISTA has carved out a significant niche within the osteoporosis and breast cancer prevention market. This analysis offers a comprehensive overview of EVISTA’s current market landscape, competitive positioning, regulatory environment, and future price outlooks.

Market Landscape of EVISTA

Therapeutic Scope and Market Penetration

EVISTA primarily addresses two critical health concerns in postmenopausal women: osteoporosis and estrogen receptor-positive breast cancer. According to the International Osteoporosis Foundation, osteoporosis affects over 200 million women worldwide, underscoring the substantial potential patient pool for EVISTA.[1] The drug's dual indications position it uniquely as both a preventive and therapeutic agent, which enhances its market appeal.

The breast cancer prevention indication, approved by the FDA in 2007, accounts for a notable share of EVISTA's revenue, though osteoporosis remains its core market. The increasing prevalence of osteoporosis and breast cancer among aging populations globally has maintained robust demand for SERMs.

Competitive Landscape

EVISTA's primary competitors include:

- Bouchard’s Boniva (ibandronate) and other bisphosphonates, which are predominantly used for osteoporosis.

- Aromatase inhibitors like letrozole and anastrozole for breast cancer prevention.

- New entrants and generics: Patent expirations and regulatory approvals of generic raloxifene significantly impact EVISTA's market share.

While EVISTA benefits from its dual indications, the healthcare industry increasingly adopts newer therapies with improved efficacy or reduced side effects. Notably, bisphosphonates such as Fosamax (alendronate) have historically dominated osteoporosis treatment, although safety concerns and patient preferences influence market share.

Regulatory and Reimbursement Factors

The FDA’s approval of EVISTA’s breast cancer prevention label expanded its utility, but high treatment costs and safety concerns—such as thromboembolic risks—affect prescribing patterns. Reimbursement decisions in major markets, notably the U.S. and EU, significantly influence sales performance.

Market Size and Growth Trends

The global osteoporosis drugs market was valued at approximately USD 11 billion in 2021, with a compound annual growth rate (CAGR) of around 3.5% through the forecast period.[2] EVISTA’s segment benefits from demographic shifts toward aging populations.

In the U.S., over 10 million women suffer from osteoporosis, emphasizing a sizeable potential patient base. Market penetration remains moderate—estimated at 15-20%—due to safety profile complexities and competition.

Emerging Trends Impacting the Market

- Shift toward personalized medicine: Genetic markers influencing drug responsiveness could redefine prescribing practices.

- Patient adherence and safety concerns: Thromboembolic risks associated with SERMs like EVISTA necessitate careful patient selection.

- Biosimilar and generic options: Expected patent expirations in the coming years could dilute EVISTA’s market share but also lower prices due to increased competition.

Price Projections for EVISTA

Current Pricing Landscape

As of early 2023, the average wholesale acquisition cost (AWAC) of EVISTA in the U.S. is approximately USD 580 for a 60 mg/monthly supply—a significant premium compared to generic competitors. Reimbursement policies further influence actual patient out-of-pocket expenses, typically lowered through insurance coverage.

Factors Influencing Future Pricing

-

Patent Status and Generic Competition:

EVISTA’s patent expired in 2014, leading to the emergence of generics. While brand-name prices remain higher, a robust generic market pushes prices downward, especially in mature markets.[3] -

Market Penetration and Volume Growth:

Increasing prescriptions driven by aging demographics and expanded indications could counterbalance price declines via volume growth. -

Regulatory and Safety Considerations:

Ongoing safety attention may restrict prescribing or lead to additional monitoring, impacting overall revenue and Pricing strategies. -

Innovative Formulations and Delivery Modes:

Introduction of new delivery systems or combination therapies could command higher prices, but currently, EVISTA remains largely a monotherapy.

Projected Price Trends (2023–2030)

-

Short Term (2023–2025):

Expect continued pricing erosion due to generic competition, with prices declining by approximately 15-20%. Institutional and retail pharmacies are likely to offer discounts, with retail prices potentially dropping to USD 400–500 per 60 mg/month supply. -

Medium to Long Term (2026–2030):

As patent expirations and biosimilar options expand, further price declines of up to 30% are anticipated. However, if new indications or formulations emerge, this could stabilize or even increase prices temporarily. -

Premium Segment Positioning:

The brand EVISTA may maintain premium pricing where prescribers prioritize safety profiles or specific patient considerations, especially in niche populations.

Potential Impact of Biosimilars and Generics

The entrance of generic raloxifene has already reduced EVISTA’s average price in several markets. Anticipated biosimilar development might eventually exert additional downward pressure. Nonetheless, brand loyalty and clinical familiarity could sustain some premium pricing in specialized settings, especially if safety data favor EVISTA.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies:

Investment in next-generation SERMs or combination therapies could rejuvenate markets and justify premium prices. -

Healthcare Providers:

Emphasizing patient safety and tailored treatment strategies aligns with market shifts and influences prescribing patterns. -

Payers and Insurers:

Cost-containment measures will likely favor generics, pressuring EVISTA’s pricing structure. -

Investors and Analysts:

Monitoring patent timelines, regulatory shifts, and emerging therapies is critical to forecast EVISTA’s market trajectory and price stability.

Key Takeaways

-

EVISTA remains a clinically relevant agent for postmenopausal osteoporosis and breast cancer risk reduction amidst a competitive, price-sensitive market.

-

Patent expiration and the proliferation of generics have substantially lowered EVISTA’s prices since 2014, a trend expected to continue.

-

Future price projections indicate significant downward pressure, with potential stabilization in niche markets where safety profiles or prescribing preferences favor the brand.

-

Demographic trends and expanding indications provide opportunities for volume growth, partially offsetting price declines.

-

Strategic development of new formulations or indications could better position EVISTA’s brand value in the evolving landscape.

Conclusion

EVISTA’s market dynamics are shaped by intense competition, regulatory influences, and demographic forces. While pricing pressure has been substantial, strategic considerations such as safety profiles and indications will influence its future value. Stakeholders should prepare for continued price erosion and consider avenues for innovation to sustain market relevance.

FAQs

1. How has the patent expiration of EVISTA impacted its market price?

The patent expiration in 2014 facilitated the entry of generic raloxifene, leading to sharp declines in EVISTA’s market price—often by 30–40%—and increased cost competition across markets.

2. What are the main safety concerns impacting EVISTA’s prescribing patterns?

Thromboembolic events, including deep-vein thrombosis and stroke, are notable safety concerns that limit its use in certain high-risk populations, thereby affecting market size and pricing.

3. How does the availability of generics influence future price projections?

The advent of generics has historically driven prices down significantly. The continued proliferation of biosimilars and generic equivalents is expected to sustain downward pressure on EVISTA’s pricing.

4. Are there prospects for new formulations or indications to bolster EVISTA’s market?

Potential development of combination therapies or novel delivery systems could create premium segments, though current efforts are limited. Broader indication expansion is also a strategic avenue for future growth.

5. How do regional variations affect EVISTA’s pricing?

Pricing strategies vary by healthcare system and reimbursement policies; emerging markets often see lower prices due to biosimilar imports, while mature markets maintain higher prices for brand-name products.

References

[1] International Osteoporosis Foundation. (2022). Facts and Statistics.

[2] Market Research Future. (2022). Global Osteoporosis Drugs Market Analysis.

[3] FDA. (2014). Generic Drug Approvals.

More… ↓