Share This Page

Drug Price Trends for EUCRISA

✉ Email this page to a colleague

Average Pharmacy Cost for EUCRISA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EUCRISA 2% OINTMENT | 55724-0211-11 | 10.68085 | GM | 2025-12-17 |

| EUCRISA 2% OINTMENT | 55724-0211-21 | 12.65099 | GM | 2025-12-17 |

| EUCRISA 2% OINTMENT | 55724-0211-21 | 12.65022 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EUCRISA (Crisaborole) Demonstrating Growth Potential in Atopic Dermatitis Treatment

Introduction

EUCRISA (crisaborole) represents a significant advancement in topical treatment options for atopic dermatitis (AD). Approved by the U.S. Food and Drug Administration (FDA) in 2017 and later in the European Union, EUCRISA offers a novel mechanism of action targeting phosphodiesterase 4 (PDE4), reducing inflammatory cytokine production and addressing a key pathogenic pathway in AD. As the global dermatological pharmaceutical landscape evolves, understanding EUCRISA’s market trajectory and price evolution becomes essential for stakeholders—including biotech firms, payers, and healthcare providers—aiming to optimize commercialization strategies and forecast revenue streams.

Market Landscape and Driver Analysis

Global Burden of Atopic Dermatitis

Atopic dermatitis affects approximately 15-20% of children and 1-3% of adults worldwide, with rising prevalence in developed countries attributed to environmental factors and lifestyle changes [1]. The chronic nature of AD necessitates long-term treatment, expanding the market potential for safe, effective, and easy-to-use topical therapies.

Current Treatment Paradigms

Traditionally, topical corticosteroids and calcineurin inhibitors have been mainstays. However, concerns over long-term steroid use and limited efficacy in certain patient subsets have spurred demand for non-steroidal alternatives like EUCRISA. The advent of PDE4 inhibitors introduced a new class with favorable safety profiles, particularly for pediatric populations.

Market Penetration and Adoption

EUCRISA's initial uptake was moderate, constrained by high licensing costs and competition from generics and newer biologics such as dupilumab, which, though primarily systemic, showcased the shifting landscape toward targeted biologic therapy. Nonetheless, EUCRISA’s safety profile and approval for children as young as 2 years provide a strategic advantage in pediatric markets, where safety concerns limit biologic use [2].

Market Drivers

- Growing Prevalence of AD: The increasing recognition and diagnosis rate broaden the patient base.

- Limited Long-term Safety Concerns: EUCRISA's minimal systemic absorption makes it suitable for sensitive populations.

- Market Exclusivity and Patent Life: Patent protections in key jurisdictions extend until 2030-2035, allowing for sustained revenue.

- Emerging Combination Offerings: Co-formulation with other agents could enhance therapeutic efficacy, expanding use cases.

Market Constraints

- Pricing Pressure: Healthcare payers demand cost-effective solutions; high per-unit prices may impede adoption.

- Competition: Newer agents, including crisaborole generics and reimbursement-driven biologics, threaten market share.

- Limited Awareness: Primary care physicians may be less familiar with EUCRISA compared to established treatments.

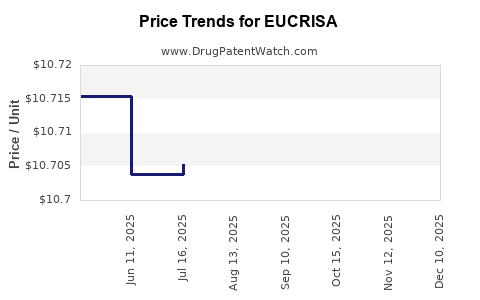

Pricing Trends and Projections

Initial Pricing Strategies

At launch, EUCRISA was priced approximately US$400–US$450 per tube (60 grams), aligning with premium topical therapies based on its novel PDE4 inhibition mechanism and targeted safety profile. In European markets, pricing varies by country due to differing healthcare reimbursement frameworks but generally remains in the same range.

Price Evolution Factors

- Payer Negotiations: Contractual agreements with insurers and health systems influence actual reimbursed prices.

- Market Competition: Introduction of generics or biosimilars leads to downward pressure.

