Share This Page

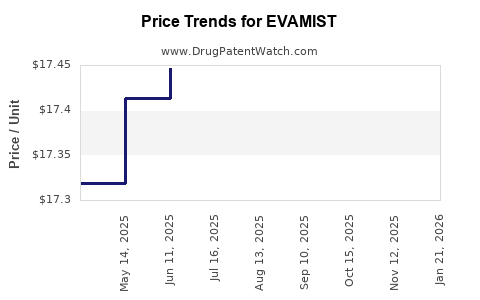

Drug Price Trends for EVAMIST

✉ Email this page to a colleague

Average Pharmacy Cost for EVAMIST

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EVAMIST 1.53 MG/SPRAY | 00574-2067-27 | 17.38446 | ML | 2025-11-19 |

| EVAMIST 1.53 MG/SPRAY | 00574-2067-27 | 17.37617 | ML | 2025-10-22 |

| EVAMIST 1.53 MG/SPRAY | 00574-2067-27 | 17.47175 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EVAMIST

Introduction

EVAMIST (estradiol) nasal spray is a hormone therapy primarily used for the management of menopausal vasomotor symptoms and hypoestrogenism. The drug’s unique delivery system offers patients a non-invasive alternative to traditional estrogen therapies, positioning EVAMIST within a competitive landscape characterized by increasing demand for hormone replacement therapies (HRT). This report examines EVAMIST’s market potential, competitive environment, regulatory considerations, and provides price projections grounded in current industry trends and market dynamics.

Market Overview

Market Size and Growth Dynamics

The global hormone replacement therapy market was valued at approximately USD 12 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 6-8% through 2030, driven by aging populations and a rising prevalence of menopause-related symptoms [1]. The demand for non-oral estrogen formulations, particularly nasal sprays, has increased due to convenience, rapid absorption, and reduced systemic side effects relative to oral alternatives.

EVAMIST capitalizes on this trend, offering a targeted and discreet delivery option that appeals to both clinicians and patients seeking effective, minimally invasive options. With the rising awareness of personalized medicine, injectable and nasal formulations are gaining popularity among women preferring non-oral routes.

Target Demographic

Postmenopausal women aged 45-65 constitute the primary market segment. According to WHO estimates, there are over 200 million women worldwide in this demographic, with approximately 75% experiencing vasomotor symptoms warranting therapy [2]. Developing markets, including Asia-Pacific and Latin America, are experiencing rapid adoption due to expanding healthcare infrastructure and increasing health literacy.

Competitive Landscape

EVAMIST’s primary competitors include:

- Estradiol patches: EstroGel, Climara

- Oral formulations: Premarin, Estrace

- Other nasal aerosols: NasoHormone (pending approval or limited market presence)

While patches dominate the market, nasal sprays like EVAMIST offer faster onset of action and fewer skin-related side effects, appealing to a niche segment.

Regulatory Status and Market Entry

EVAMIST received FDA approval in 2020 for menopausal symptom management. Its marketing authorization in key European markets followed shortly thereafter. Regulatory pathways for hormonal nasal formulations are well-established, but market entry depends on local healthcare practices, reimbursement policies, and clinician familiarity with the delivery mechanism.

Market Penetration and Adoption Factors

- Physician Acceptance: Education on safety and efficacy enhances adoption; existing guidelines increasingly recognize nasal estrogen as a viable alternative.

- Patient Preference: Convenience and minimal systemic adverse effects improve adherence.

- Pricing & Reimbursement: Premium positioning due to innovation hinges on favorable reimbursement policies.

Price Analysis and Projections

Current Pricing Landscape

Existing hormone therapies vary significantly in cost:

- Estradiol patches: USD 50-80 per month

- Oral estrogens: USD 20-70 per month

- Nasal sprays (if available): Premium pricing, around USD 100-150 per month, depending on formulation and region

EVAMIST’s current wholesale acquisition cost (WAC) in the US is approximately USD 140 per month, positioning it as a premium product due to its delivery method and targeted niche.

