Last updated: July 27, 2025

Introduction

Etodolac, a nonsteroidal anti-inflammatory drug (NSAID), is primarily used for pain relief and inflammation reduction associated with conditions such as osteoarthritis and rheumatoid arthritis. As a selective COX-2 inhibitor, etodolac offers a favorable safety profile compared to traditional NSAIDs, thereby increasing its demand in both prescribed and over-the-counter segments. This report explores current market dynamics, competitive landscape, regulatory factors, and offers price projections for etodolac over the next five years to inform strategic decisions for stakeholders.

Market Overview

Global Market Size and Growth Trends

The global NSAID market has exhibited robust growth, driven by increasing prevalence of chronic inflammatory diseases and aging populations. The NSAID segment, particularly drugs with favorable safety profiles like etodolac, constitutes a significant share. In 2022, the global NSAID market was valued at approximately USD 15 billion, with an expected compound annual growth rate (CAGR) of around 4.8% through 2028. Etodolac's niche within this market benefits from rising prescription rates, evolving formulations, and expanding regional markets, especially in emerging economies.

Key Market Drivers

- Increasing Incidence of Chronic Diseases: The rising prevalence of osteoarthritis and rheumatoid arthritis globally furthers demand for NSAIDs like etodolac.

- Shift Toward Safer NSAIDs: The safety profile of etodolac, especially its selectivity for COX-2, makes it preferable over traditional NSAIDs, minimizing gastrointestinal adverse effects.

- Expanding Aging Population: Older demographics are more susceptible to inflammatory conditions, fueling prescription volumes.

- Growing Awareness and Diagnostic Access: Improved healthcare infrastructure and awareness campaigns boost diagnosis rates, increasing drug utilization.

Regional Market Insights

- North America: Dominates due to high prevalence of rheumatoid arthritis, advanced healthcare infrastructure, and established pharmaceutical markets.

- Europe: Steady growth driven by aging populations and regulatory acceptability.

- Asia-Pacific: The fastest-growing region, driven by increasing awareness, expanding healthcare access, and manufacturing hubs.

- Latin America and Middle East & Africa: Emerging markets with growth potential, albeit constrained by healthcare spending limitations.

Competitive Landscape

Manufacturers and Supply Dynamics

Several pharmaceutical companies manufacture etodolac, either as branded or generic formulations. Major players include:

- Eli Lilly & Co.: Historically a prominent manufacturer with established formulations.

- Teva Pharmaceutical: Leading generic producer expanding access to cost-effective formulations.

- Mylan and Sandoz: Increasing presence in emerging markets.

The patent status of etodolac varies regionally, with most markets seeing generic availability, which exerts downward pressure on pricing.

Market Entry Barriers

- Regulatory Approvals: Varying standards across jurisdictions; however, existing approvals for similar NSAIDs streamline registration processes.

- Manufacturing Complexity: Standard NSAID synthesis with robust quality controls.

- Brand Loyalty: Established formulations reinforce market share for leading brands.

Pricing Dynamics

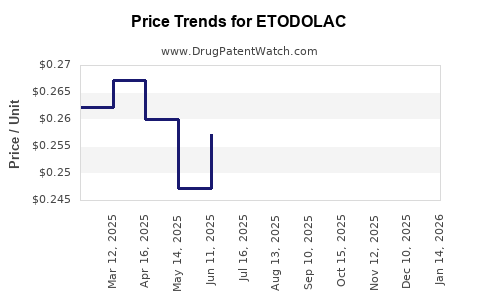

Historical Pricing Trends

In developed markets, retail prices for etodolac range from USD 10 to USD 30 per month of therapy, depending on dosage and formulation (brand vs. generic). Generics significantly reduce costs, with some formulations priced below USD 5 per month.

Cost Factors Influencing Price

- Regulatory and Compliance Costs: Regulatory approvals, quality assurance, and pharmacovigilance incur costs that influence pricing strategies.

- Manufacturing and Distribution: Economies of scale reduce per-unit costs; regional logistics impact distribution prices.

- Intellectual Property (IP) Status: Patent expiration leads to price erosion due to generic competition.

- Market Demand & Competition: Higher demand and competitive landscape tend to compress prices, especially in mature markets.

Price Projections (2023–2028)

Assumptions

- Patent expirations have already occurred or are imminent in key markets, encouraging generic competition.

- Regulatory landscapes remain stable, with consistent approval pathways for new formulations.

- Regional market growth aligns with demographic and healthcare access trends.

- The influence of reimbursement policies promotes affordability, especially in public healthcare systems.