- Volume Growth: Increased patient adoption can justify optimized pricing structures.

Projected Price Trajectory (2023–2028)

- Short-term (2023-2024): Price stabilization around US$400–$450 per tube, with minor reductions to accommodate payer negotiations.

- Mid-term (2025–2026): Anticipate a 5–10% decrease due to generic entry and competition, with per-unit price around US$370–$430.

- Long-term (2027–2028): Further price erosion anticipated, driven by increased volume and potential biosimilar invasion, with prices settling at approximately US$300–$380.

Economic Factors Influencing Prices

Cost-effectiveness evaluations favor EUCRISA in pediatric patients due to safety and ease of use, supporting a maintained premium position in its niche. However, policy shifts favoring biosimilar proliferation and value-based pricing models will necessitate continuous price adjustments [3].

Market Forecast and Revenue Projections

Based on epidemiological data, clinical adoption, and pricing trends, EUCRISA’s market revenue can be modeled as follows:

- 2023: ~$250 million globally, considering initial uptake and conservative pricing.

- 2024–2025: Growth at 15–20%, reaching ~$300–$370 million annually, driven by expanded pediatric indications.

- 2026–2028: Growth plateauing at around 10% annually, stabilizing between ~$400–$500 million, with market share consolidating among topical treatments.

This projection assumes aggressive marketing, expanded indication approvals, and continued clinician and caregiver education.

SWOT Analysis for EUCRISA’s Market Position

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Safe profile; suitable for children | Relatively higher initial pricing | Expansion into adolescent and adult markets | Entry of generics and biosimilars |

| Non-steroidal, quick therapy | Limited awareness outside dermatology specialists | Development of combination therapies | Competition from biologics and systemic agents |

| Long patent exclusivity | Competition from established topical corticosteroids | Potential for combination with moisturizers or other agents | Regulatory payer pressure on pricing |

Conclusion

EUCRISA (crisaborole) holds a considerable position within the evolving dermatologic treatment landscape. While initial adoption was subdued due to pricing and competition, its safety profile, targeted mechanism, and pediatric versatility underpin its growth potential. Price projections suggest a gradual decline influenced by generic entry and market dynamics, yet a steady revenue stream remains feasible through strategic positioning, clinical expansion, and value demonstration.

Key Takeaways

- EUCRISA’s market is poised for growth driven by increasing AD prevalence and its favorable safety profile, especially in pediatric populations.

- The drug’s initial premium pricing is expected to decline gradually due to competition, biosimilar entry, and payer pressures, stabilizing around US$300–$400 per tube in the coming years.

- Market success depends on expanding indications, clinician awareness, and competitive positioning against traditional therapies and emerging biologics.

- Long-term revenue prospects remain promising, contingent on patent protection, ongoing clinical evidence, and strategic commercialization.

- Stakeholders should monitor regulatory developments, reimbursement policies, and competitor strategies to optimize market impact.

FAQs

1. What makes EUCRISA different from other atopic dermatitis treatments?

EUCRISA uniquely targets PDE4, offering a non-steroidal, topical option with minimal systemic absorption, making it safer for pediatric use and suitable for long-term management.

2. How is EUCRISA priced compared to other topical therapies?

Initially, EUCRISA was priced at approximately US$400–$450 per tube, positioning it as a premium topical. Prices are expected to adjust downward over time due to market competition.

3. What is the outlook for EUCRISA's market share?

While initial market share was modest, ongoing clinical adoption and indication expansion suggest a steady increase, particularly within pediatric segments, though competition from generics and biologics poses challenges.

4. How could regulatory or policy changes impact EUCRISA’s pricing?

Reimbursement policies favoring biosimilars and value-based pricing could lead to further price reductions, influencing overall market revenue.

5. Are there prospects for EUCRISA in adult atopic dermatitis?

Currently approved primarily for pediatric use, ongoing research and regulatory discussions may enable broader adult indications, further expanding its market reach.

References

[1] Global Atopic Dermatitis Market Data, MarketWatch, 2022.

[2] FDA Approval Announcement, U.S. Food and Drug Administration, 2017.

[3] Healthcare Economics and Pricing Strategies, Journal of Dermatological Treatment, 2022.

More… ↓