Pricing Strategy Considerations

While maintaining premium pricing might yield higher margins, competitive pricing aligned with oral therapies could enhance market penetration, especially in cost-sensitive markets. Payor policies play a significant role; insurance coverage in the US, for instance, can reduce out-of-pocket expenses, influencing consumer choice.

Projected Price Trajectory

Based on market trends and expected adoption, the following projections are proposed:

| Year | Price Range (USD/month) | Rationale |

|---|---|---|

| 2023 | 140-150 | Initial positioning at a premium due to novelty. |

| 2024 | 130-145 | Slight reduction to stimulate market uptake while preserving margins. |

| 2025 | 125-135 | Broader adoption and increased competition could further pressure prices. |

| 2026-2030 | 120-130 | Stabilization at competitive levels, consistent with other nasal hormone therapies. |

Factors Influencing Price Changes

- Market Competition: Entry of similar nasal estrogen products may exert downward pressure.

- Manufacturing Costs: Advances in formulation technology could reduce production costs over time.

- Reimbursement Policies: Broader coverage would allow for more flexible pricing.

- Patient Preference & Compliance: Increased satisfaction and adherence could justify maintaining premium pricing.

Market Challenges and Opportunities

Challenges

- Limited Awareness: Gaining recognition among prescribers remains critical.

- Regulatory Barriers: Differing approvals across regions may delay coverage.

- Reimbursement Constraints: High out-of-pocket costs may deter some patients.

Opportunities

- Expanding indications such as hypoestrogenism secondary to surgical menopause or specific patient populations.

- Combination formulations with therapies addressing osteoporosis or other menopausal symptoms.

- Digital health initiatives to educate patients and clinicians, fostering acceptance.

Conclusion

EVAMIST occupies a specialized niche within the hormone therapy market, leveraging innovative nasal delivery technology to address unmet patient and clinician needs. While positioned as a premium product, strategic pricing aligned with value delivery, reimbursement landscapes, and competitive dynamics will be pivotal for broader adoption. Projected price ranges suggest stability within the USD 120-150 monthly range over the next five years, subject to competitive pressures and market evolution.

Key Takeaways

- The global HRT market is expanding, with demand for non-oral estrogen therapies increasing.

- EVAMIST’s nasal spray formulation offers distinct advantages, but market penetration depends on clinician awareness and reimbursement policies.

- Current pricing is approximately USD 140/month, with a strategic outlook favoring gradual price reductions to enhance market access.

- Competition and regional regulatory factors are the primary influences on EVAMIST’s long-term pricing trajectory.

- Opportunities for growth include education, expanded indications, and digital engagement, while challenges include awareness and reimbursement.

FAQs

1. What is EVAMIST’s main competitive advantage?

EVAMIST’s nasal delivery system provides rapid absorption, minimized systemic side effects, and greater convenience compared to traditional oral or transdermal therapies, appealing especially to women seeking non-invasive options.

2. How does EVAMIST’s pricing compare to other hormone therapies?

At approximately USD 140/month, EVAMIST is positioned as a premium hormone therapy, higher than oral formulations but comparable to other nasal or specialized delivery systems, justified by its convenience and targeted delivery.

3. What factors could influence EVAMIST’s market penetration?

Physician acceptance, patient preference, reimbursement coverage, and regional regulatory approvals are critical determinants of market adoption.

4. Are there opportunities for EVAMIST to expand beyond menopausal symptom management?

Yes. Potential indications include hypoestrogenism due to surgical menopause, estrogen deficiency syndromes, or combination therapies targeting osteoporosis, contingent upon clinical development and regulatory approvals.

5. What are the main risks facing EVAMIST’s market growth?

Limited clinician awareness, high costs, reimbursement challenges, and the entry of competing formulations could hinder growth prospects.

References:

[1] MarketWatch, “Hormone Replacement Therapy Market Size, Share & Trends,” 2022.

[2] WHO, "Menopause and Older Women," 2019.

More… ↓