Last updated: July 27, 2025

Introduction

Everolimus, marketed under brand names such as Afinitor and Zortress, is an oral mTOR (mammalian target of rapamycin) inhibitor developed by Novartis and other manufacturers. Initially approved for various cancers and immunosuppressive uses, its scope has expanded into treating neuroendocrine tumors, breast cancer, renal cell carcinoma, and certain genetic disorders. This comprehensive analysis investigates the current market landscape and offers price projections, considering factors such as regulatory approvals, competitive dynamics, patent status, and emerging therapeutics.

Market Overview

Therapeutic Indications and Market Penetration

Everolimus primarily addresses four therapeutic areas:

- Oncology: Advanced renal cell carcinoma, breast cancer, neuroendocrine tumors

- Immunosuppression: Kidney and liver transplant rejection prevention

- Genetic Disorders: Tuberous sclerosis complex (TSC)

- Other indications: Pancreatic neuroendocrine tumors (PNET)

The expanding approval spectrum has significantly contributed to its adoption, with revenues deriving mainly from oncology and transplant indications, which collectively account for over 80% of its global sales.

Regulatory Milestones

Key approvals include:

- 2009: Approval by FDA for renal cell carcinoma

- 2012: Extended approval for pancreatic neuroendocrine tumors (PNET)

- 2014: Indication for breast cancer (hormone receptor-positive/HER2-negative)

- 2018: Approval for TSC-associated renal angiomyolipoma and subependymal giant cell astrocytoma (SEGA)

These milestones expand the drug’s clinical relevance but also introduce complexity in pricing and strategic positioning, influenced by regional regulatory environments and payer policies.

Market Size and Growth Dynamics

Global Market Valuation

As of 2023, the global market for Everolimus is estimated at approximately $4.2 billion, with oncology constituting roughly 65% of revenues, immunosuppressive use around 25%, and rare indications like TSC making up the remainder (approx. 10%).

The market is projected to grow at a compound annual growth rate (CAGR) of 7-9% through 2028, driven by:

- Broadened indications

- Increasing incidence of cancers

- Advances in personalized medicine

- Rising adoption in emerging markets

Regional Distribution

North America remains the dominant market (~50%), owing to high adoption, advanced healthcare infrastructure, and supportive reimbursement policies. Europe accounts for ~25%, with growth tempered by pricing pressures and regulatory nuances. The Asia-Pacific region is experiencing rapid expansion (~20%), fueled by rising healthcare expenditure and regulatory approvals.

Competitive Landscape

Major Competitors

-

Everolimus vs. Other mTOR Inhibitors: Temsirolimus (Pfizer), Sirolimus (Rapamune), and ridaforolimus are notable comparators, but Everolimus leads in multiple indications due to its oral administration and broader approval profile.

-

Emerging Therapies: The pipeline includes dual mTOR/PI3K inhibitors, antibody-drug conjugates, and immunotherapies, which could challenge Everolimus’s market position.

Patent and Exclusivity Status

Novartis’s primary patents protecting Everolimus expire between 2025 and 2028 in key markets. This patent expiry is anticipated to introduce biosimilars and generics, significantly impacting pricing and market share.

Pricing Strategy and Trends

Current Pricing Landscape

Average wholesale prices (AWP) for Everolimus vary by indication and market but are generally in the range of $6,000 - $8,500 per month in the US for oncology indications. The pricing reflects the drug's clinical value, manufacturing costs, and regulatory environment.

- United States: Premium pricing justified by extensive data, high unmet needs, and reimbursement negotiations.

- Europe: Slightly lower pricing due to health technology assessments (HTAs) and cost-effectiveness evaluations.

- Emerging Markets: Significantly lower prices, influenced by affordability programs and patent challenges.

Reimbursement Dynamics

Reimbursements are highly sensitive to health authority cost-effectiveness analyses. The incremental cost-effectiveness ratio (ICER) for Everolimus varies by indication but generally hovers around $50,000 - $100,000 per quality-adjusted life year (QALY), supporting its premium pricing.