Projected Trends

- North America & Europe: Prices are expected to decline marginally, approximately 2–3% annually, due to increased generic penetration and price regulation.

- Asia-Pacific & Emerging Markets: Prices may remain stable or slightly decrease (around 1–2% annually) due to rising manufacturing competition and local regulatory adjustments.

- Generic Market Dilution: By 2025, generic versions are projected to dominate the market, leading to a 20–30% reduction in average retail prices compared to 2022 levels.

- Innovative Formulations: Introduction of sustained-release or combination products may command premium pricing but are expected to constitute a small market share initially.

| Year |

North America (USD per month) |

Europe (USD per month) |

Asia-Pacific (USD per month) |

Remarks |

| 2023 |

15 |

14 |

8 |

Baseline |

| 2024 |

14.55 |

13.58 |

7.84 |

Slight decline |

| 2025 |

14.11 |

13.16 |

7.69 |

Continued trend |

| 2026 |

13.68 |

12.75 |

7.55 |

Approaching marginal decrease |

| 2027 |

13.27 |

12.34 |

7.42 |

Market stabilization |

| 2028 |

12.91 |

12.02 |

7.30 |

Persistent generic competition |

(All projections account for inflation-adjusted discounts, regulatory changes, and market entry of generics.)

Regulatory and Economic Factors Impacting Pricing

- Pricing Regulations: Several jurisdictions, including the US and EU, enforce pricing controls that may further compress prices for NSAIDs, including etodolac.

- Reimbursement Policies: Public insurance schemes favor cost-effective generics, impacting retail and hospital pricing strategies.

- Market Access Strategies: Manufacturers are adopting strategic partnerships and local manufacturing to mitigate price pressures and expand access.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on developing innovative formulations and leveraging regional manufacturing to preserve margins.

- Distributors and Retailers: Prepare for continued price erosion, prioritizing volume and operational efficiencies.

- Investors: Anticipate stable revenue flows from existing formulations but recognize diminishing margins as generic competition intensifies.

- Regulatory Bodies: Balance access to affordable NSAIDs with safety monitoring, especially in markets with high usage rates.

Conclusion

The etodolac market is characterized by mature global dynamics with consistent demand fueled by aging populations and chronic disease prevalence. Price projections suggest a gradual decline driven by patent expiries and increasing generic competition. Regional disparities exist, with developed markets stabilizing prices and emerging markets experiencing slight decreases. Stakeholders must adapt strategies, emphasizing formulation innovation and cost efficiencies to sustain profitability amid market saturation.

Key Takeaways

- The global etodolac market remains stable but faces inevitable price reductions due to patent expiry and generic competition.

- Price declines are projected at 2–3% annually in mature markets, with potential stabilization in the near term.

- Emerging markets may experience slower price reductions, offering growth opportunities for low-cost formulations.

- Formulation innovation, such as sustained-release or combination drugs, can mitigate margin erosion.

- Regulatory landscapes and reimbursement policies are pivotal in shaping future pricing and access strategies.

FAQs

1. What factors most significantly influence etodolac pricing in different regions?

Pricing is primarily influenced by patent status, the degree of generic competition, regulatory approval processes, reimbursement policies, and manufacturing costs. Mature markets with many generic options tend to have lower prices, while regions with patent protections maintain higher prices.

2. How does patent expiration impact etodolac prices?

Patent expiration opens the market for generics, typically leading to substantial price reductions—often 20–30%—due to increased competition and reduced licensing costs.

3. Are there any recent innovations in etodolac formulations that could affect market prices?

Yes. Development of sustained-release formulations and combination drugs aims to enhance efficacy and patient compliance, often commanding premium prices initially. However, these represent a small segment compared to standard formulations.

4. What are the key regions for growth in etodolac demand over the next five years?

The Asia-Pacific region is expected to see the fastest growth, driven by expanding healthcare infrastructure, increasing disease prevalence, and lower manufacturing costs, enabling more affordable pricing.

5. How might regulatory changes influence the future pricing of etodolac?

Stricter regulations on drug pricing and reimbursement policies could put additional downward pressure on prices, especially in countries with active price control mechanisms. Conversely, streamlined approval processes for new formulations could temporarily increase some prices.

Sources

[1] MarketsandMarkets. “NSAID Market by Type, Application, and Region – Global Forecast to 2028.”

[2] Grand View Research. “Pain Management Market Size and Forecasts.”

[3] U.S. Food and Drug Administration (FDA). “Drug Approvals and Patent Data.”

[4] IQVIA. “Global Prescription Drugs Market Dynamics.”

[5] European Medicines Agency (EMA). “Regulatory Policies on NSAIDs.”