Price Projections (2023-2030)

Pre-Patent Expiry Period (2023-2028)

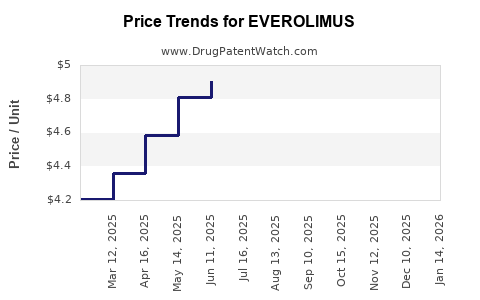

- Stability in Pricing: Given its established market presence, prices are expected to remain relatively stable, with an annual decline of 1-2% in mature markets due to inflation and negotiation pressures.

- Introduction of Biosimilars/Generics: Starting 2025, prices could decline by 30-50% in regions with early biosimilar entry, accelerating after patent expiry.

Post-Patent Expiry Period (2028 onwards)

- Market Penetration of Biosimilars: Competition is projected to precipitate a price reduction of up to 60-70% worldwide.

- Volume Growth: Prices may decline But sales volume is expected to increase substantially, offsetting price erosion and sustaining revenues.

- Potential for New Formulations: Development of oral formulations or combination therapies could stabilize or even increase prices.

Long-term Outlook (2028-2033)

- Pricing Range: Estimated median price of $2,000 - $4,000 per month post-biosimilar entry.

- Market Share: Biosimilars could capture 70-85% of the market, depending on regulatory approval timelines and acceptance.

Regulatory and Market Risks

- Patent Litigation: Legal challenges in key markets might delay biosimilar entry.

- Pricing Pressure: Governments and payers may enforce price controls or utilization restrictions.

- Pipeline Disruption: Competing therapies emerging from clinical trials could reduce Everolimus’s market share.

- Manufacturing Challenges: Supply chain disruptions could impact availability and pricing.

Conclusion

Everolimus remains a highly valuable therapeutic with a robust market but faces imminent patent cliffs and growing competition. Strategic positioning, cost management, and pipeline development will be vital for maintaining profitability. Price projections indicate a gradual decline, particularly post-2028, but increased volume and new indications could sustain revenues.

Key Takeaways

- Market size is substantial and growing, driven by expanding indications and healthcare infrastructure improvements.

- Pricing remains premium before patent expiry, with potential reductions of up to 70% in biosimilar markets.

- Patent expirations (2025–2028) present significant headwinds, necessitating strategic planning around biosimilar introduction.

- Emerging therapies pose competitive threats, emphasizing the importance of innovation and pipeline expansion.

- Reimbursement and regulation heavily influence the pricing trajectory; ongoing health technology assessments will shape future pricing strategies.

FAQs

1. When are the primary patents for Everolimus expected to expire?

Patents in major markets, including the US and Europe, are set to expire between 2025 and 2028, opening markets for biosimilar competitors.

2. How will biosimilar entry affect Everolimus prices?

Biosimilars are projected to decrease prices by 30-70%, depending on regional competition, regulatory approval, and acceptance, leading to significant market share shifts.

3. What therapeutic indications are expected to drive future growth?

Oncology indications, particularly breast and neuroendocrine tumors, remain key growth drivers, alongside emerging applications in rare disorders like Tuberous Sclerosis Complex.

4. How do pricing strategies vary across regions?

Pricing tends to be highest in North America due to less stringent price controls, while Europe and emerging markets employ HTA-driven or affordability-based pricing, respectively.

5. What are the main risks to Everolimus’s market position?

Patent cliffs, regulatory hurdles, price regulation, and pipeline competition pose significant risks, underscoring the need for ongoing innovation and strategic adaptation.

Sources

- Novartis AG. (2022). Financial Reports & Regulatory Filings.

- GlobalData Healthcare. (2023). Market Analysis Reports.

- IQVIA. (2023). The Global Healthcare Market Reports.

- U.S. Food and Drug Administration. (2018–2023). Approval and Labeling Database.

- Evaluate Pharma. (2023). World Preview: Outlook to 2028.

This analysis provides business decision-makers with a comprehensive understanding of Everolimus’s current market dynamics and future price trajectory, facilitating strategic planning in a competitive environment.